There are several types of bank accounts, each with its own features and benefits. Here are some of the most common types of bank accounts:

- Savings Account: This is a basic type of bank account that allows you to deposit and withdraw money. Savings accounts usually offer low interest rates but are a safe place to store your money.

- Checking Account: This type of account is designed for frequent transactions such as writing checks, using a debit card, or making electronic transfers. Checking accounts often offer features such as overdraft protection, online bill pay, and mobile banking.

- Money Market Account: This is a type of savings account that typically offers higher interest rates than a regular savings account, but requires a higher minimum balance. Money market accounts may also offer check-writing privileges.

- Certificate of Deposit (CD): This is a type of savings account that requires you to deposit a set amount of money for a fixed period of time, ranging from a few months to several years. CDs offer higher interest rates than regular savings accounts, but your money is locked in until the CD matures.

- Individual Retirement Account (IRA): This is a type of savings account that allows you to save for retirement with tax advantages. There are two types of IRAs: traditional and Roth. With a traditional IRA, you can deduct your contributions from your taxable income and pay taxes when you withdraw the money in retirement. With a Roth IRA, you make contributions with after-tax dollars and can withdraw the money tax-free in retirement.

- Joint Account: This is a bank account that is shared by two or more people. Joint accounts are often used by couples or family members to manage household finances.

- Trust Account: This is a bank account that is managed by a trustee on behalf of a beneficiary. Trust accounts are often used to manage assets for minors, elderly individuals, or people with disabilities.

These are just some examples of the types of bank accounts available. Different banks and financial institutions may offer variations on these types of accounts or other specialized accounts. It’s important to carefully review the terms and features of a bank account before opening one to ensure it fits your needs and financial situation.

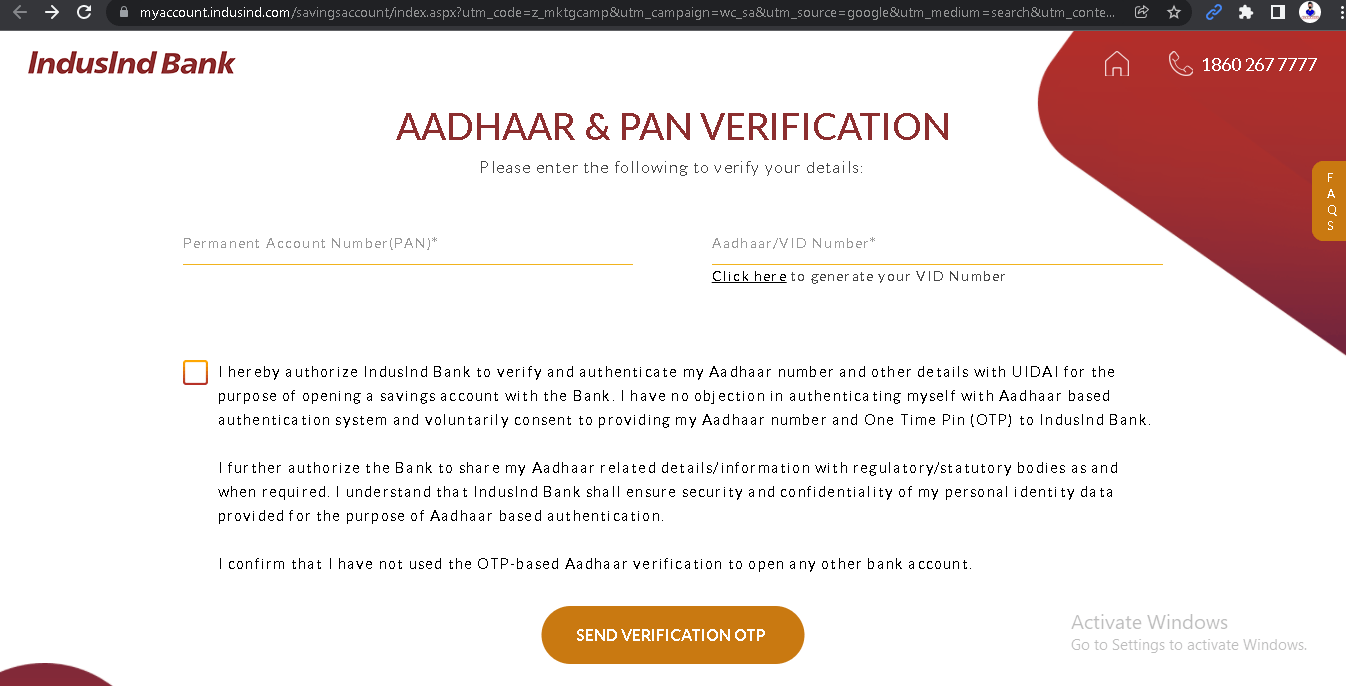

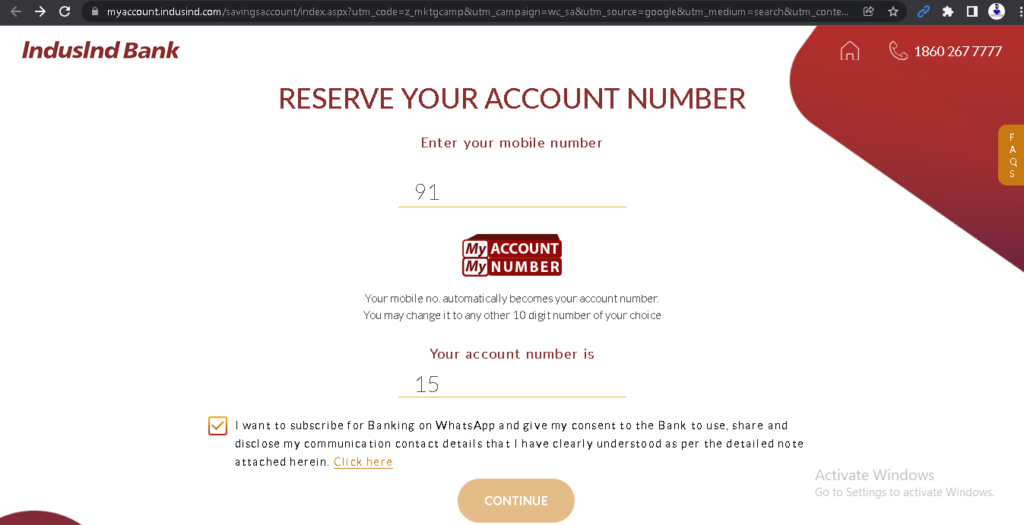

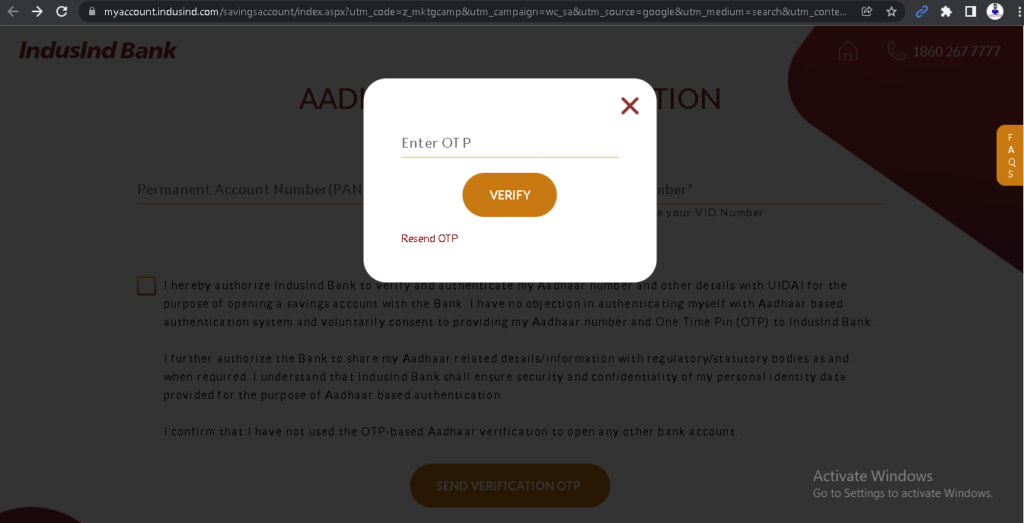

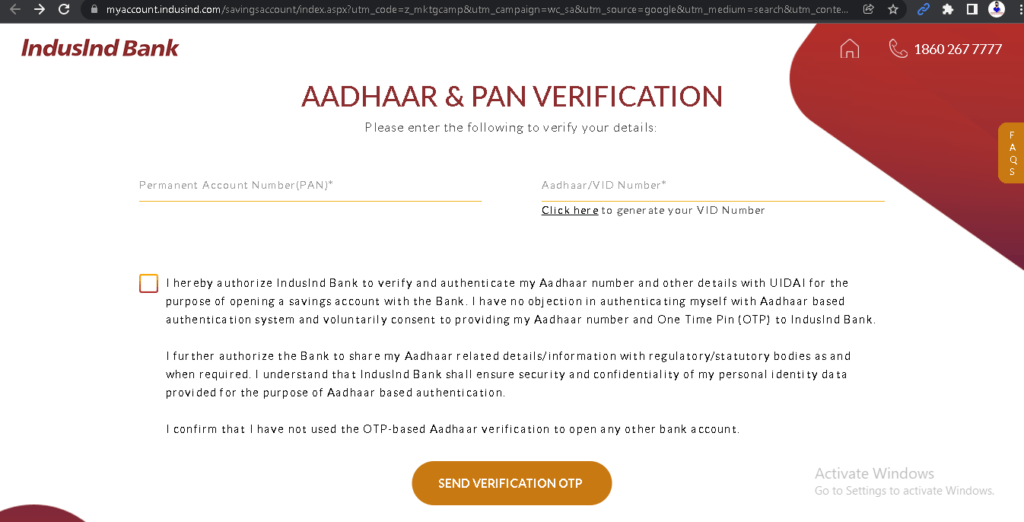

The specific documents required to open a bank account may vary depending on the bank and the type of account you are opening, as well as the country and local regulations. However, here are some common documents that are typically required to open a bank account:

- Proof of identity: You will typically need to provide a government-issued photo ID such as a passport, driver’s license, or national ID card to verify your identity.

- Proof of address: You may also need to provide a document that shows your current address, such as a utility bill, bank statement, or rental agreement.

- Tax identification number (TIN): In some countries, you may need to provide a TIN or similar identification number.

- Employment information: You may need to provide information about your employment, including your employer’s name and address, your job title, and your salary or income.

- Initial deposit: You may need to make an initial deposit to open the account, depending on the bank and account type.

These are some of the common documents that may be required to open a bank account. However, it’s important to check with the specific bank and account type you are interested in to determine the exact documents required. Additionally, some banks may require additional documentation or information depending on your specific circumstances, such as if you are a non-resident or have a complex financial situation.