It sounds like you’re looking for software that handles recharge (for mobile or utilities) and manages PAN card (Permanent Account Number) details. These types of software solutions generally serve two different purposes, so I’ll break down the needs for each.

1. Recharge Software:

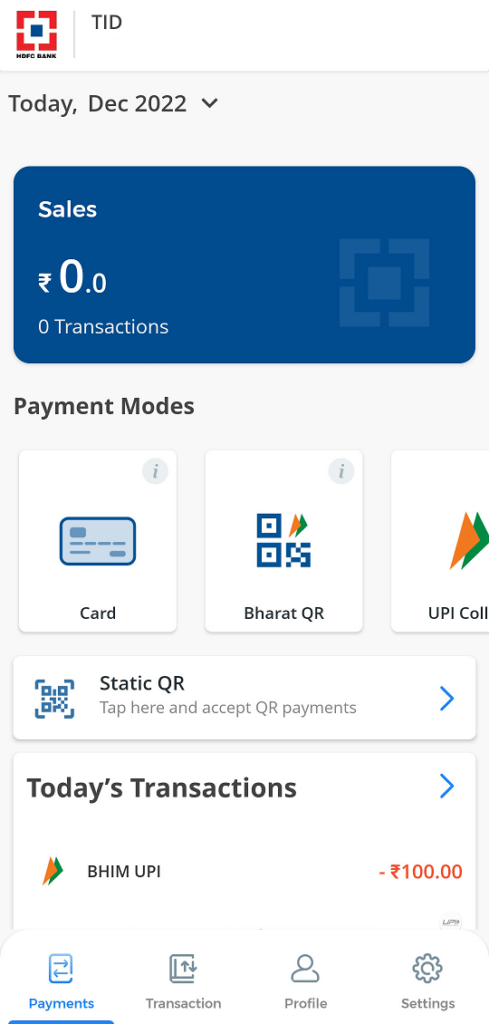

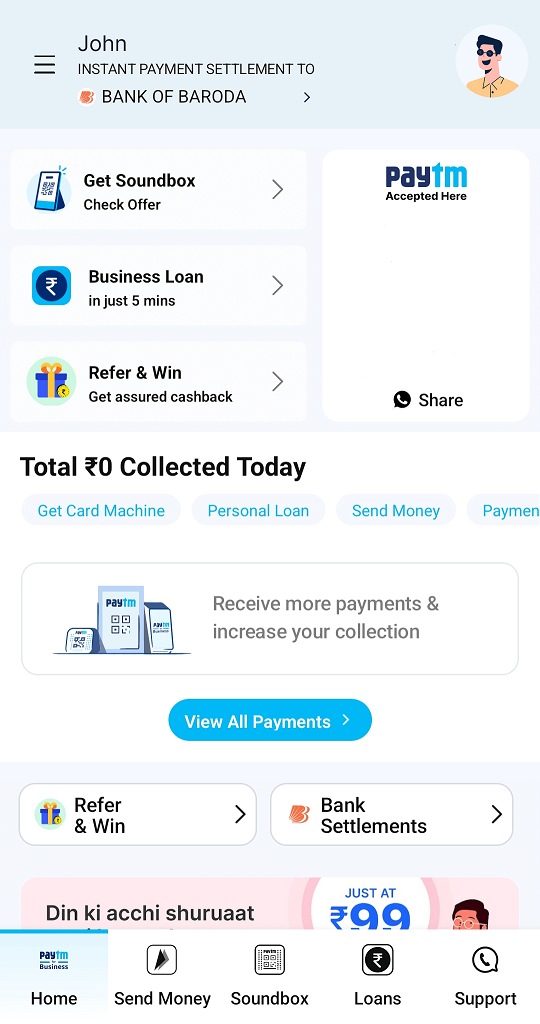

Recharge software is typically used by businesses or agents to process mobile recharges, utility payments, and sometimes even DTH (Direct-to-Home) recharges. These software systems enable users to recharge phones, pay bills, and perform other payment tasks.

Some popular features of recharge software include:

- Mobile and DTH recharge services: Allows agents to recharge prepaid/postpaid mobile numbers, DTH accounts, and data cards.

- Bill payments: Can handle various utility bill payments like electricity, water, gas, etc.

- Commission tracking: Tracks the commissions earned by agents for each transaction.

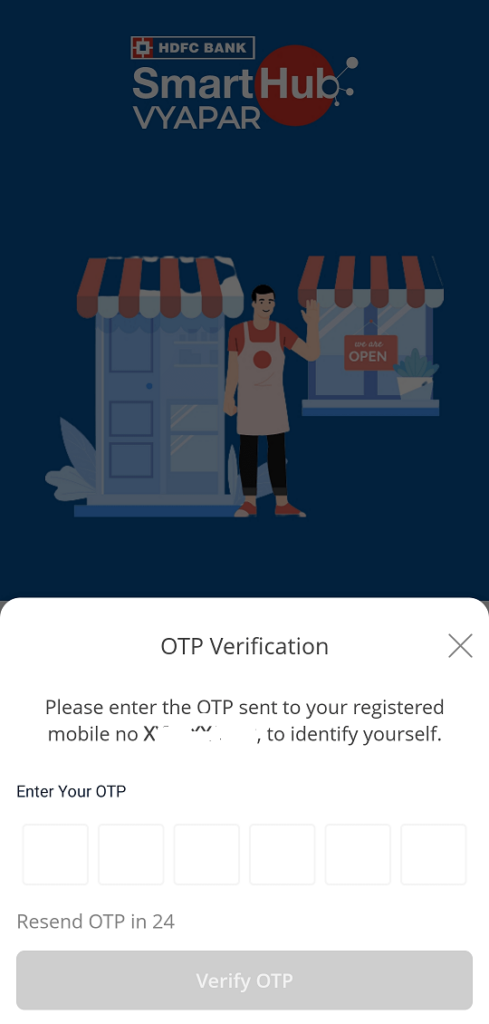

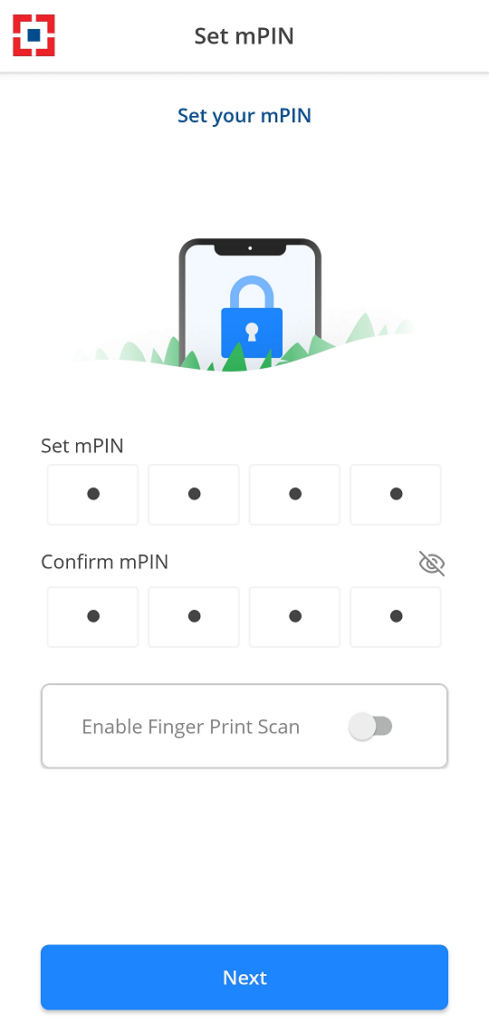

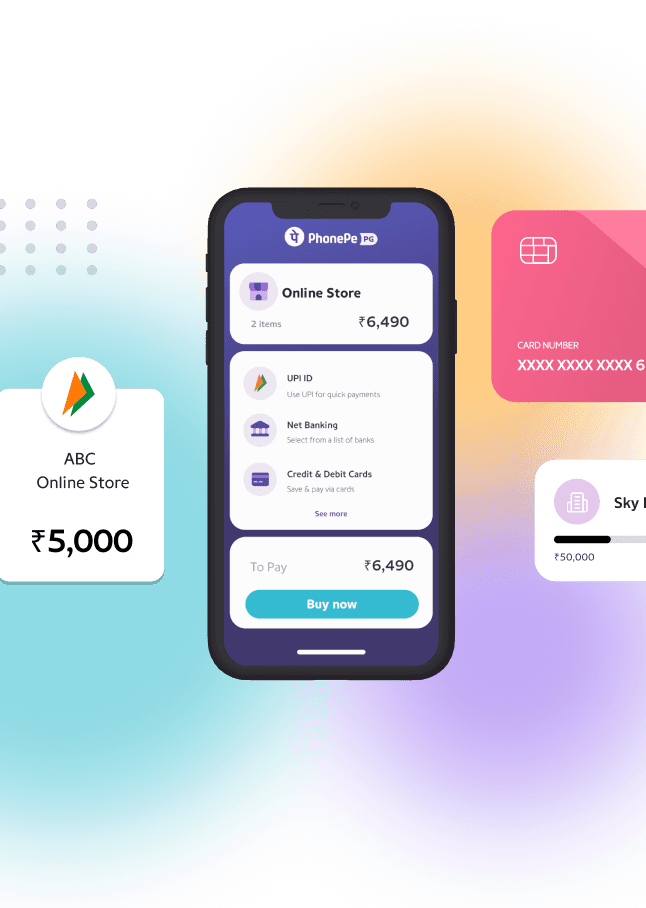

- Integration with payment gateways: Supports multiple payment methods such as UPI, wallets, and card payments.

- Multi-language support: For diverse regions and customers.

Popular examples include:

- Ekendrapan.in (for recharge and bill payments)

- deeperweb.in

2. PAN Card Software:

PAN card software is used by businesses and organizations for managing, validating, and issuing PAN card-related services. It is especially useful for tax filing, financial institutions, or agencies providing PAN-related services to customers.

Features you might find in PAN card software:

- PAN application: Helps users apply for a new PAN card or update details.

- PAN verification: Allows businesses to verify the authenticity of a PAN card for KYC (Know Your Customer) processes.

- Tax filing integration: Some software offers integration with tax systems for easier tax filing.

- Bulk PAN data processing: For large organizations dealing with many clients.

Popular examples of PAN card-related services:

- NSDL (National Securities Depository Limited) software for PAN application and verification

- UTIITSL PAN services

If you need a specific kind of solution that combines these functionalities, there are integrated software platforms or customized solutions available for businesses that handle both types of services.

Is there a particular platform or feature you’re looking for, or do you need more specific recommendations? Let me know how you’d like to proceed!