The Income Tax Department has introduced a new initiative call ePAN card. Users can use the ePAN card facility to instantly obtain a PAN card by applying online. ePAN card application facility is free of cost and is currently being tested in Beta. To obtain a e-PAN card, it is mandatory for the applicant to possess an Aadhar card as the Aadhar number of the PAN applicant is mandatorily required to obtain e-PAN. Individuals already possessing a PAN cannot apply for an e-Pan. Also, ePAN cannot be obtained by a company or LLP, or partnership firm.

Eligibility for ePAN

ePAN card can be applied for only by Indian residents other than minors and people covered under Section 160 of the Income Tax Act. Hence, ePAN card cannot be obtained by Hindu Undivided Families, firms, trusts, companies, etc. ePan is created based on the details entered in the Aadhar Card. Hence, only persons holding Aadhar can obtain ePAN and if the details in the Aadhar Card is incorrect, the ePAN will also be incorrect. Hence, in case of correction, the applicant can visit the official website of UIDAI before applying for ePAN.

Procedure to Apply for ePAN

The following steps have to be followed to apply for an e-Pan card:

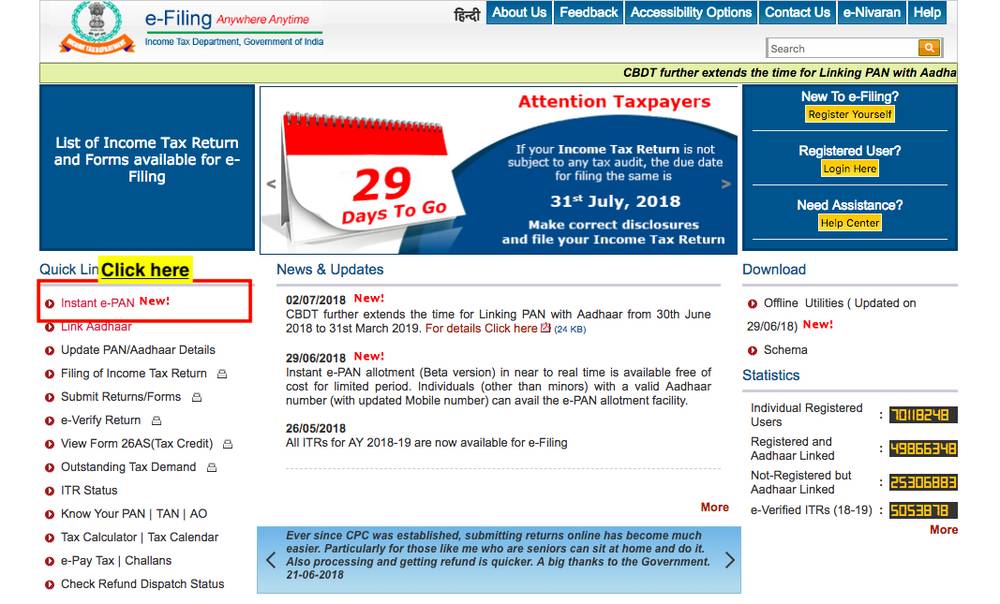

Step 1: Log on to the website

The applicant has to log on to the official website http://incometaxindiaefiling.gov.in.

Step 2: Mobile number linked to Aadhar

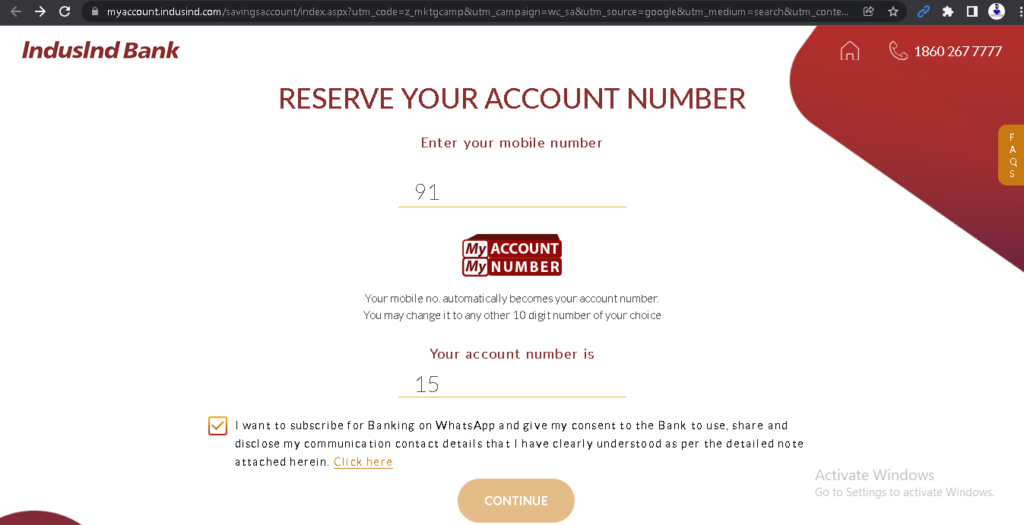

The applicant has to possess the registered mobile number that is linked with the Aadhar card.

Step 3: Click on Instant e-Pan

The applicant has to click on the Instant e-Pan option.

Step 4: Enter the details

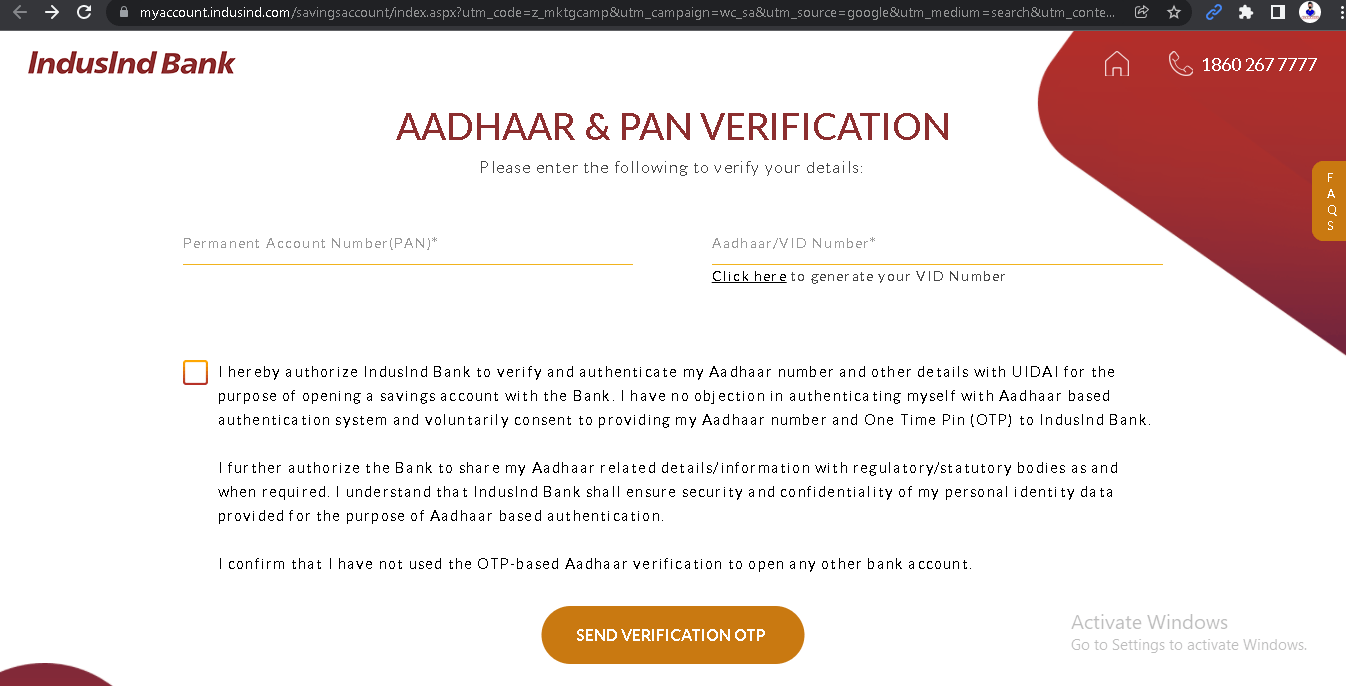

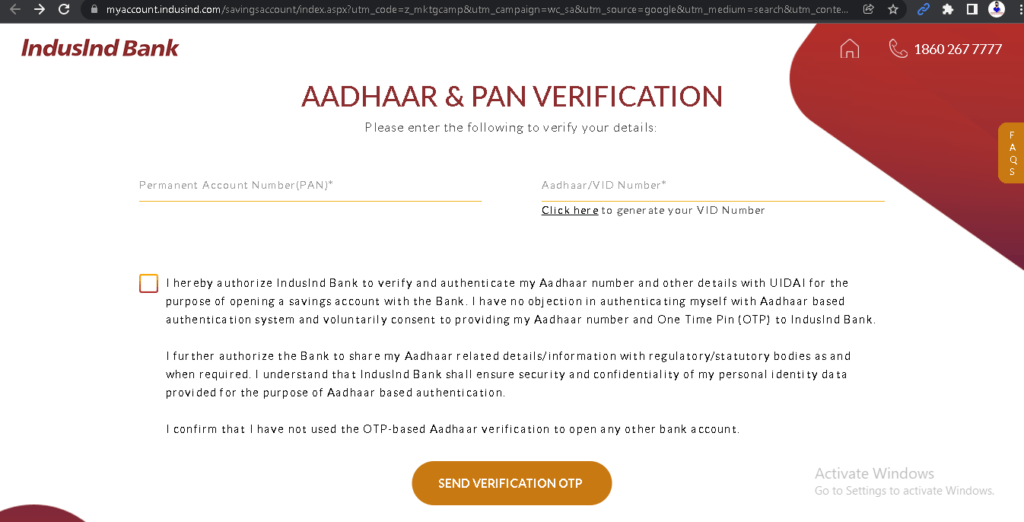

In the Aadhar e-KYC, the applicant has to enter the details as registered in the Aadhar card and the Aadhar Number.

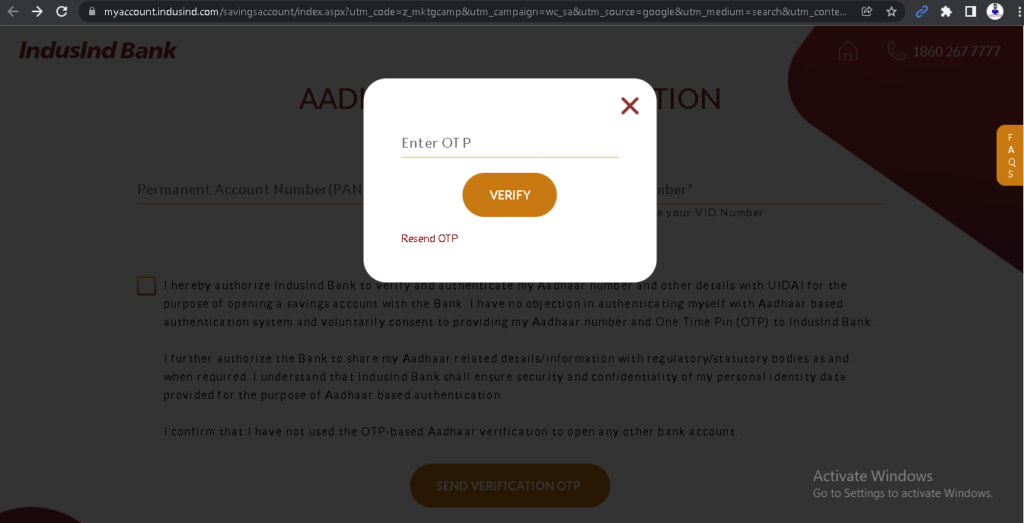

Step 5: Enter the OTP

Once, the Aadhar number is entered, an OTP will be sent to the registered mobile number.

Step 6: Uploading the signature

The applicant has to upload the scanned copy of the signature on white paper with a resolution of 200 DPI, with a file type of JPEG of 10 KB with a dimension of 2×4.5 cm.

Step 7: Acknowledgement Number

Once all the details are entered correctly, the applicant will receive a 15 acknowledgment number to the registered mobile number.

Checking Status

To check the status of the ePAN card, the following steps have to be followed:

Step 1: Log on to the website

The applicant has to log on to the official website http://incometaxindiaefiling.gov.in.

Step 2: Click on Check Instant e-Pan Status

In this page, the applicant has to enter the 15 digit acknowledgement number.

Step 3: Knowing the Status

Once the acknowledgement number is submitted, the applicant can view the status of the e-Pan card.