DTH (Direct-to-Home) recharge refers to the process of making a payment to a DTH service provider for the usage of their services. DTH is a digital television broadcasting service that allows viewers to receive television channels through a satellite dish installed at their homes.

To make a DTH recharge, you need to follow these steps:

- Log in to your DTH service provider’s website or mobile app.

- Navigate to the recharge section.

- Enter your customer ID or registered mobile number.

- Choose the amount you want to recharge for, and select a payment method.

- Confirm the payment and wait for the confirmation message.

- The payment will be reflected on your account balance, and you will be able to access the DTH services.

It’s important to note that there are several DTH service providers in India, and each has different recharge plans and offers. Some of the major DTH service providers in India include Tata Sky, Dish TV, Airtel Digital TV, and Videocon d2h. To choose the best recharge plan for your needs, you can compare the plans and offers of different service providers and select the one that best suits your budget and viewing preferences.

There are several DTH (Direct-to-Home) service providers in India. Here is a list of some of the major DTH service providers in India:

- Tata Sky

- Dish TV

- Airtel Digital TV

- Videocon d2h

- Sun Direct

- Reliance Digital TV

- DD Free Dish

- Independent TV

- Jio DTH (yet to launch)

Each of these DTH service providers offers a range of plans and packages with different channel lineups, pricing, and benefits. To choose the best DTH service provider for your needs, you can compare the plans and offers of different providers and select the one that offers the channels and services you need at the best price.

Postpaid recharge refers to the process of making a payment to a mobile service provider for the usage of their services after the services have been used. In a postpaid mobile plan, the customer is billed at the end of the billing cycle for the usage of services such as voice calls, text messages, and data.

To make a postpaid recharge, you need to follow these steps:

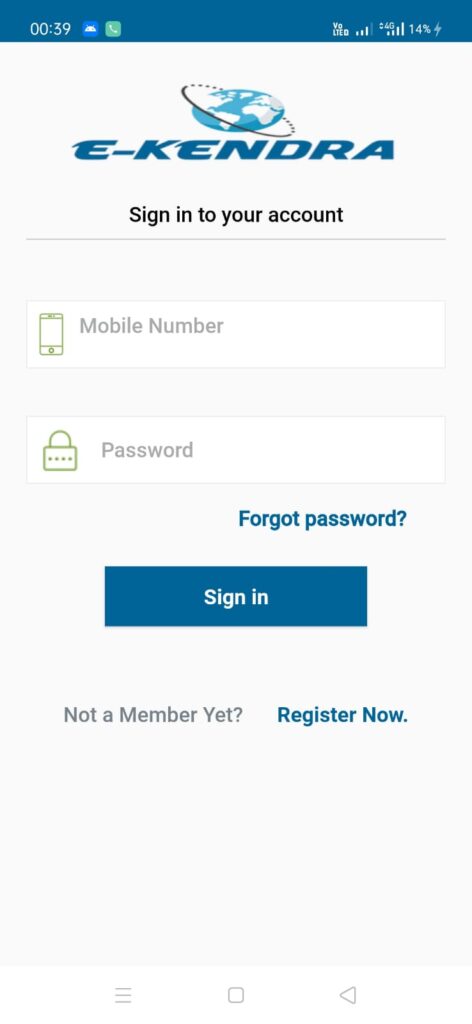

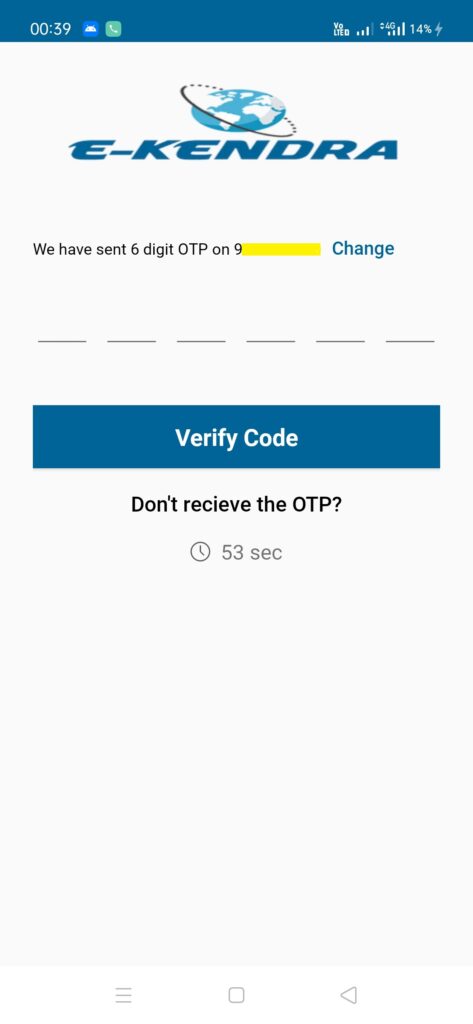

- Log in to your mobile service provider’s website or mobile app.

- Navigate to the postpaid recharge section.

- Enter your mobile number and select your billing cycle.

- Choose the amount you want to recharge for, and select a payment method.

- Confirm the payment and wait for the confirmation message.

- The payment will be reflected on your next billing cycle.

It’s important to note that postpaid recharges are different from prepaid recharges, where customers make a payment upfront and then use the services. In postpaid plans, the customer is billed at the end of the billing cycle based on their usage, whereas in prepaid plans, the customer has to recharge their account before they can use the services.

There are several postpaid mobile service providers in India. Some of the major postpaid operators in India are:

- Airtel Postpaid: Airtel is one of the largest telecom operators in India, and its postpaid plans offer a range of benefits such as unlimited calling, data rollover, and device protection.

- Vodafone Idea Postpaid: Vodafone Idea is another major telecom operator in India, and its postpaid plans offer benefits such as unlimited calling, data carry forward, and entertainment subscriptions.

- Jio Postpaid: Reliance Jio is a relatively new entrant in the Indian telecom market, but it has quickly gained market share with its affordable plans and unlimited calling and data benefits.

- BSNL Postpaid: Bharat Sanchar Nigam Limited (BSNL) is a government-owned telecom operator in India, and its postpaid plans offer benefits such as unlimited calling and data rollover.

- MTNL Postpaid: Mahanagar Telephone Nigam Limited (MTNL) is another government-owned telecom operator that provides postpaid services in select cities in India.

These are just a few examples of the postpaid operators in India. There are many other operators in the market, each offering different plans and benefits, so it’s important to research and compare different options to choose the one that best suits your needs.

LIC stands for Life Insurance Corporation of India, which is a state-owned insurance company in India. It is the largest insurance company in India and one of the largest insurance companies in the world in terms of policies sold and assets under management.

LIC was established in 1956 by the Government of India and nationalized in 1956. Its main objective is to provide life insurance coverage to people at an affordable cost and to promote savings and investment among the public.

LIC offers a wide range of life insurance products, including term insurance, endowment plans, money-back plans, unit-linked insurance plans (ULIPs), pension plans, and group insurance plans. The company has a large network of agents and offices across India and offers its services to customers in both urban and rural areas.

In addition to life insurance, LIC also offers other financial products such as mutual funds, home loans, and other investment products. The company plays a significant role in the Indian economy, particularly in the area of long-term investments, and is seen as a reliable and trustworthy institution by many Indians.

There are several ways to pay LIC premium. Here are some of the common methods:

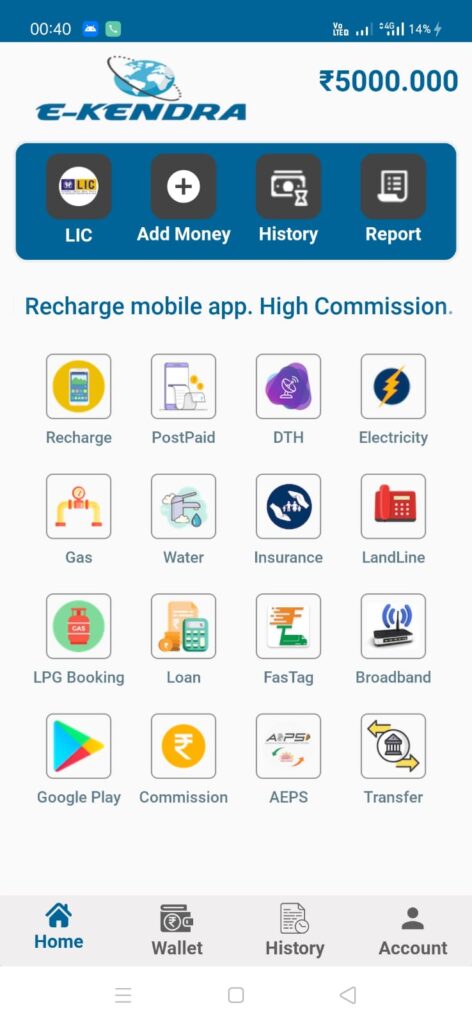

- Online Payment: LIC policyholders can make premium payments online through the company’s official website, www.recharge2.in They can register on the website, log in, and make payments using their net banking, credit card, or debit card. The process is quick, easy, and convenient.

- Mobile App Payment: LIC policyholders can also make premium payments using the company’s official mobile app, Reharge2 App. The app is available for download on both Android devices, and allows policyholders to pay their premiums using their debit card, credit card, or net banking.

- Auto Debit: LIC policyholders can set up an auto-debit facility with their bank account or credit card to pay their premiums automatically on the due date. This is a hassle-free method of payment as policyholders do not need to remember the due date or initiate the payment manually.

- LIC Branch Office: Policyholders can also visit any LIC branch office and make their premium payments in person using cash, cheque, or demand draft. They need to provide their policy details and make the payment at the counter.

- Authorized Banks: LIC has authorized several banks to collect premium payments on its behalf. Policyholders can visit any of the authorized banks and make their premium payments using cash, cheque, or demand draft.

It is important to pay LIC premiums on time to avoid policy lapse and ensure continuous coverage.

SOFTWARE CODE: EKSF01

User ID: DEMO Password: DEMO

SOFTWARE CODE: EKSF02

User ID: DEMO Password: 123

SOFTWARE CODE: EKSF03

USER ID: DEMO PASSWORD: DEMO

SOFTWARE CODE: EKSF04

USER ID: DEMO PASSWORD: 123

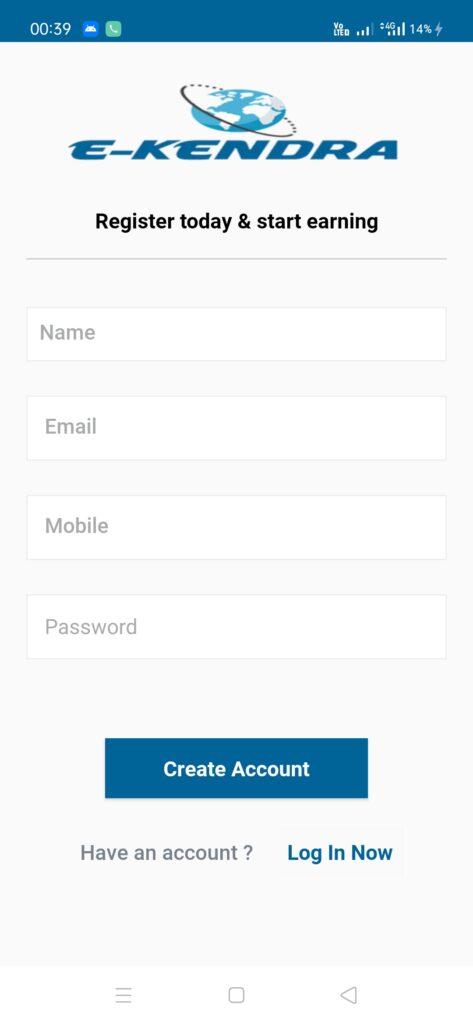

NextGen Neo-Banking Master Franchise

| Master Franchise | Join Fees | Retailer create fees |

| Distributor | ₹999 | ₹99 |

| Master Distributor | ₹1999 | ₹49 |

Contact : +91-7585811607

Email: hi@e-kendra.co.in

Latest offer NSDL PAAM BRANCH INR 499

Highlights :

- NO DATA ENTRY & NO PHOTO -SIGN CROPPING/ ONLY RECT GENERATE & SCANNING.

- We will provide you online training from our office at no extra cost.

- You will get a branch code allotted by NSDL within 7 days.

- Aadhaar Base eKYC PAN allotted by NSDL within 3 hours.

- Your customer’s will get PAN NO in 3/4 days and PAN CARD within a week’s time.

- You will get a branch code allotted by NSDL within 5 days.

Terms & Conditions :

- Penalty : NIL

- Minimum 70+ pan card application every month

- For PAN center one time processing fees of Rs.499

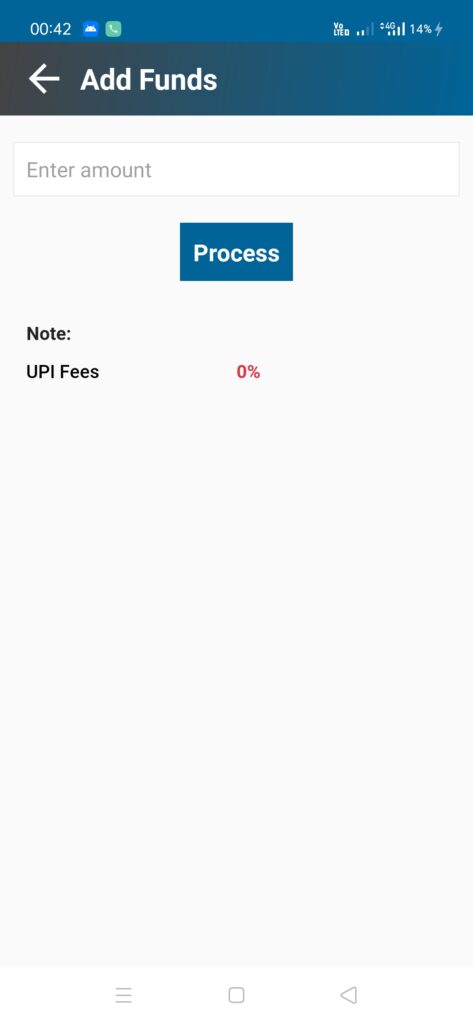

- Business on wallet recharge basis

Eligibility Criteria :

SEBI / IRDA / AMFI / RBI / CCA / CA / RA for Distribution of DSC / UIDAI / CSC / GST / ICWA / ICAI / ICSI / ADVOCATE / TAX CONS / ACCT PRACT / TRPs by ITD.

Documents Required :

- PAN card

- Aadhaar card

- Cancelled cheque

Software requirement : Windows (Professional / Ultimate edition) / licensed Antivirus.

Commission:

- Our remuneration is at par as per industry standard & the commission is disbursed once in a month.

- Our’s is a scan base software hence you will have to send us only scanned images.

- PAN : Upto 500 forms Rs.6/-, Upto 1000 forms Rs.9/- & above 1000 forms Rs.11/-

Contact Table: