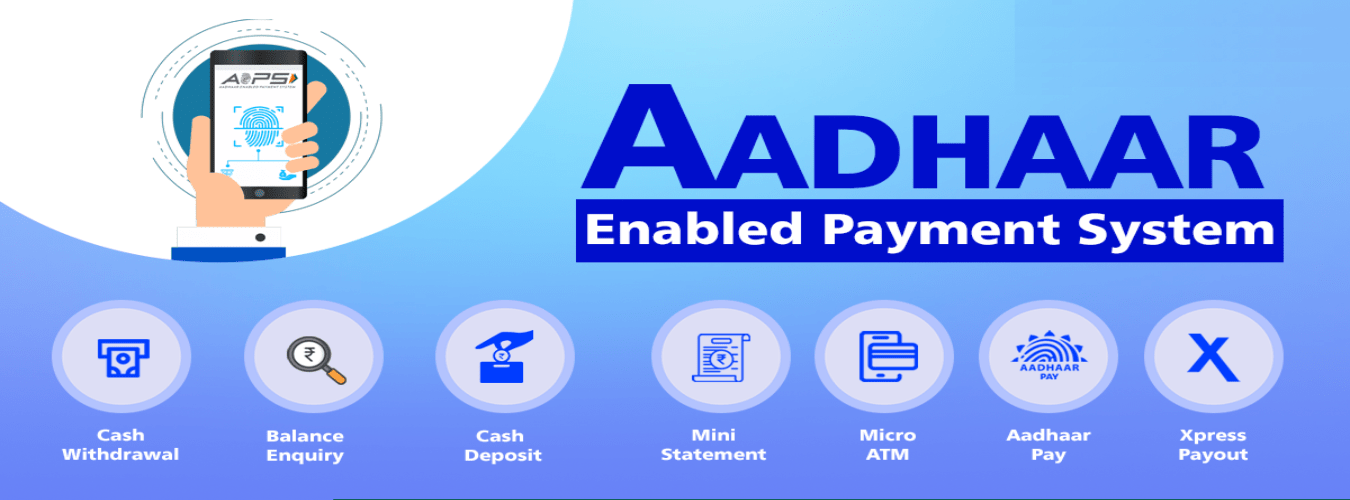

AEPS stands for “Aadhaar Enabled Payment System”. It is a payment system that allows customers to make financial transactions using their Aadhaar number and biometric authentication (fingerprint or iris scan). AEPS is an initiative by the National Payments Corporation of India (NPCI) and is a part of the government’s Digital India program.

With AEPS, customers can perform basic banking transactions such as deposit, withdrawal, balance inquiry, and funds transfer, without the need for a physical debit card or a bank branch. All they need is their Aadhaar number and a biometric authentication device, which can be a fingerprint scanner or an iris scanner.

AEPS is a secure and convenient payment system that is especially useful for customers who live in remote areas and do not have easy access to traditional banking services. AEPS can also be used by business correspondents or banking agents who can provide these services to customers in their local communities.

Some of the benefits of AEPS include increased financial inclusion, reduced transaction costs, and improved efficiency and transparency in the banking system. AEPS is widely used in India and is becoming increasingly popular as a simple and reliable payment system for individuals and businesses alike.

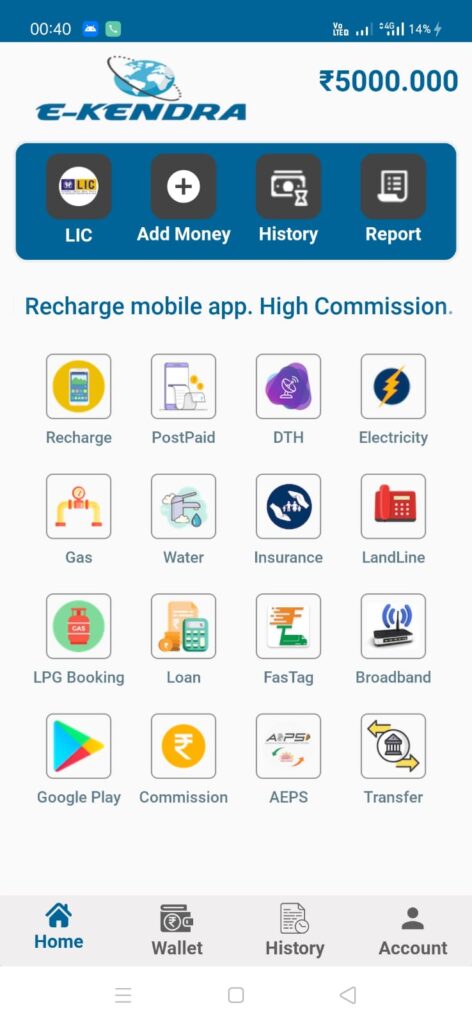

There are several types of AEPS services that are available to customers. Some of the common AEPS services are:

- Balance Inquiry: This service allows customers to check their bank account balance using their Aadhaar number and biometric authentication.

- Cash Withdrawal: This service allows customers to withdraw cash from their bank account using their Aadhaar number and biometric authentication. This service is particularly useful for customers who do not have access to an ATM or a bank branch.

- Cash Deposit: This service allows customers to deposit cash into their bank account using their Aadhaar number and biometric authentication. This service is particularly useful for customers who live in remote areas and do not have access to a bank branch.

- Fund Transfer: This service allows customers to transfer funds from their bank account to another bank account using their Aadhaar number and biometric authentication.

- Aadhaar Seeding: This service allows customers to link their Aadhaar number to their bank account using their biometric authentication. This is a mandatory requirement for availing various government subsidies and benefits.

These are some of the common AEPS services that are available to customers. The specific services that are available may vary depending on the bank or financial institution that is offering the AEPS service.

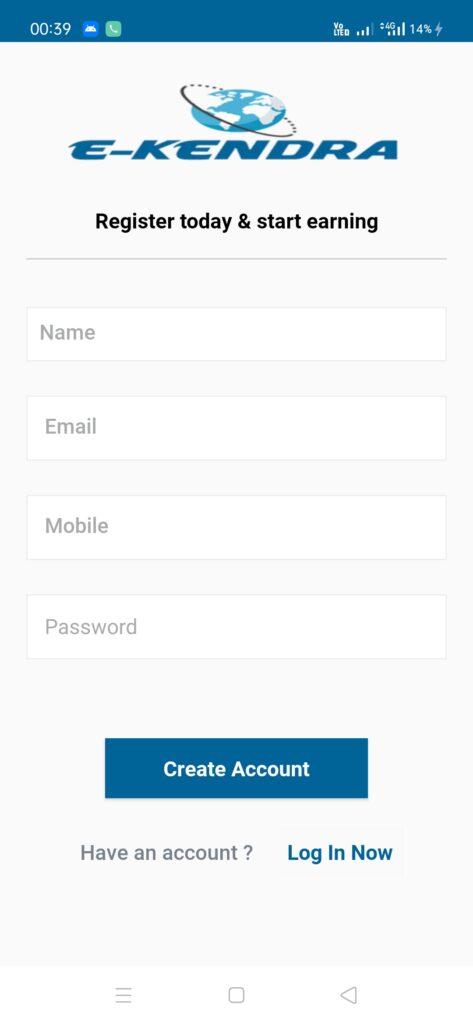

To become an AEPS agent, you may need to provide the following documents:

- Business registration documents: This includes registration of your business as a legal entity with the government, which may include business licenses, tax identification numbers, and other registration documents.

- Bank account details: You will typically need to provide bank account details for your business, including the name of the account, account number, and the bank’s name and address.

- Professional indemnity insurance: Some financial institutions may require AEPS agents to have professional indemnity insurance to cover any liability that may arise from errors or omissions in their services.

- Office premises proof: You may be required to provide proof of your office premises, such as a lease agreement or utility bill.

- ID and address proof: You will need to provide proof of your identity, such as a passport or national ID card, as well as proof of your address, such as a utility bill or bank statement.

- Experience certificate: Some financial institutions may require AEPS agents to have a minimum level of experience in the financial services industry, and may ask for an experience certificate to verify your qualifications.

- AEPS training certificate: You may be required to undergo training on AEPS services and obtain a certificate of completion before you can register as an AEPS agent.

These are some of the common documents that may be required to register as an AEPS agent. It is important to check with the specific financial institution that you are interested in working with to determine the exact requirements for registration.