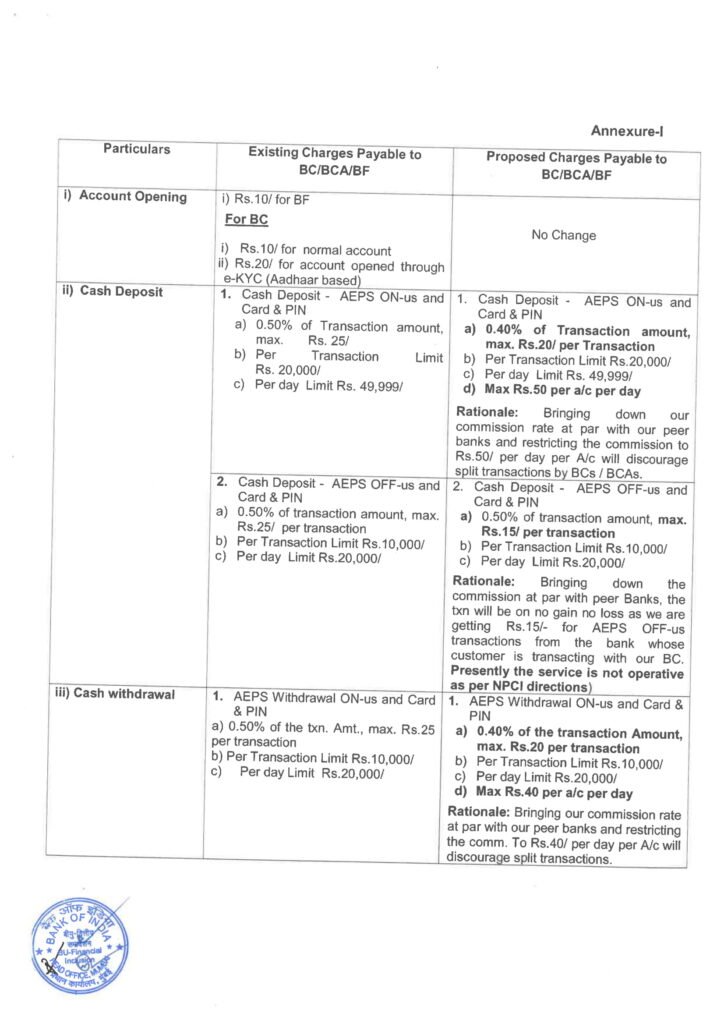

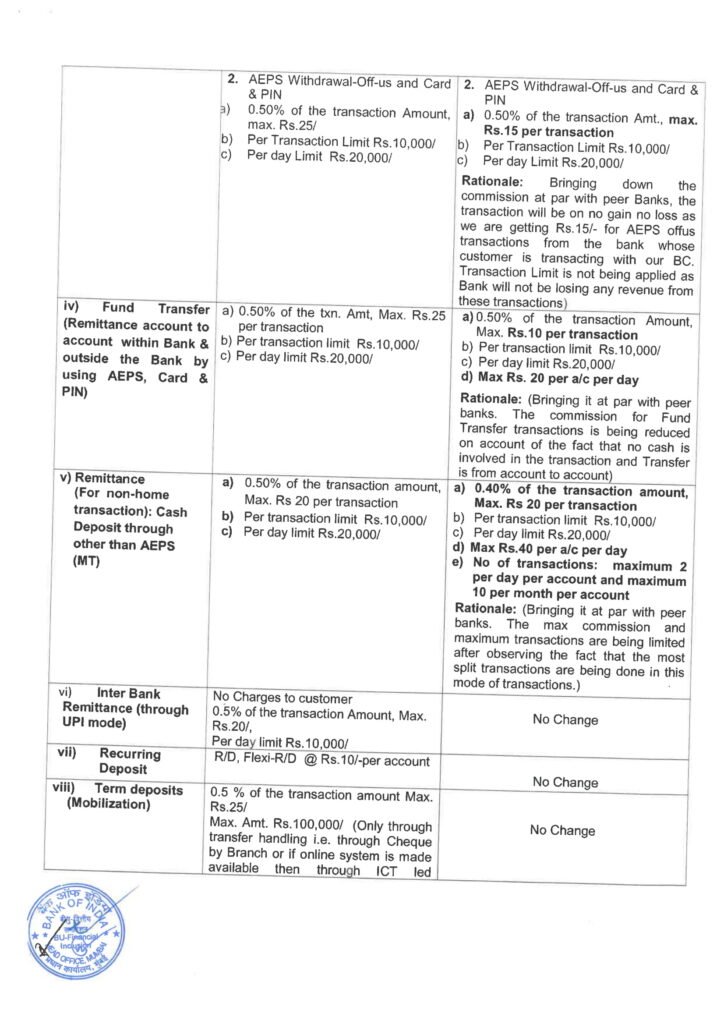

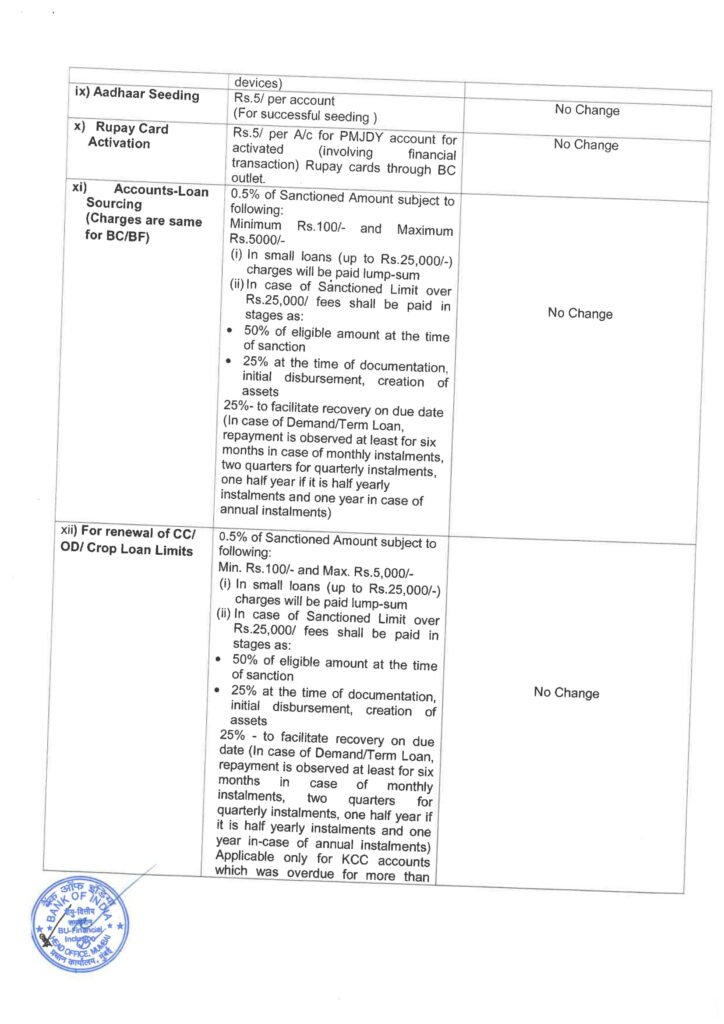

Bank of India Bank BC Commission Structure

CSP stands for Customer Service Point. It refers to a model where banks or financial institutions appoint agents or third-party entities to provide basic banking services to customers in remote or underserved areas where establishing a full-fledged branch may not be feasible. These CSPs act as intermediaries, offering services like account opening, deposits, withdrawals, fund transfers, and other basic banking transactions on behalf of the bank. They help extend banking services to a wider population, especially in rural areas, thereby promoting financial inclusion.

Bank BC stands for Bank Business Correspondent. These are individuals or entities appointed by banks to provide banking and financial services on their behalf, especially in remote or underserved areas where traditional banking infrastructure may be lacking. BCs act as intermediaries between the bank and customers, offering services such as account opening, cash deposits, withdrawals, fund transfers, loan disbursement, and other basic banking transactions. They play a crucial role in extending banking services to unbanked or underbanked populations, thereby promoting financial inclusion.

Bank Business Correspondents (BCs) offer a range of services on behalf of banks, typically in areas where traditional banking infrastructure is limited. Some common services provided by BCs include:

- Account Opening: BCs assist customers in opening bank accounts, including savings accounts, current accounts, and other types of accounts offered by the bank.

- Cash Deposits: BCs accept cash deposits from customers into their bank accounts, allowing them to securely store their funds.

- Cash Withdrawals: Customers can withdraw cash from their bank accounts through BCs, providing convenient access to their funds.

- Fund Transfers: BCs facilitate fund transfers between accounts, including within the same bank or to accounts in other banks.

- Balance Inquiry: Customers can check their account balance through BCs, allowing them to monitor their finances conveniently.

- Mini-Statements: BCs provide mini-statements to customers, offering a summary of recent transactions and account activity.

- Loan Application Processing: Some BCs assist customers in applying for loans offered by the bank, including personal loans, business loans, or agricultural loans.

- Insurance Sales: In some cases, BCs may also offer insurance products on behalf of the bank, such as life insurance or health insurance policies.

These services help extend banking access to underserved populations, promoting financial inclusion and allowing individuals to participate more fully in the formal financial system.

Related post:

- EkendraPAN Mobile App

- DeeperWeb Recharge App

- Recharge API Get 7% Margin

- Recharge & PAN Card Software

- What is the meaning of Lapu in Airtel?

Very nice information found in your website, I hope this kind of information is always available, I hope that many people will find information through your website.