AEPS (Aadhaar Enabled Payment System) offers numerous benefits for financial transactions, making it a popular choice among users and service providers alike. Here are some of the top benefits:

- Financial Inclusion: AEPS enables individuals, especially in remote and rural areas, to access basic banking services conveniently. It empowers those without traditional bank accounts to conduct various financial transactions.

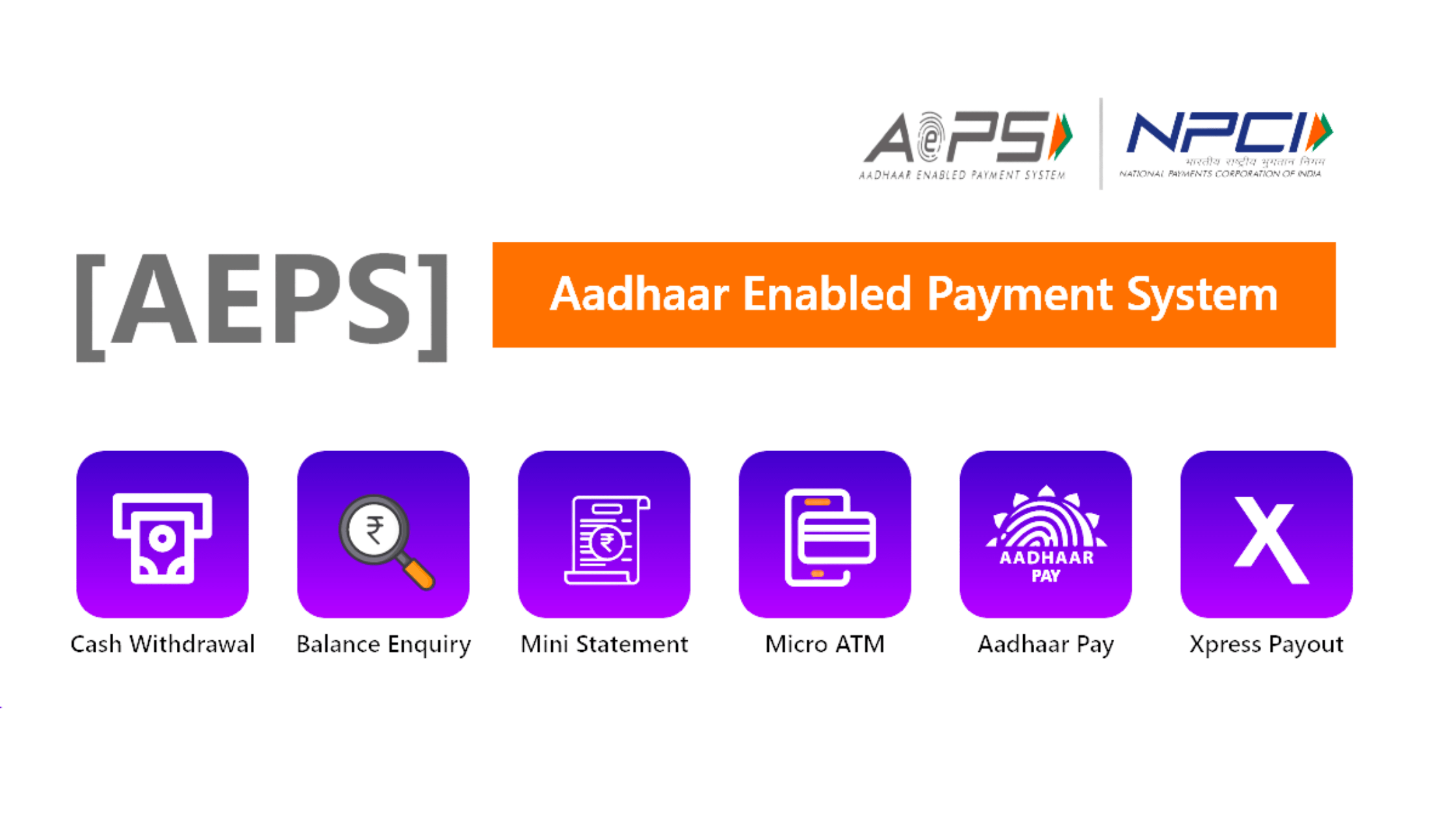

- Convenience: With AEPS, users can perform transactions such as cash withdrawals, balance inquiries, and fund transfers using only their Aadhaar number and biometric authentication. This eliminates the need for physical bank cards or remembering account numbers.

- Security: Biometric authentication adds an extra layer of security to transactions, reducing the risk of fraud and unauthorized access to accounts. Users can be assured that their transactions are secure and protected.

- Accessibility: AEPS services are available 24/7, allowing users to conduct transactions at their convenience, regardless of location or time. This accessibility is particularly beneficial for individuals living in areas with limited banking infrastructure.

- Cost-Effective: AEPS transactions often have lower transaction fees compared to traditional banking methods, making it an affordable option for both users and service providers. This cost-effectiveness promotes financial inclusion and encourages the adoption of digital payment systems.

- Interoperability: AEPS is interoperable across different banks and financial institutions, allowing users to access their accounts and conduct transactions through various service providers. This interoperability enhances the reach and usability of AEPS services.

- Reduced Dependency on Cash: By facilitating digital transactions through biometric authentication, AEPS helps reduce dependency on cash transactions. This promotes a cashless economy and contributes to the government’s efforts to curb black money and promote transparency in financial transactions.

- Empowerment of Agents: AEPS also benefits banking agents who act as intermediaries between users and financial institutions. It provides them with an additional source of income and expands their business opportunities by enabling them to offer AEPS services to customers.

Overall, AEPS plays a crucial role in advancing financial inclusion, promoting digital transactions, and enhancing the security and accessibility of financial services for individuals across various socio-economic backgrounds.

Introduction:

In the realm of modern finance, leveraging Advanced Electronic Payment Systems (AEPS) has emerged as a pivotal strategy for individuals and businesses alike. AEPS offers a myriad of benefits, streamlining financial transactions and enhancing accessibility to banking services. This article delves into the transformative advantages of integrating AEPS into your financial operations, paving the way for unparalleled convenience, security, and efficiency.

Understanding AEPS:

AEPS, an acronym for Advanced Electronic Payment Systems, represents a revolutionary approach to conducting financial transactions. Unlike traditional banking methods, AEPS leverages cutting-edge technology to facilitate seamless transactions without the need for physical bank branches. By harnessing biometric authentication techniques, AEPS enables individuals to access a range of banking services, including cash withdrawal, fund transfer, balance inquiry, and more, directly from their registered bank account.

Enhancing Financial Accessibility:

One of the primary benefits of AEPS is its role in enhancing financial accessibility for individuals residing in remote or underserved areas. Through AEPS-enabled outlets, individuals can perform banking transactions conveniently, regardless of geographical constraints. This accessibility fosters financial inclusion by extending banking services to previously unbanked populations, empowering them to participate actively in the formal financial system.

Facilitating Secure Transactions:

Security stands as a cornerstone of AEPS, ensuring that every financial transaction is conducted with the utmost confidentiality and integrity. Biometric authentication, such as fingerprint or iris scanning, adds an extra layer of security, mitigating the risks associated with unauthorized access or fraudulent activities. With AEPS, users can conduct transactions with peace of mind, knowing that their financial data remains safeguarded against potential threats.

Empowering Rural Economy:

AEPS plays a pivotal role in bolstering the rural economy by facilitating seamless financial transactions in remote areas. Through AEPS-enabled outlets, farmers, artisans, and small-scale entrepreneurs can access banking services conveniently, eliminating the need to travel long distances to traditional bank branches. This empowerment fosters economic growth and uplifts livelihoods by enabling individuals to manage their finances efficiently and invest in productive ventures.

Driving Financial Inclusion:

At its core, AEPS embodies the spirit of financial inclusion, bridging the gap between traditional banking services and underserved communities. By providing a user-friendly interface and simplified transaction processes, AEPS ensures that individuals from diverse socio-economic backgrounds can avail banking services without encountering bureaucratic hurdles. This inclusivity fosters economic empowerment and societal progress, laying the foundation for a more equitable financial landscape.

Expanding Digital Payments Ecosystem:

In an increasingly digital world, AEPS serves as a catalyst for expanding the digital payments ecosystem, driving the adoption of cashless transactions. By offering a seamless interface for conducting financial transactions, AEPS encourages individuals to embrace digital payment methods, thereby reducing dependency on cash and enhancing transparency in financial dealings. This transition towards digital payments fosters economic efficiency and contributes to the overall digitalization of the economy.

Simplifying Government Benefit Disbursement:

Governments worldwide are increasingly leveraging AEPS for the efficient disbursement of social welfare benefits and subsidies. By integrating AEPS into welfare programs, governments can ensure direct and transparent transfer of funds to beneficiaries’ bank accounts, eliminating intermediaries and reducing the risk of fund misappropriation. This streamlined approach enhances the efficacy of social welfare schemes, ensuring that beneficiaries receive timely and hassle-free access to essential financial support.

Harnessing Real-time Transaction Processing:

AEPS leverages real-time transaction processing capabilities, enabling users to execute financial transactions swiftly and efficiently. Whether it’s withdrawing cash from an AEPS-enabled ATM or transferring funds to a family member’s bank account, users can experience seamless transaction processing without delays or disruptions. This real-time functionality enhances user experience and instills confidence in the reliability and efficiency of AEPS-enabled services.

Fostering Financial Literacy:

By promoting the adoption of AEPS, financial institutions and government agencies can contribute to enhancing financial literacy among the masses. Through educational initiatives and awareness campaigns, individuals can learn about the benefits and functionalities of AEPS, empowering them to make informed decisions regarding their financial management. This emphasis on financial literacy fosters a culture of responsible financial behavior and empowers individuals to leverage AEPS effectively for their financial needs.

Conclusion:

In conclusion, the utilization of AEPS for financial transactions offers a myriad of benefits, ranging from enhanced accessibility and security to fostering economic empowerment and driving digitalization. By embracing AEPS, individuals and businesses can unlock new avenues for seamless financial management, paving the way for a more inclusive and efficient financial ecosystem.

FAQs:

1. How does AEPS ensure the security of financial transactions? AEPS employs biometric authentication techniques, such as fingerprint or iris scanning, to ensure secure transactions, mitigating the risks of unauthorized access or fraudulent activities.

2. Can AEPS be accessed from rural areas with limited banking infrastructure? Yes, AEPS-enabled outlets extend banking services to remote and underserved areas, empowering individuals to conduct financial transactions conveniently.

3. What role does AEPS play in driving financial inclusion? AEPS bridges the gap between traditional banking services and underserved communities, enabling individuals from diverse backgrounds to access banking services without encountering barriers.

4. How does AEPS contribute to the expansion of the digital payments ecosystem? AEPS encourages the adoption of digital payment methods by offering a seamless interface for conducting cashless transactions, thereby reducing dependency on cash and promoting transparency.

5. Can governments leverage AEPS for social welfare benefit disbursement? Yes, governments utilize AEPS for the efficient disbursement of social welfare benefits and subsidies, ensuring direct and transparent transfer of funds to beneficiaries’ bank accounts.

6. What steps can individuals take to enhance their financial literacy regarding AEPS? Individuals can participate in educational initiatives and awareness campaigns to learn about the benefits and functionalities of AEPS, empowering them to make informed financial decisions.

Contain table:

1, Banking:

2, Payment gateway:

3, Recharge Services:

- Mobile Recharge

- DTH Recharge

- Googleplay redeem

4, API Solutions:

5, PAN Card Services:

- UTIITSL Agent Registration

- How to apply new pan card with UTI PSA Portal

- Paperless eKyc PAN Agent – UTI

- utipan psa

- PAN Rate Banner

- Important Court Directives

6, Products:

- B2B Mobile Recharge Software

- B2C Mobile Recharge Software

- B2B Reseller Recharge Software

- API Reselling Software

- Whit label Recharge Software

- Pan Card White Label / Pan Card API

- Pan Card White Label / Pan Card API

Social media: Follow the CSS Ekendra Private Limited channel