Apply Authorized PAN Agency

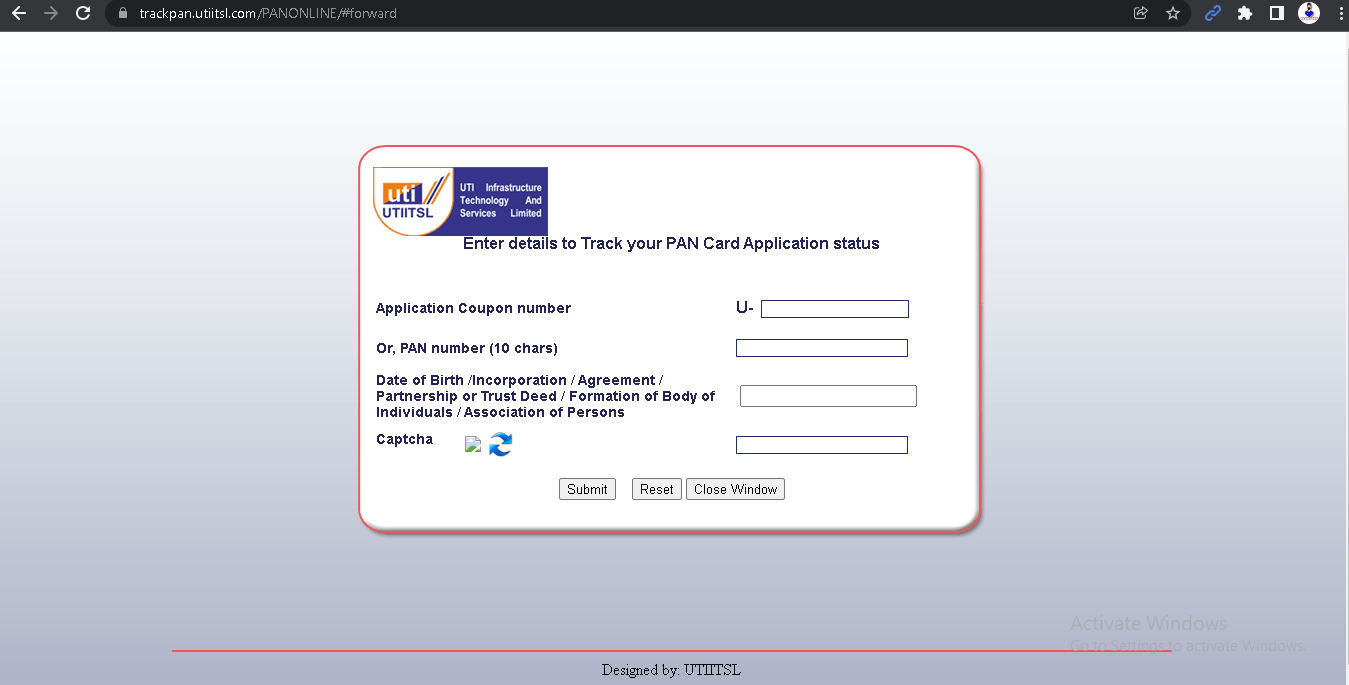

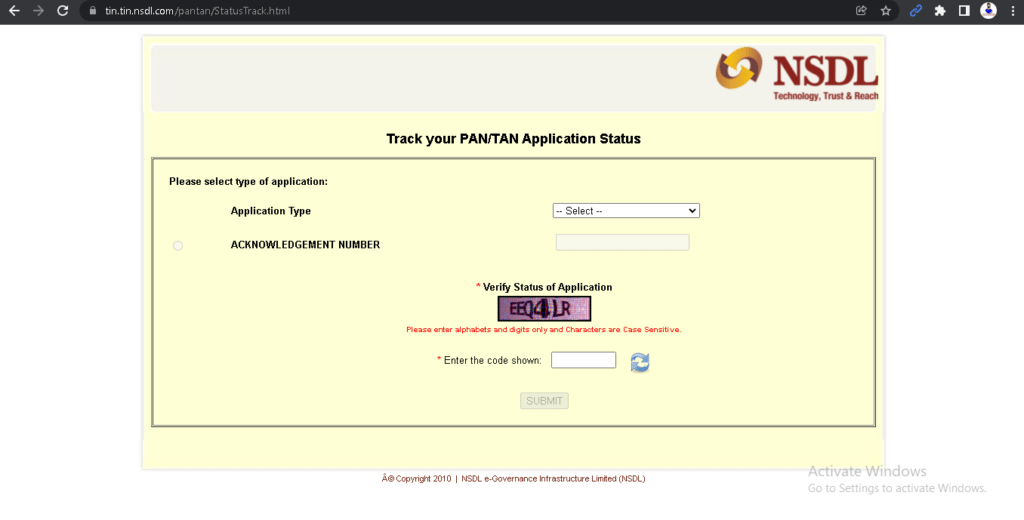

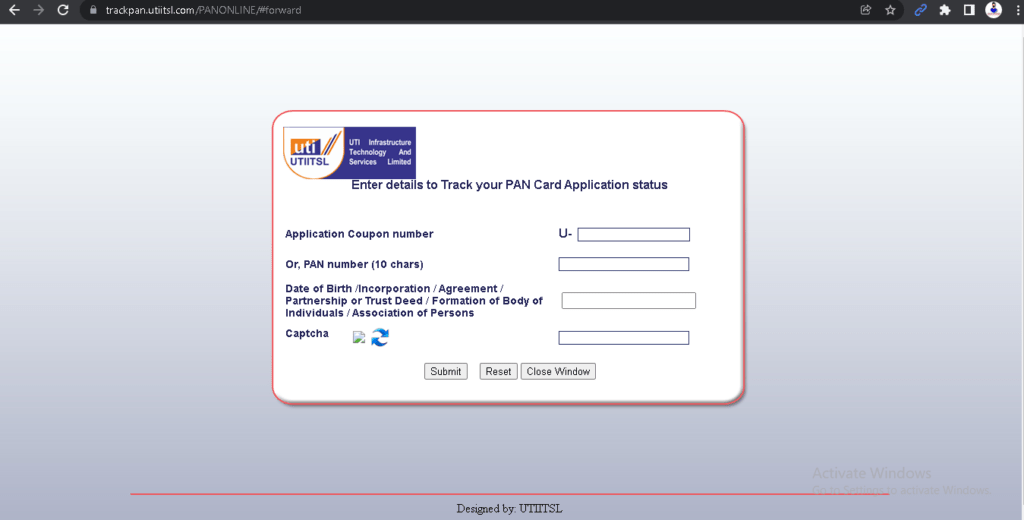

UTIITSL Agent Registration acts as the unified platform for all services related to the application of the PAN card and all other procedures, Permanent Account Number (PAN), the ten-digit number issued in the form of a laminated card by the Income Tax Department in India, counts as one of the most important document as the unique identification number allotted to each taxpayer of the country. Tax Information Network (TIN) is a contemporary system for collecting, processing, monitoring and accounting of direct taxes.

UTIITSL PAN Card Center Some of the key benefits:

- Efficient and helpful Servicing Staff.

- Hassle-Free works to improve customer comfort.

- Transparent procedures and responsible handling of documents.

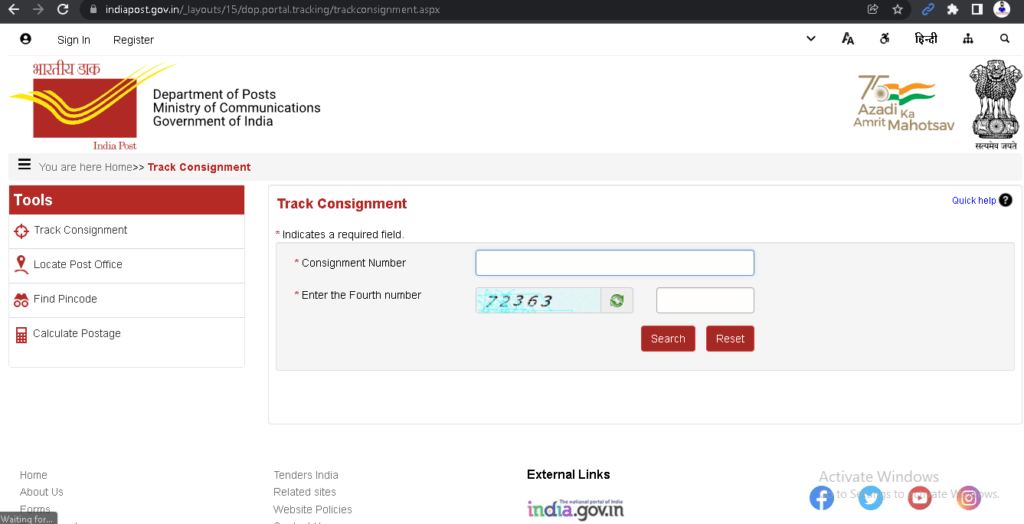

- Time-sensitive approach to delivery.

- Enormous access to the most remote corners of every region.

Services offered

UTIITSL Authorised PAN Agent / Franchise, Acceptance of New PAN/Change or Correction Application Form for Individual, Organization, and NRIs. Linking of PAN card with Aadhaar.

Manpower Required

Minimum one official required at PAN Card centre. The staff of the centre must have knowledge of taxation, operating systems, and general hardware, preferably should be well educated.

Infrastructure

UTIITSL Authorised PAN Agent / Franchise should be at a prominent place with adequate space for discharging operations. Basic infrastructure requirement:

- Office space of minimum 100 square feet.

- Availability of drinking water, drop box, sitting place, proper ventilation, lighting, housekeeping, etc.

- Computer with internet connectivity.

Hardware & Software

Minimum 1 computer systems / Laptop with following configuration:

- 2/4GB Ram

- Pentium IV Processor 2.8 Ghz

- Intel Mother Board PIV

- 50 GB HDD* 2

- Key Board

- Optical Mouse

- Internet connection

Scanner & Printer

HP / Epson / Any Other Company.

Fingerprint Biometric facility is enabled using:

Mantra Device (MFS100)

Software Portal for registration of PAN Application will be provided by UTIITSL.

Note: All the physical documents should be dispatched within 15 days of enrolment to UTIITSL Office, otherwise, UTIITSL Authorised PAN Agent / Franchise ID will be held & further activation is chargeable.

Social media: Follow the CSS Ekendra Private Limited channel