REVISED CHARGES FROM CUSTOMERS AT BC LOCATION W.E.F. 01.04.2020

Pun

| S No. | Parameter | Revised Charges (charges are inclusive of GST, except where it is specified) |

| 1 | Account Opening | |

| SB | NIL | |

| RD | NIL | |

| TD | NIL | |

| 2 | Cash Deposit | |

| On-us (FI) | NIL | |

| On-us (Non-FI) | Four free transaction across all channels per month. Beyond four, Rs. 20/- per transaction. | |

| On-us Intersol (FI) | NIL | |

| On-us Intersol (Non-FI) | ||

| Upto Rs. 10000/- | Rs. 25/- per transaction | |

| Rs. 10001/- to Rs. 15000/- | Rs. 35/- per transaction | |

| Rs. 15001 to Rs. 20000/- | Rs. 45/- per transaction | |

| Rs. 20001/- to Rs. 25000/- | Rs. 55/- per transaction | |

| AePS Acquirer | NIL | |

| 3 | Cash Withdrawal | |

| On-us (FI) | NIL | |

| On-us (Non-FI) | Four free transaction across all channels per month. Beyond four, Rs. 20/- per transaction. | |

| On-us Intersol (FI) | NIL | |

| On-us Intersol (Non-FI) | Rs. 20/- per transaction | |

| AePS Acquirer | NIL | |

| AePS Issuer | Non FI : Rs. 20/- per transaction | |

| 4 | Remittance (IMPS) | |

| upto Rs. 2500/- | Rs. 30/- per transaction | |

| >2500 to <5000/- | Rs. 30/- per transaction | |

| 5000/- to Rs 10000/- | Rs. 50/- per transaction | |

| Rs. 10000/- to Rs. 25000/ | Rs. 60/- per transaction | |

| 5 | Indo Nepal Remittance | Charges at BC location (exclusive of GST) : Up to Rs.5,000/- : Rs 22/-, Rs.5,001/- to Rs.10,000/- : Rs 43/- Rs. 10,001/- to Rs. 15000/- : Rs 65/- Rs. 15,001/- to Rs.20,000/- : Rs 87/- Rs. 20,001/- to 25,000/- : Rs 109/- |

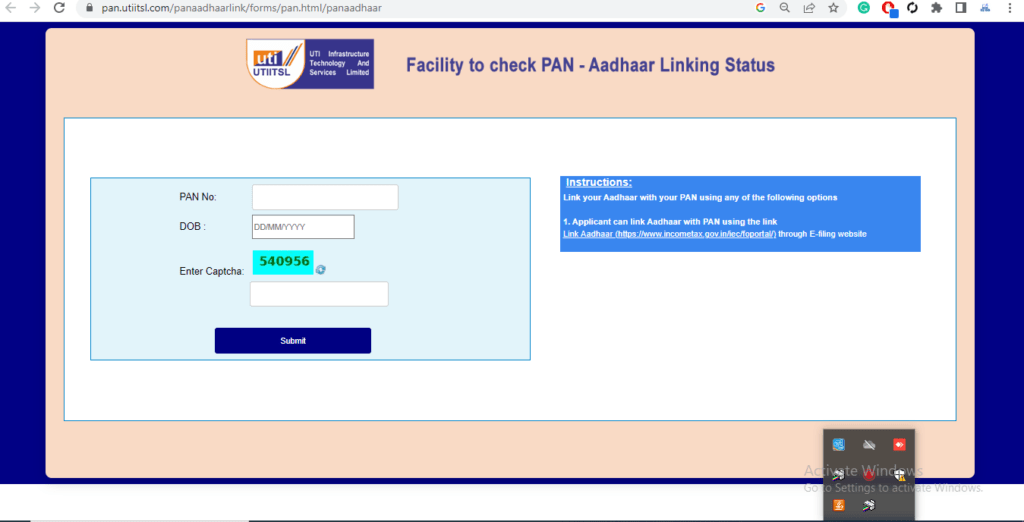

| 6 | Aadhaar Seeding | NIL |

| 7 | BBPS | Rs. 6/- (NIL for DTH recharge) per transaction |

| 8 | Fund Transfer (Non Cash Remittance) | Rs. 6/- per transaction (For remitter other than BSBD customer) |

| 9 | Request for Cheque Book, Debit Card | No charges for “Request for Debit Card”. Request for cheque book : Same as branch charges |

| 10 | Stop Cheque Request | As per branch charges |

| 11 | Block Debit Card | NIL |

| 12 | NEFT | |

| upto Rs. 2500/- | Rs. 2/- + GST | |

| >2500 to <5000/- | Rs. 2/- + GST | |

| 5000/- to Rs 10000/- | Rs. 2/- + GST | |

| Rs. 10000/- to Rs. 25000/- | Rs. 4/- + GST | |

| 13 | Cheque Receipt for Collection | Rs. 6/- per cheque leaf |

| 14 | Passbook Update | NIL |

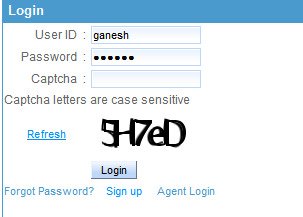

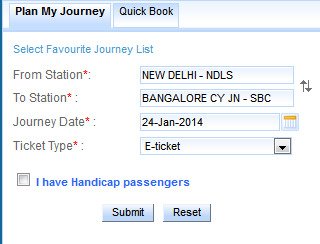

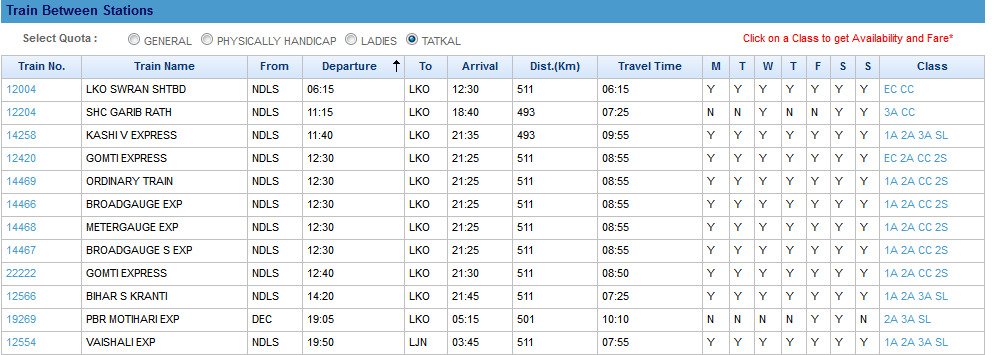

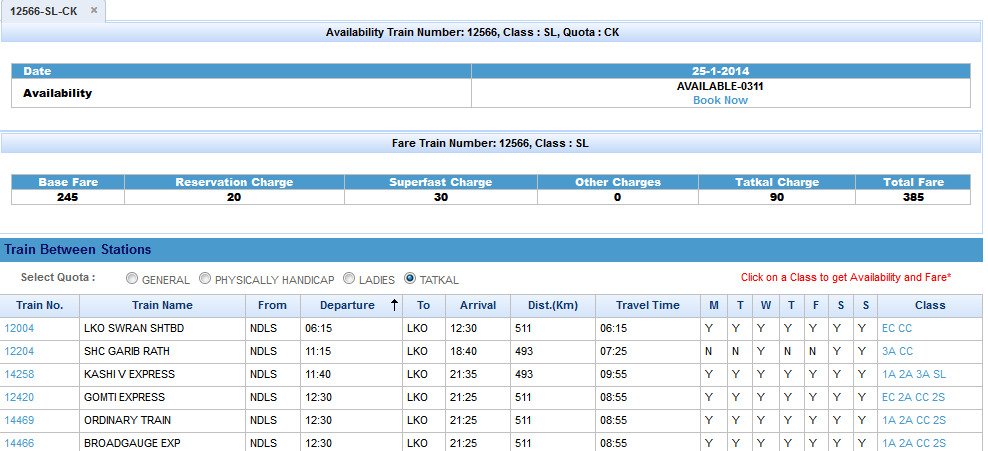

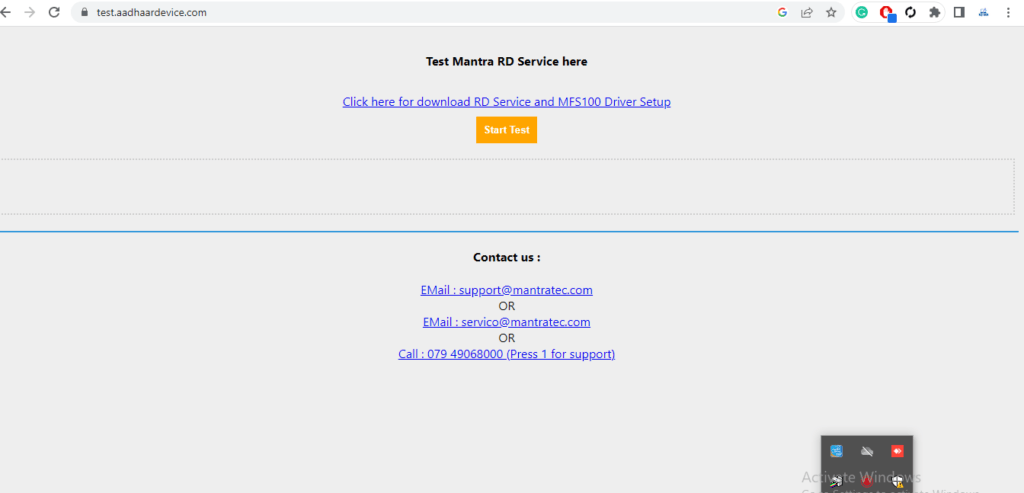

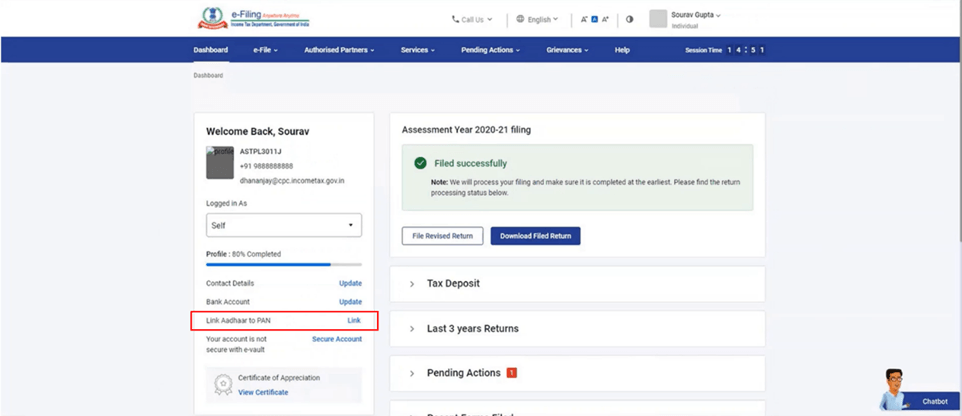

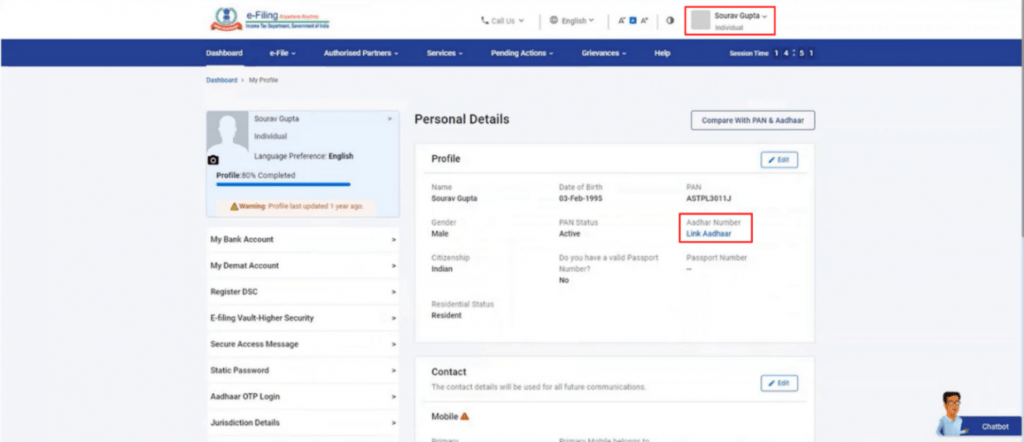

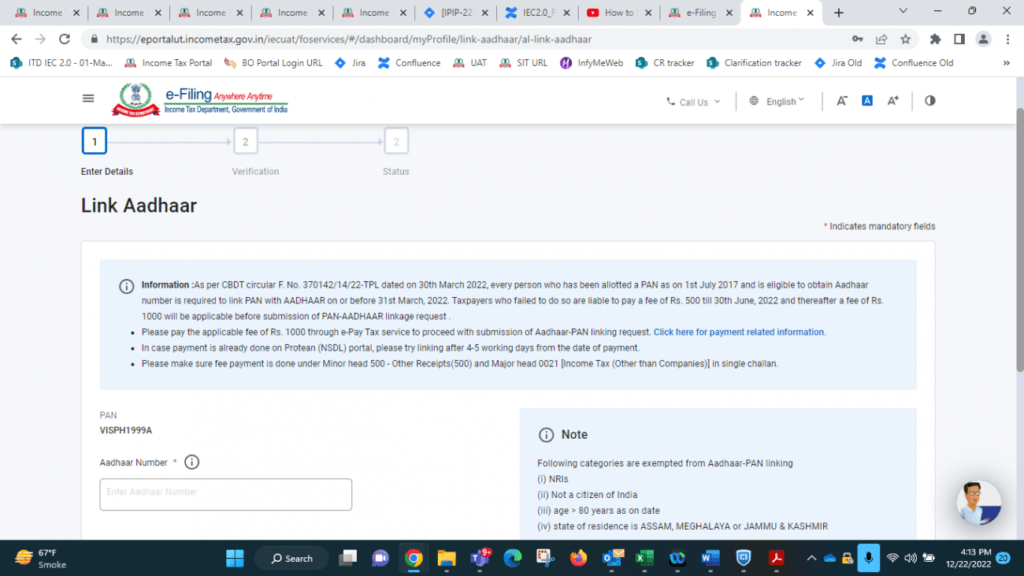

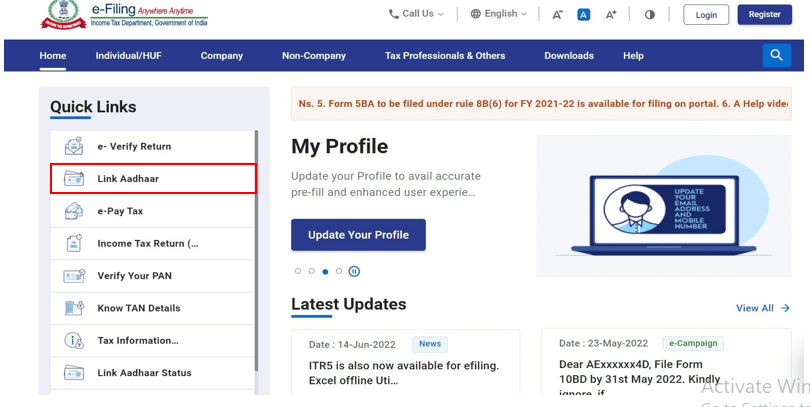

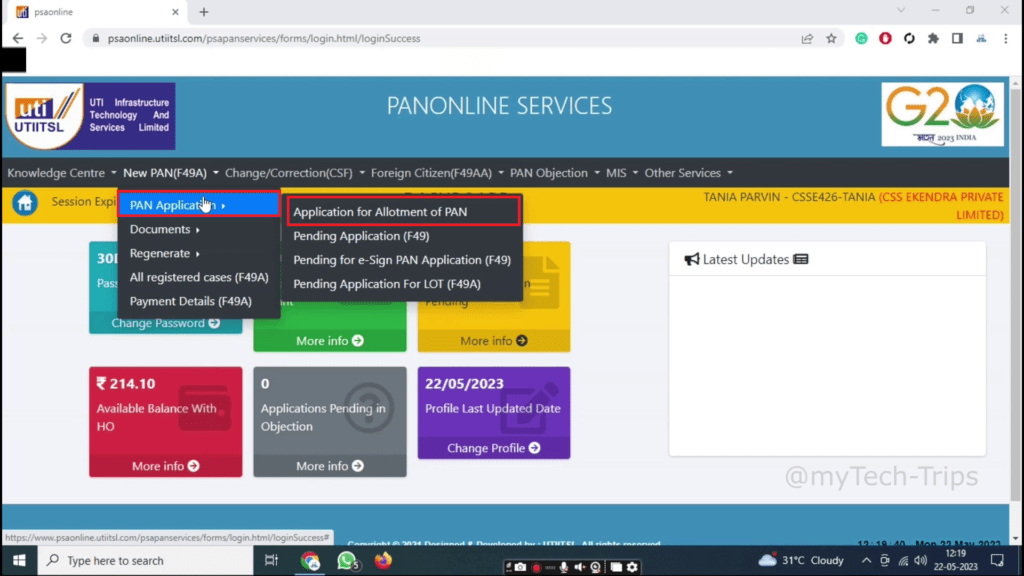

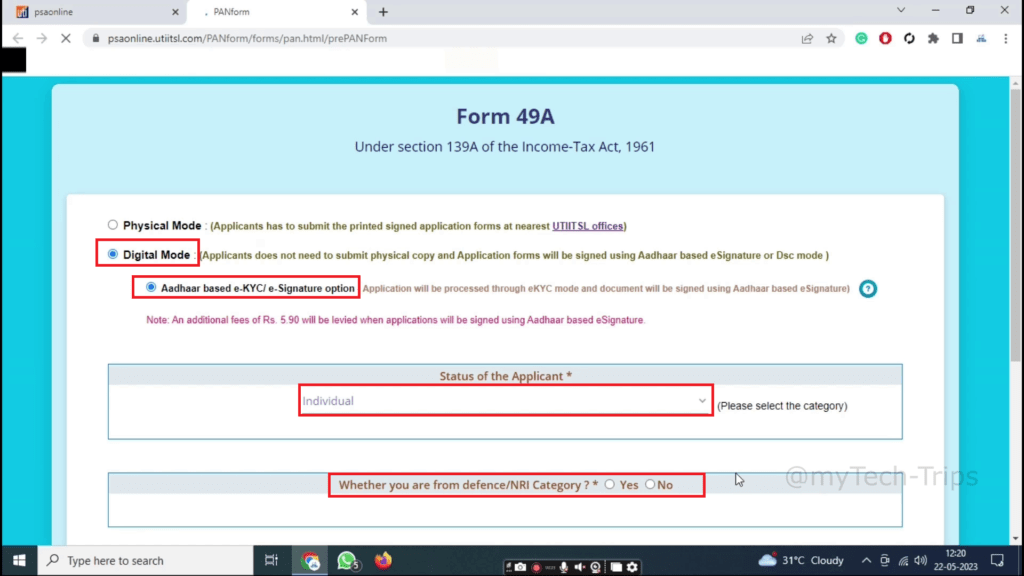

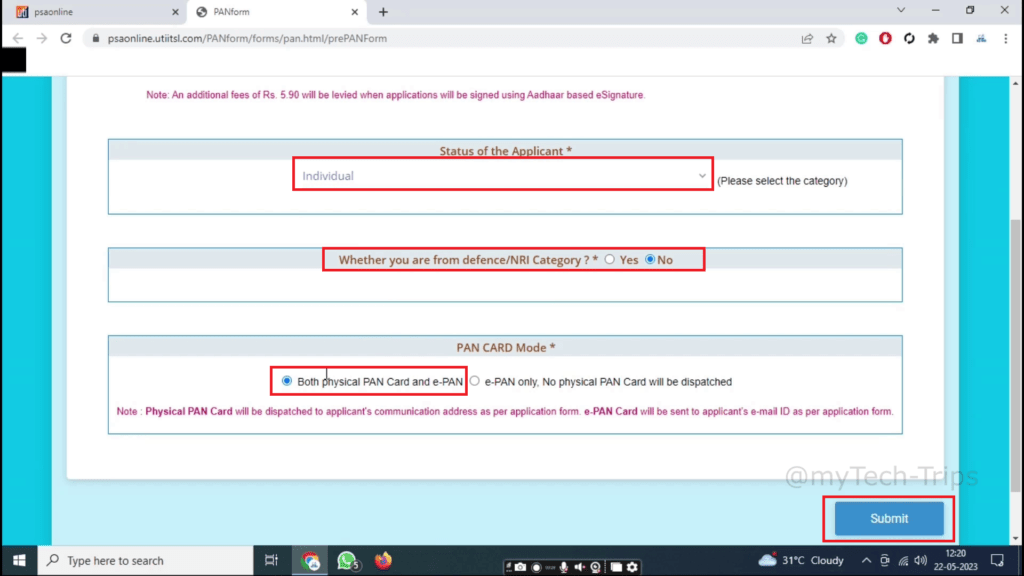

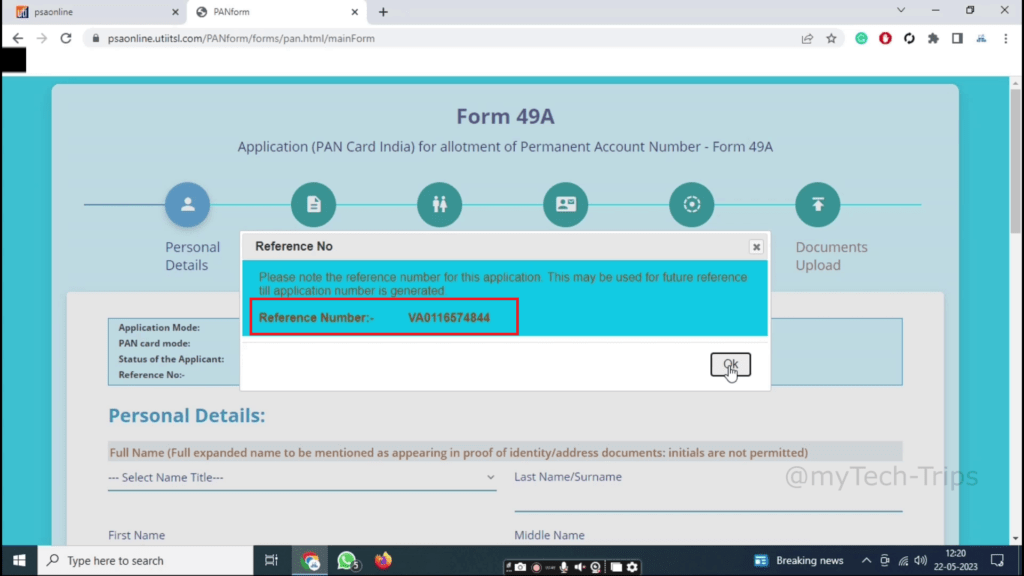

- CSP BC Login

- IndusInd Bank CSP Registration 2023

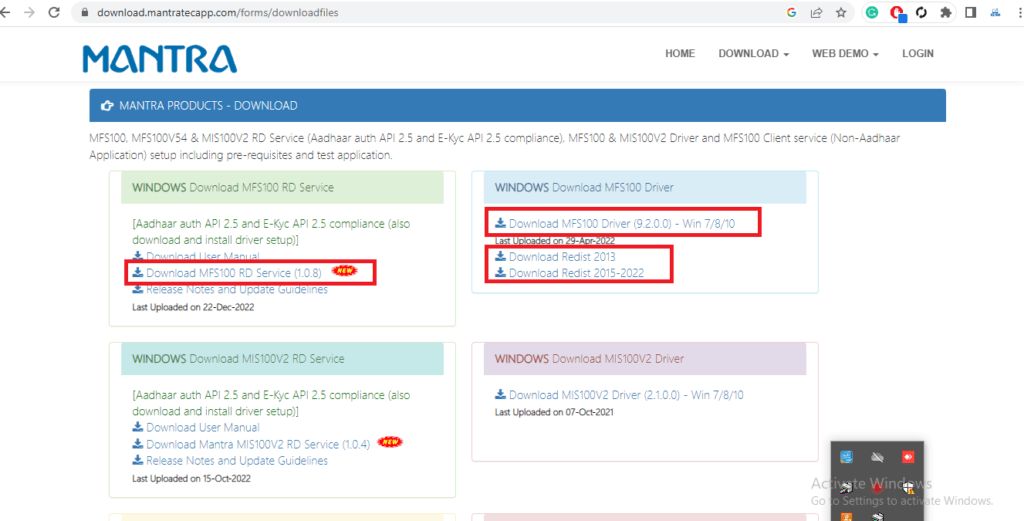

- BOB BC Software – BOB CSP Driver

- Axis Bank CSP

- Process of CSP apply

- pnb bc registration

- BOI Software

- SBI Kiosk Software

The commission structure for CSP (Customer Service Point) BC (Business Correspondent) varies based on the agreement between the BC and the bank or financial institution. CSP BCs typically earn a commission or fee for providing various banking services on behalf of the bank. However, it’s important to note that the specific commission rates and structure may differ depending on the bank and the services offered.

Here are some common types of commissions that CSP BCs may earn:

- Account Opening Commission: BCs may receive a commission for each new bank account opened through their CSP. The commission amount can vary based on factors such as the type of account opened (savings, current, etc.) and the target customer segment (rural, urban, etc.).

- Transaction-based Commission: BCs may earn a commission for every transaction conducted through their CSP. This can include commissions for cash deposits, cash withdrawals, money transfers, bill payments, and other banking transactions facilitated by the BC.

- Micro Insurance Commission: If the BC offers microinsurance products on behalf of the bank, they may earn a commission for each policy sold or renewed.

- Loan-related Commission: In some cases, BCs may receive a commission for promoting and facilitating loans provided by the bank. This can include commissions for loan applications, loan disbursements, and loan repayments made through the CSP.

- Government Benefit Commission: BCs may earn a commission for assisting in the distribution of government benefits, such as pensions, subsidies, or social welfare payments. The commission can be based on the number of beneficiaries served or the amount disbursed.

The exact commission rates and structure are determined through negotiations between the BC and the bank. It’s important for BCs to understand the terms and conditions related to the commission structure, including any performance targets, payment cycles, and associated fees or charges.

It is advisable for individuals interested in becoming a CSP BC to directly inquire with the bank or financial institution they wish to collaborate with to obtain specific details about the commission structure and other related aspects.