No notice was given by UTIITSL, But going to the corporate email said there is a server issue. The website has not been working since the 26th, Even Uti’s official website is not working. However, it was informed by UTI that the website will start working within the next 7 days.

The RailTel server using UTI has issues on the server end. But we have to remember that it is not a small company and its database is very big. So remember, it will take some time to restore, but it will be fine.

The developer and server teams are continuously working on it and any updates will be communicated to the corporate label. We are talking to everyone from UTI’s RM to the branch manager.

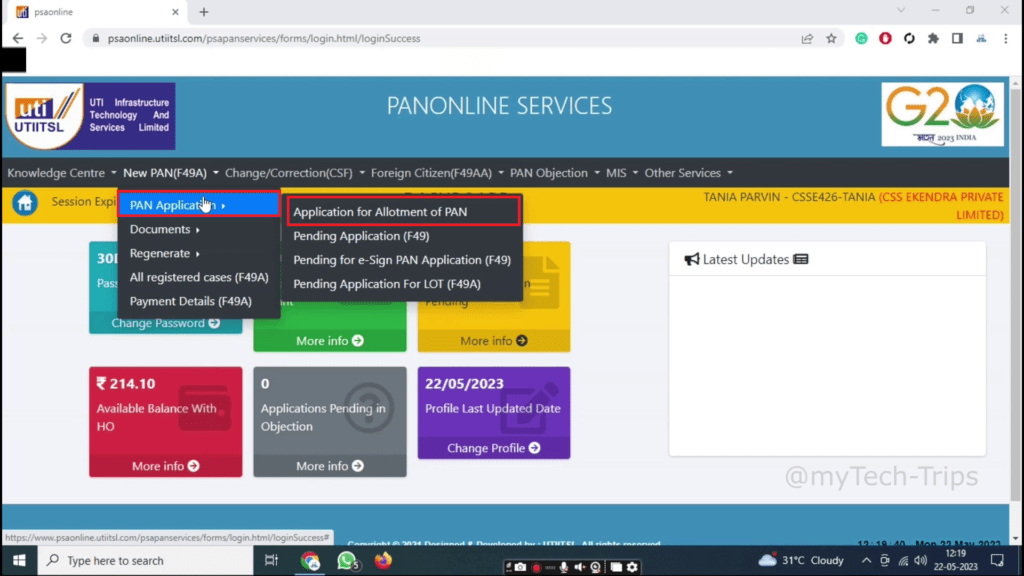

Another thing to keep in mind is that Uti and Protean are government-authorized PAN card service providers, So if we are having issues like site down, think how many other issues are happening in UTI. Think about how many crores of PAN card data, how many crores of users.

Stay tuned the site will be fixed and follow our WhatsApp and YouTube channels we will update and give.

The links are given below for your convenience

Related post:

- Temporally stopped UTIITSL Agent Registration

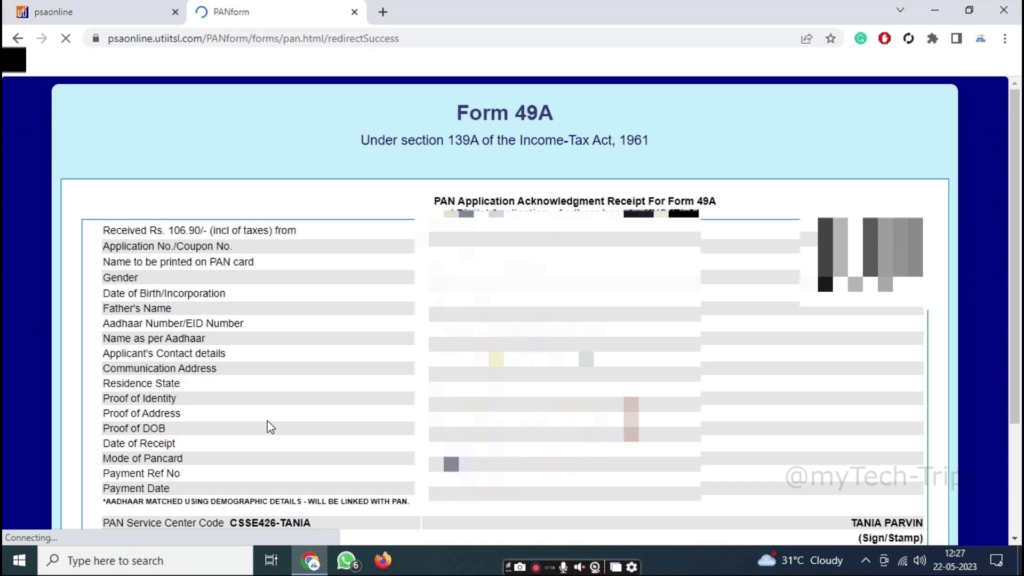

- UTI Pan card agent police verification upload process

- The KYC process explained | Ekendra

- How to Start a Pan Card Center or Agency?

What is the benefit of PAN card agent?

Additionally, agents can provide updates on the status of the application and assist with any corrections or changes that need to be made. Another benefit of using a Pan Card Agent is that they can save individuals time and effort.

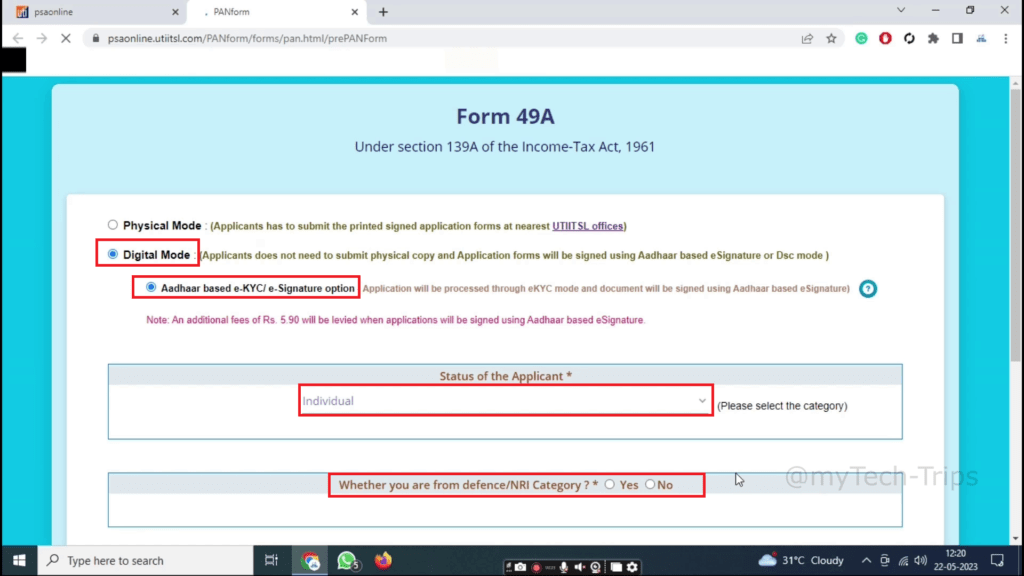

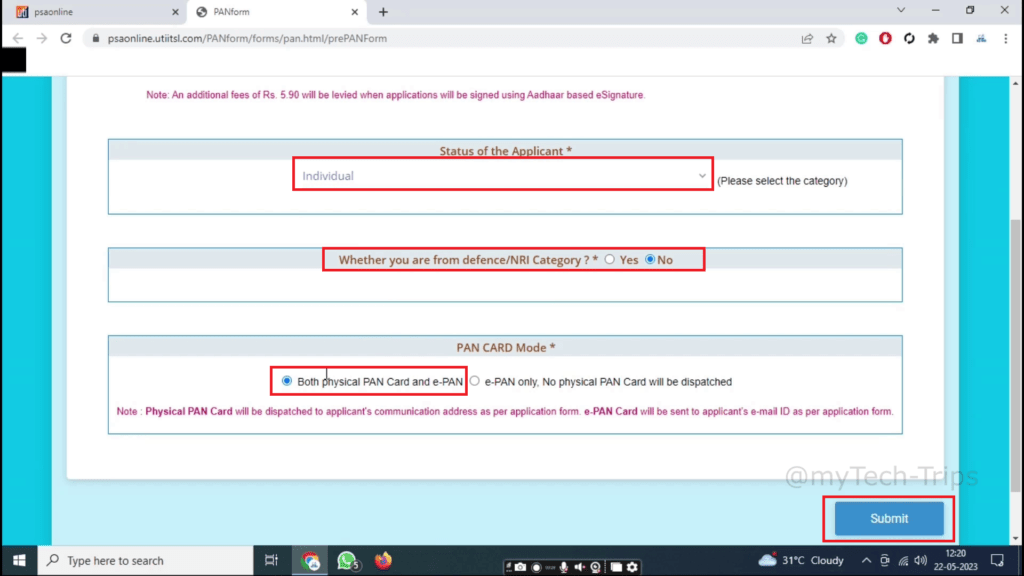

Who can open a PAN card?

Adults: Individuals above 18 years can apply for a PAN Card using a valid ID and address proof.

How to be a PAN card agent?

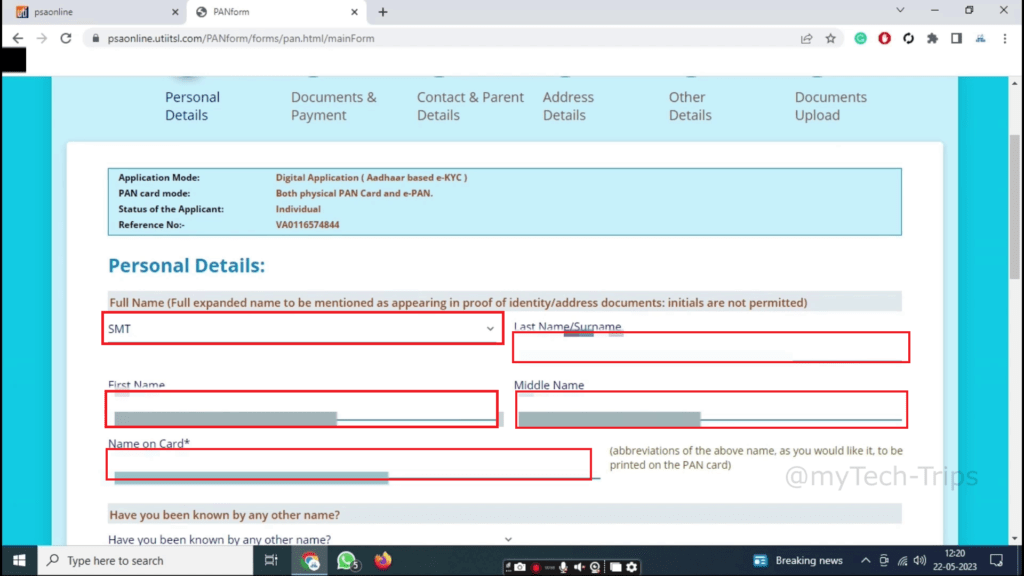

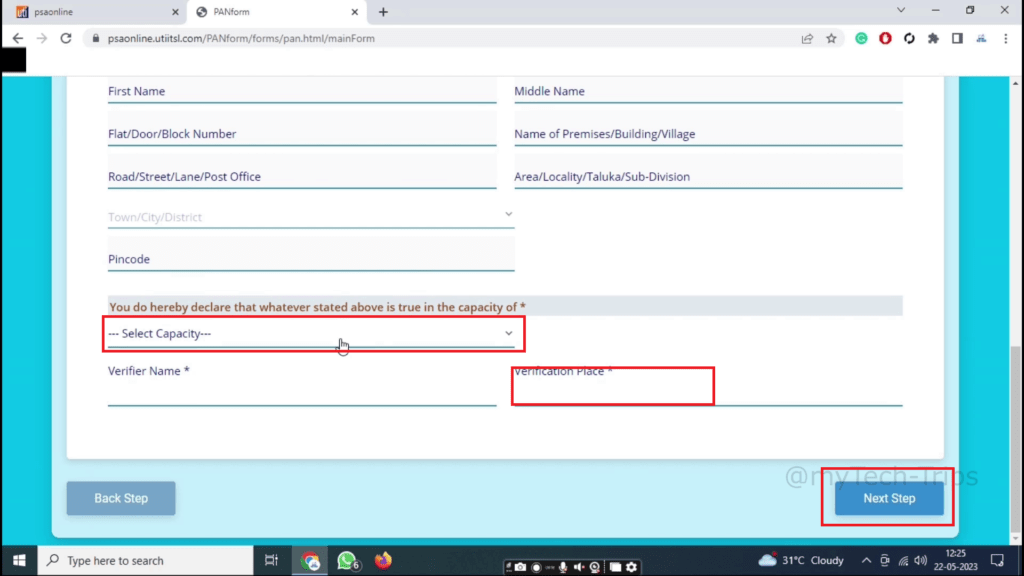

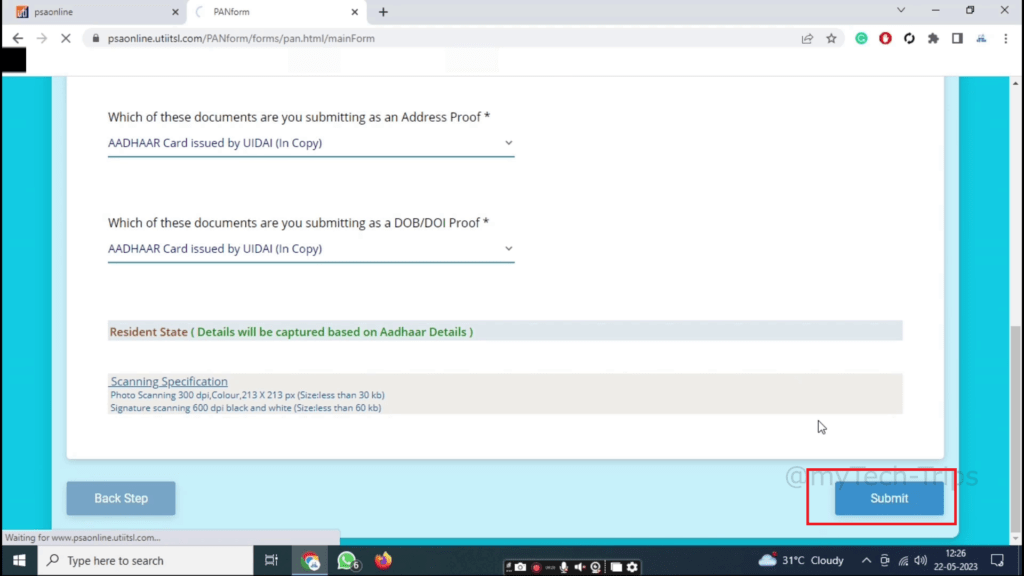

- Signup. Click on signup and register your shop by filling up the registration form.

- ID Activation. The registration form is verified, and your ID is activated within 24-48 hours.

- Activate Service. Login to ekendrapan.in and go to the “Add Service” page. ...

- Start Transaction.

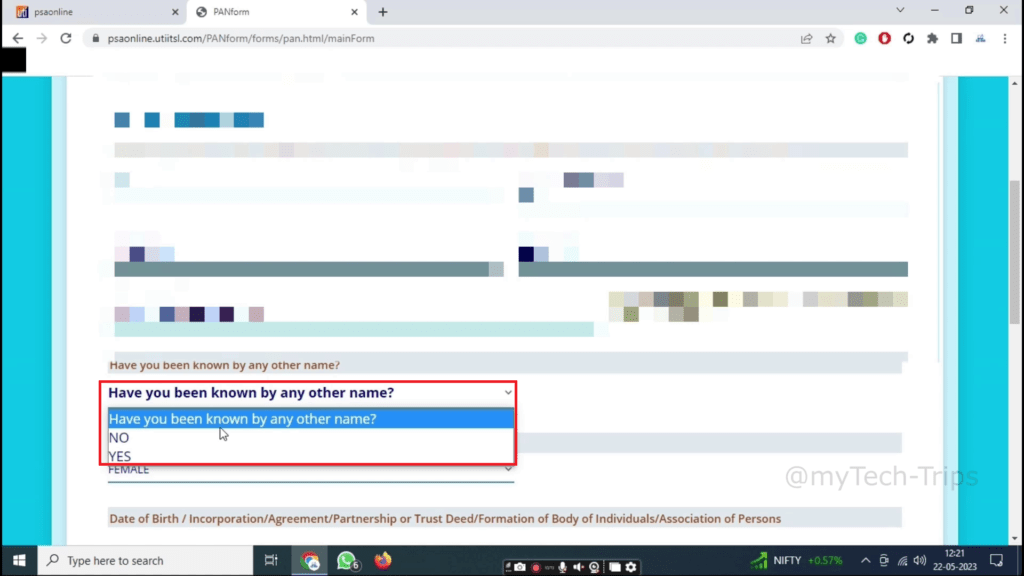

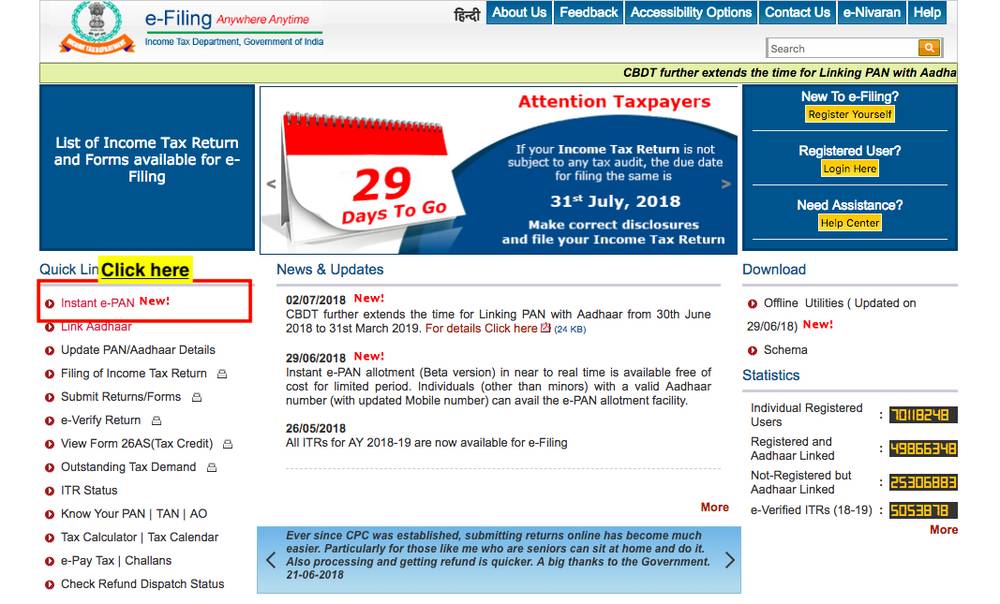

How to get PAN card in 2 hours?

Step 1: Visit the official ekendrapan.in

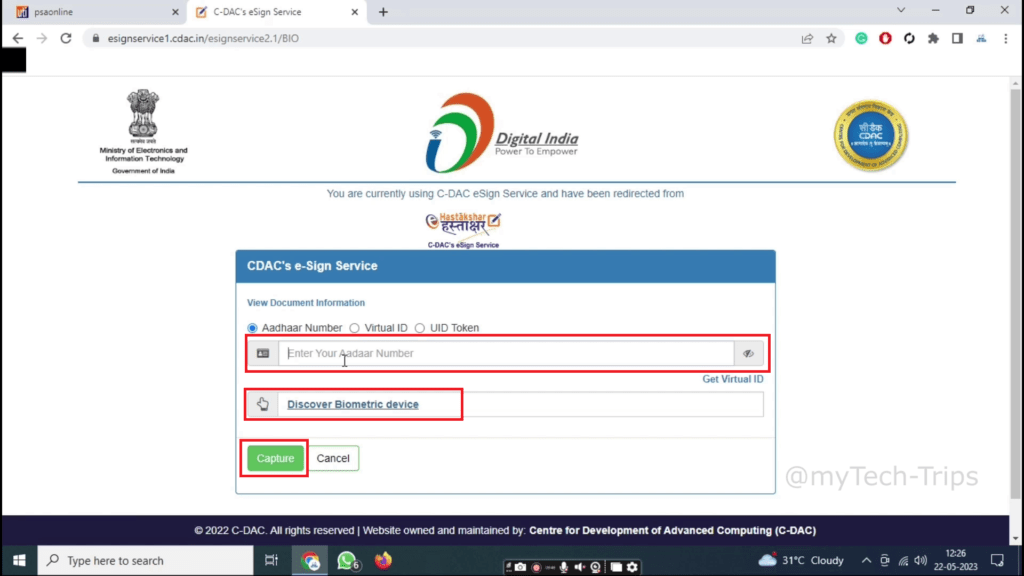

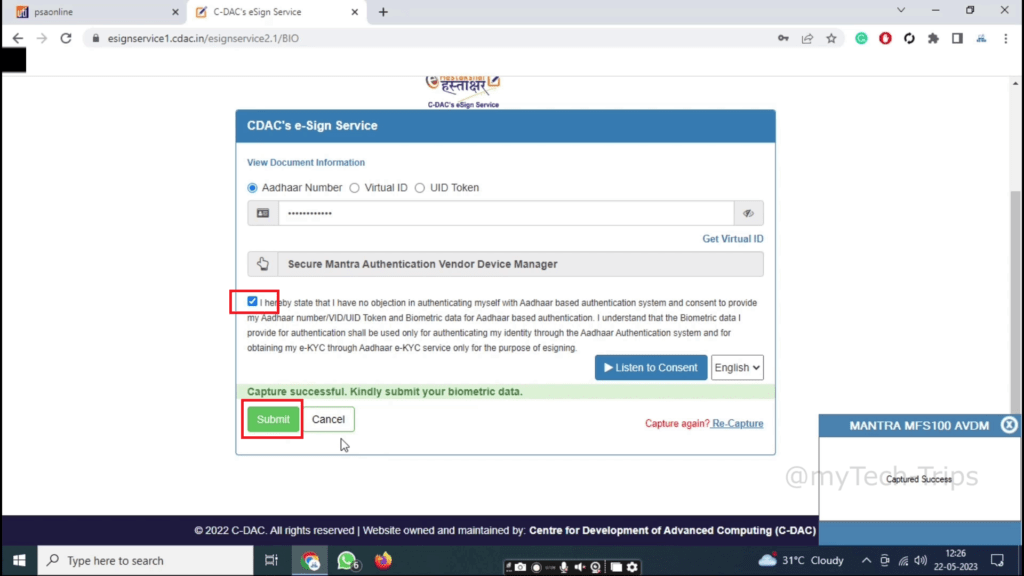

Step 2: Click on the 'Protean EKYC' option under the 'menu' section on the homepage.

Step 3: Click on the 'Check Status/Download PAN' button.

Step 4: Enter your valid Aadhaar number and captcha code.

Social media: Follow the CSS Ekendra Private Limited channel