A “white-label” PAN card service typically refers to a solution where financial institutions or companies can offer PAN card services under their own brand using Ekendra. This allows businesses to provide PAN application and related services without having to develop their own systems.

Key Features of White-Label PAN Card Services:

- Branding: Companies can brand the PAN services as their own while leveraging Ekendra’s backend processes.

- Ease of Use: Streamlined application processes that can be integrated into the company’s existing services.

- Comprehensive Support: Access to Ekendra’s technology and support for processing PAN applications.

- Market Reach: Businesses can expand their service offerings to include PAN-related services, appealing to a wider customer base.

If you’re interested in this service, it’s best to contact Ekendra or a financial services provider for more detailed information on how to set it up or integrate it into your offerings. Let me know if you need further assistance!

Ekendra offers a white-label solution for PAN card services, allowing businesses and financial institutions to provide PAN application and processing services under their own brand. Here are some key aspects:

Features of UTI PAN Card White-Label Services:

- Custom Branding: Companies can present PAN card services as part of their offerings, complete with their branding and interface.

- Integration: The service can be integrated into existing platforms, allowing for seamless user experiences.

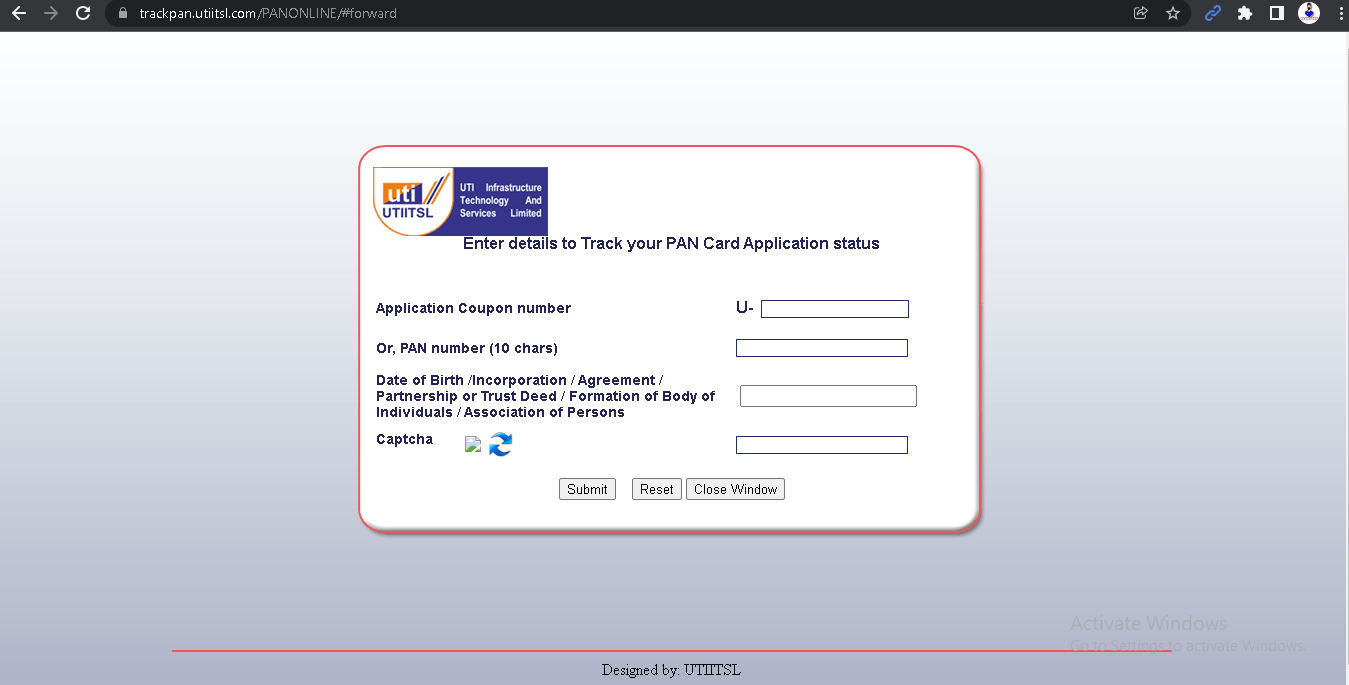

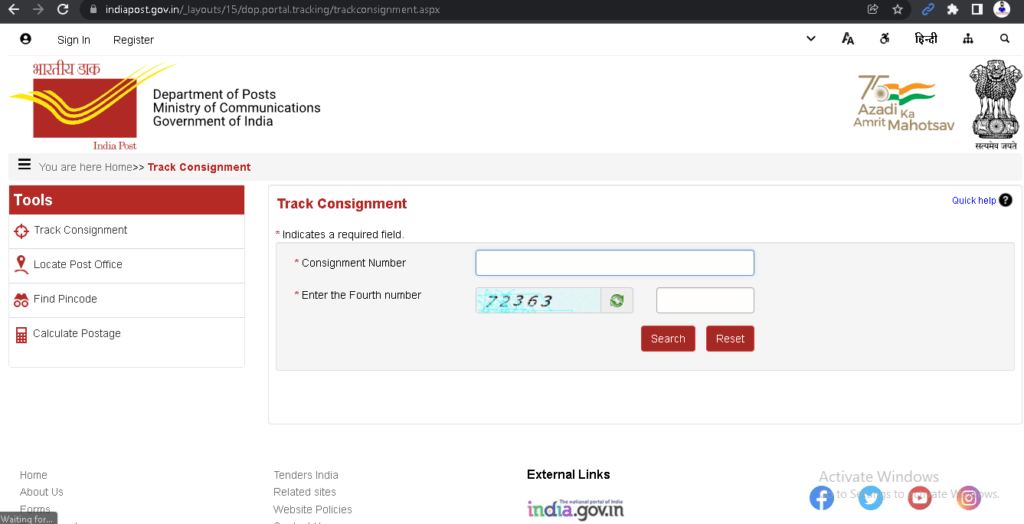

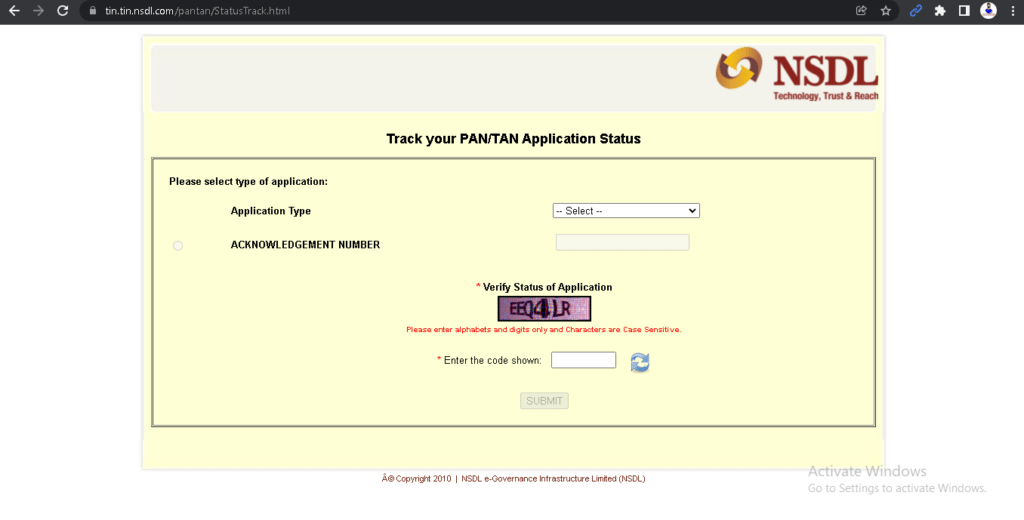

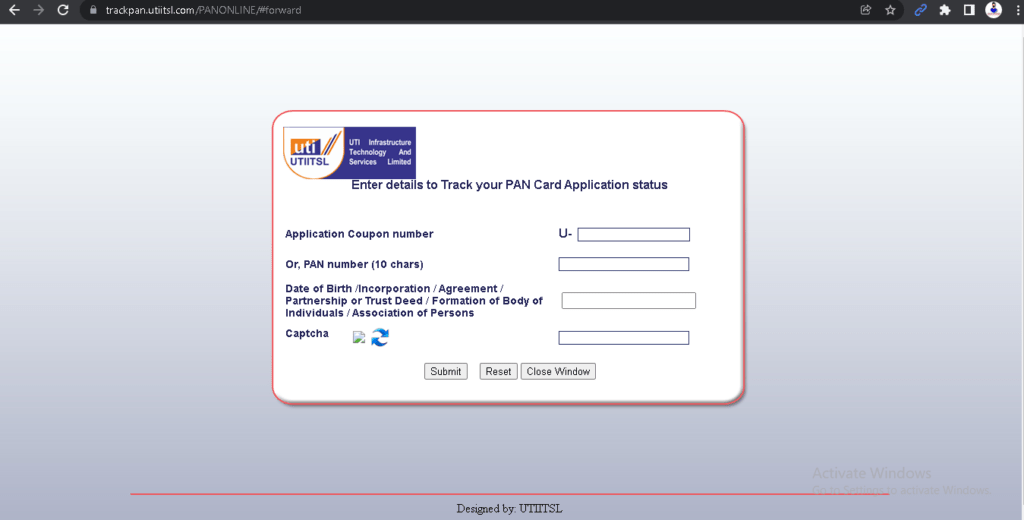

- Full Service: Ekendra handles the backend processes, including application processing, status tracking, and customer support.

- Compliance: The service adheres to regulatory standards set by the Income Tax Department in India.

- Market Expansion: Businesses can attract more customers by offering value-added services, enhancing customer loyalty.

How to Get Started:

- Contact Ekendra: Reach out to Ekendra for more details about partnership options and how to implement their white-label PAN card services.

- Business Proposal: Discuss your business model and how you wish to integrate these services.

- Technical Setup: Work with their technical team to integrate the necessary systems and ensure compliance.

If you need more specific information or assistance, feel free to ask!

Social media: Follow the CSS Ekendra Private Limited channel