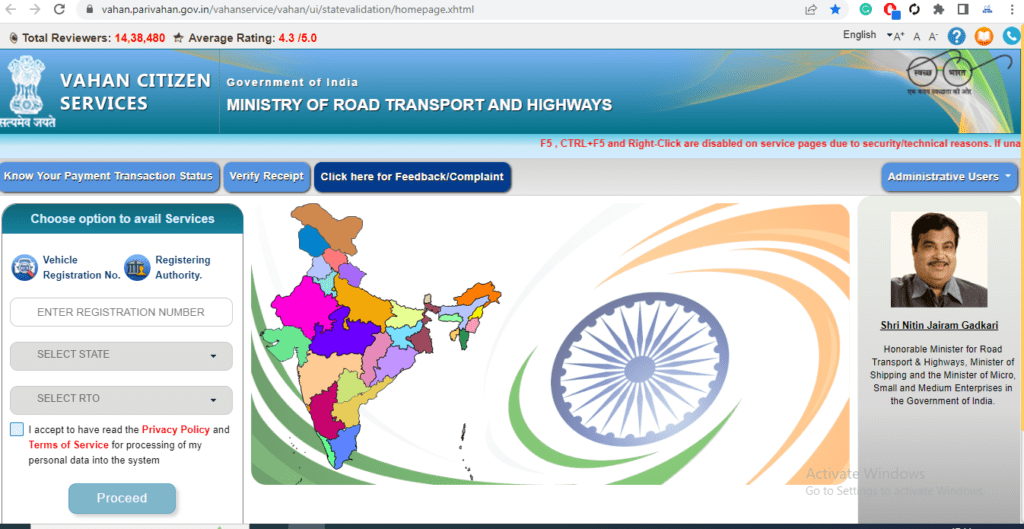

A. Visit https://vahan.parivahan.gov.in/vahanservice/vahan/

B. Enter your “Vehicle Registration Number”

C. Click on “Proceed”

D. Click on “Online Services”

E. Select “Pay Vehicle Tax”

F. Enter last 5 Digit of Chassis No. and click on “Validate Regn_no/Chasi_no”

G. Click on ‘Generate OTP’

H. Enter the OTP received on registered mobile number and Submit

I. Update “Insurance Details”

J. Review the Fee Panel and Proceed

K. Pay the Fees, as shown

L. Payment Receipt Generated

M. After this, the application will be moved to RTO for further processing

- Income tax slab for ay 2023-24

- US Tax Brackets

- PAN Aadhaar Linking Check

- GST Return File

- How do I register with GST?

- ePAN Card – Eligibility & Application Procedure

The process of paying vehicle tax online may vary depending on the country and specific jurisdiction you are in. However, I can provide you with a general guideline on how to pay your vehicle tax online, which should apply to many regions. Please note that it’s always advisable to consult your local motor vehicle department or tax authority for the most accurate and up-to-date information.

Here are the general steps to pay your vehicle tax online:

- Visit the official website of your local motor vehicle department or tax authority. Look for the section related to vehicle taxes or online services.

- Create an account or log in if you already have one. You may need to provide personal details and vehicle information to set up an account.

- Navigate to the section for online vehicle tax payment. It might be labeled as “Pay Vehicle Tax” or similar.

- Enter the required information, such as your vehicle registration number, VIN (Vehicle Identification Number), or other identification details as requested. Make sure to double-check the accuracy of the information you provide.

- Select the appropriate tax period or duration for which you wish to pay. This may be an annual tax or a different term based on your local regulations.

- Choose the payment method. Typically, you can pay using a credit or debit card, online banking, or other electronic payment options available on the website.

- Enter your payment details, including the card information or bank account details required for the transaction.

- Review the payment details and confirm the payment. Take note of any reference numbers or confirmation codes provided.

- After the payment is processed, you may receive a digital receipt or confirmation of payment. It’s a good practice to save or print this receipt for your records.

- If applicable, affix any tax stickers or decals received to your vehicle as proof of payment.

Remember to adhere to any specific deadlines for paying your vehicle tax to avoid penalties or fines. Additionally, keep track of any renewal requirements for future tax payments.

If you encounter any difficulties or have specific questions about paying your vehicle tax online, reach out to your local motor vehicle department or tax authority for further assistance.

- SBI CSP Commission Structure effective

- CSP BC Login

- IndusInd Bank CSP Registration 2023

- BOB BC Software – BOB CSP Driver

- Axis Bank CSP

- Process of CSP apply

- REVISED CHARGES FROM CUSTOMERS AT BC LOCATION

- pnb bc registration

- BOI Software

- SBI Kiosk Software

The road tax slabs in India vary from state to state as each state has its own regulations and rates. The road tax is typically based on factors such as the type of vehicle, its engine capacity, age, and purpose (personal or commercial). However, I can provide you with a general overview of the road tax slabs that are commonly followed in India:

- Private Cars:

- Small Cars (Engine Capacity up to 1000cc): Generally falls in the lower tax bracket.

- Mid-Size Cars (Engine Capacity between 1000cc and 1500cc): Moderate tax rates.

- Large Cars (Engine Capacity above 1500cc): Higher tax rates.

- Two-wheelers:

- Motorcycles with engine capacity up to 75cc: Lower tax rates.

- Motorcycles with engine capacity between 75cc and 150cc: Moderate tax rates.

- Motorcycles with engine capacity above 150cc: Higher tax rates.

- Commercial Vehicles:

- Buses, Trucks, and Lorries: Tax rates are usually determined based on the Gross Vehicle Weight (GVW) or carrying capacity of the vehicle.

- Taxis and Cabs: May have a separate category with different tax rates.

- Luxury or High-End Vehicles:

- Luxury cars, SUVs, and high-performance vehicles: These vehicles often attract higher road tax rates, as they fall into premium categories.

It’s important to note that the road tax slabs can differ significantly from one state to another in India. Additionally, some states may have additional taxes or cesses imposed on vehicles, such as environment taxes or green taxes.

To get accurate and up-to-date information on road tax slabs in your specific state or jurisdiction in India, it is advisable to visit the website of your state’s Regional Transport Office (RTO) or contact them directly. The RTO will have the most current information regarding road tax rates applicable to your vehicle category and specifications.