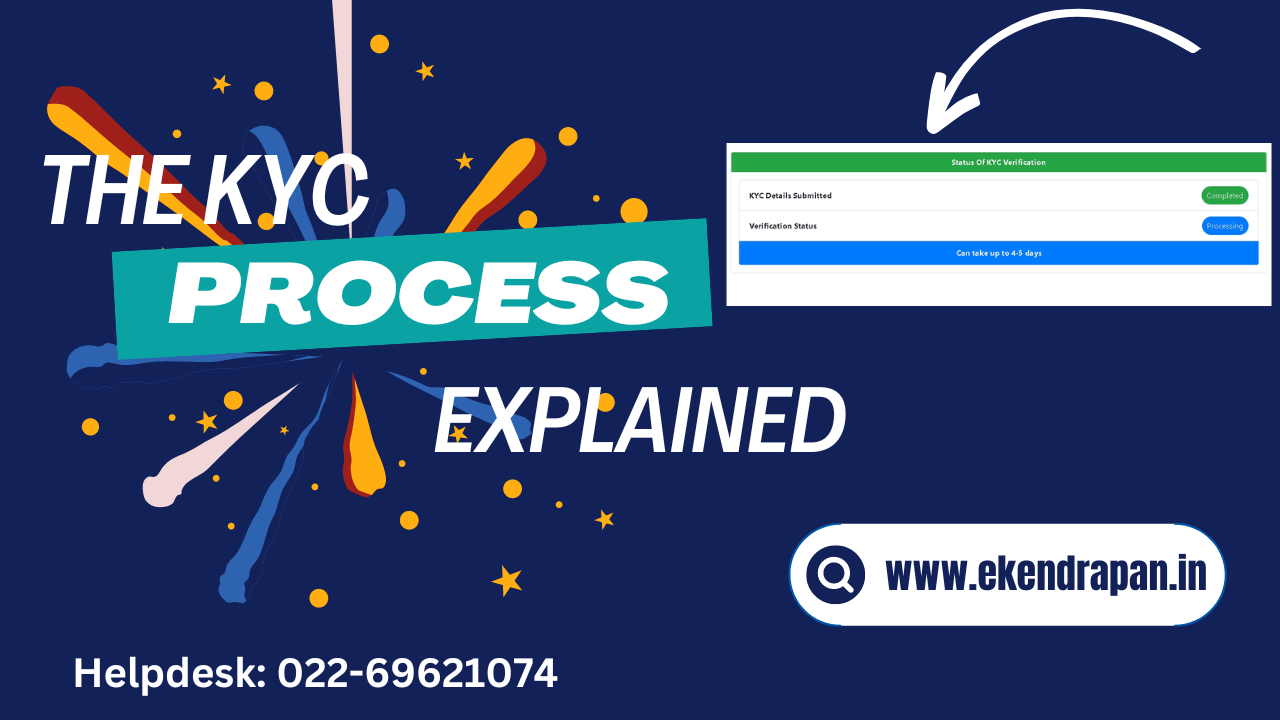

The KYC process explained | Ekendra

1, Visit https://www.ekendrapan.in

2, Login your credentials

3, Select Physical mode KYC

4, Type PAN Number and UID number

5, Upload documents png and jpg format [size blow 1mb]

6, Colour xrox or print your document

7, Self attested documents and write your register mobile number

8, Finally submitted and wait few hours for verifications

More details contact

02269621074

The KYC process explained

What is KYC?

The KYC (Know Your Customer) process is a procedure implemented by businesses to verify the identity of their customers. It’s primarily used in industries like banking, finance, and e-commerce to prevent fraud, money laundering, and other illicit activities. Here’s a breakdown of the KYC process:

- Identity Verification: Customers are required to provide documents proving their identity, such as government-issued IDs (e.g., passport, driver’s license), social security numbers, or other official documents. These documents are used to confirm the customer’s identity and ensure they are who they claim to be.

- Address Verification: In addition to verifying identity, businesses may also require proof of the customer’s address. This can be done through documents like utility bills, bank statements, or rental agreements. Verifying the customer’s address helps ensure that they reside at the location provided and can receive correspondence.

- Risk Assessment: Once the customer’s identity and address have been verified, businesses may conduct a risk assessment to evaluate the potential risks associated with the customer. Factors such as the customer’s financial history, transaction patterns, and geographical location may be taken into account during this assessment.

- Ongoing Monitoring: KYC is not a one-time process; it requires ongoing monitoring of customer accounts and activities. Businesses may use automated systems to monitor transactions for any suspicious or unusual activity. This helps detect and prevent fraudulent behavior or money laundering attempts.

- Compliance: KYC procedures are often mandated by regulatory authorities to ensure compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. Businesses must adhere to these regulations and may face penalties for failing to comply.

Overall, the KYC process is crucial for businesses to establish the identity of their customers, mitigate risks, and comply with regulatory requirements aimed at combating financial crime.

Related post:

- EkendraPAN Mobile App

- DeeperWeb Recharge App

- Recharge API Get 7% Margin

- Recharge & PAN Card Software

- What is the meaning of Lapu in Airtel?