What is GST?

GST is a product of the biggest tax reform in India that has tremendously improved the ease of doing business and also increased the taxpayer base in India by including millions of small businesses under one uniform tax system. The tax complexities have reduced considerably due to the introduction of GST in India. As multiple tax systems are abolished and subsumed into a single, simple tax system under GST.

The GST regime mandates that all the entities that are involved in buying or selling the goods or providing services or both are required to register and obtain the GSTIN.

What is GSTIN?

GSTIN is a unique 15 digit code that is allocated to every taxpayer that has valid GST registration in India. It is a unique code that is allocated to every taxpayer which is given based on the state and the PAN. GSTIN is mandatory for businesses when the annual turnover is exceeding Rs.20 lakh. If the business is carrying out a business e-commerce platform it is necessary to obtain the GSTIN.

GST registration is mandatory once the entity is crossing a minimum threshold turnover or when the individual starts a new business that is expecting to cross the prescribed turnover.

Who is eligible to obtain GST registration?

In general, any business or individual who supplies goods or services in India and has an annual turnover exceeding the threshold limit of Rs. 20 lakhs (Rs. 10 lakhs for special category states) is required to obtain GST registration.

However, certain businesses are required to obtain GST registration regardless of their turnover, such as:

- Businesses making inter-state taxable supplies.

- Casual taxable persons or non-resident taxable persons.

- Businesses required to pay tax under reverse charge.

- E-commerce operators or aggregators.

- Persons who supply goods or services on behalf of other registered taxable persons, whether as an agent or otherwise.

- Input service distributors.

- Businesses that supply goods or services through e-commerce platforms.

- Businesses that supply online information and database access or retrieval services from a place outside India to a person in India.

- Persons who are required to deduct tax at source (TDS) under GST.

- Persons who supply goods or services on which tax is payable by the recipient under reverse charge.

- Non-resident taxable persons who supply goods or services in India.

It is important to note that even if a business is not required to register under GST, they may voluntarily register for GST to claim input tax credit, make their business more credible, and comply with GST regulations.

What are the documents required to obtain GST registration?

The following documents must be submitted by regular taxpayers applying for GST registration.

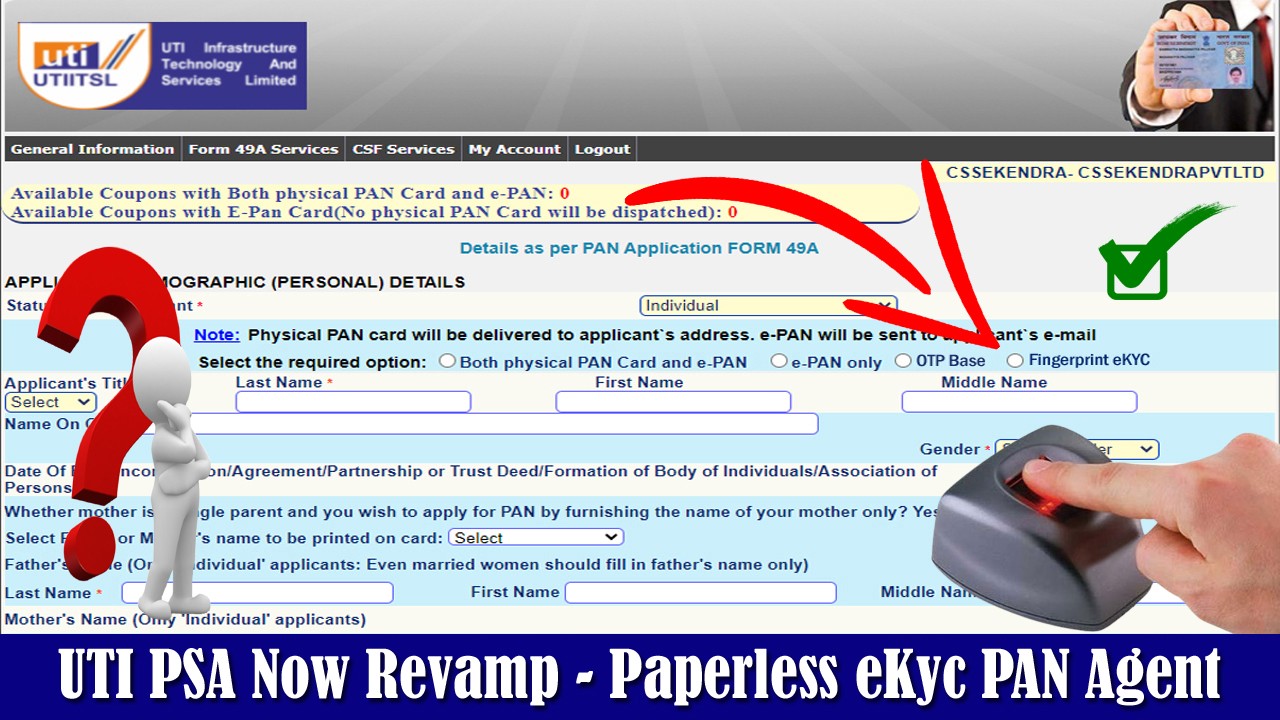

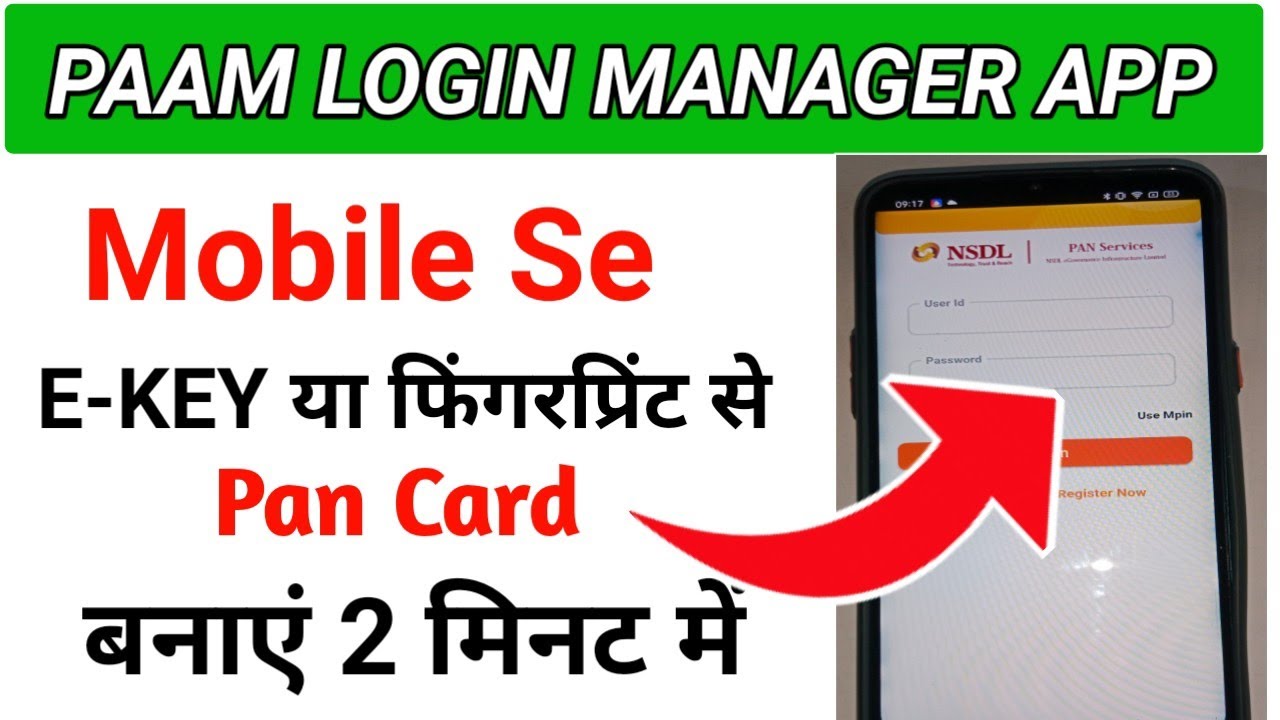

PAN Card of the business

PAN of the applicant

Identity proof of the applicant along with the photographs

Address proof of the applicant.

Business registration document or the Certificate of Incorporation.

Business location proof

Bank Account statement or canceled cheque

Digital Signature Certificate

Letter of authorization or Board Resolution for the authorized signatory.