How to Start a Pan Card Center or Agency?

To start a PAN Card center or agency, follow these steps:

Research and Understand the Requirements: Begin by researching the requirements and regulations set by the government or relevant authorities for operating a PAN Card center. Understand the eligibility criteria, documentation, and other prerequisites needed to establish the center.

Identify Location and Space: Choose a suitable location for your PAN Card center. It should be easily accessible to the public and preferably located in a commercial area. Ensure that the space you select meets the necessary infrastructure requirements and has adequate space for handling customer inquiries and processing applications.

Obtain Necessary Licenses and Permits: Acquire the required licenses and permits to operate a PAN Card center legally. This may include obtaining a business license, tax registrations, and any other permits mandated by local authorities.

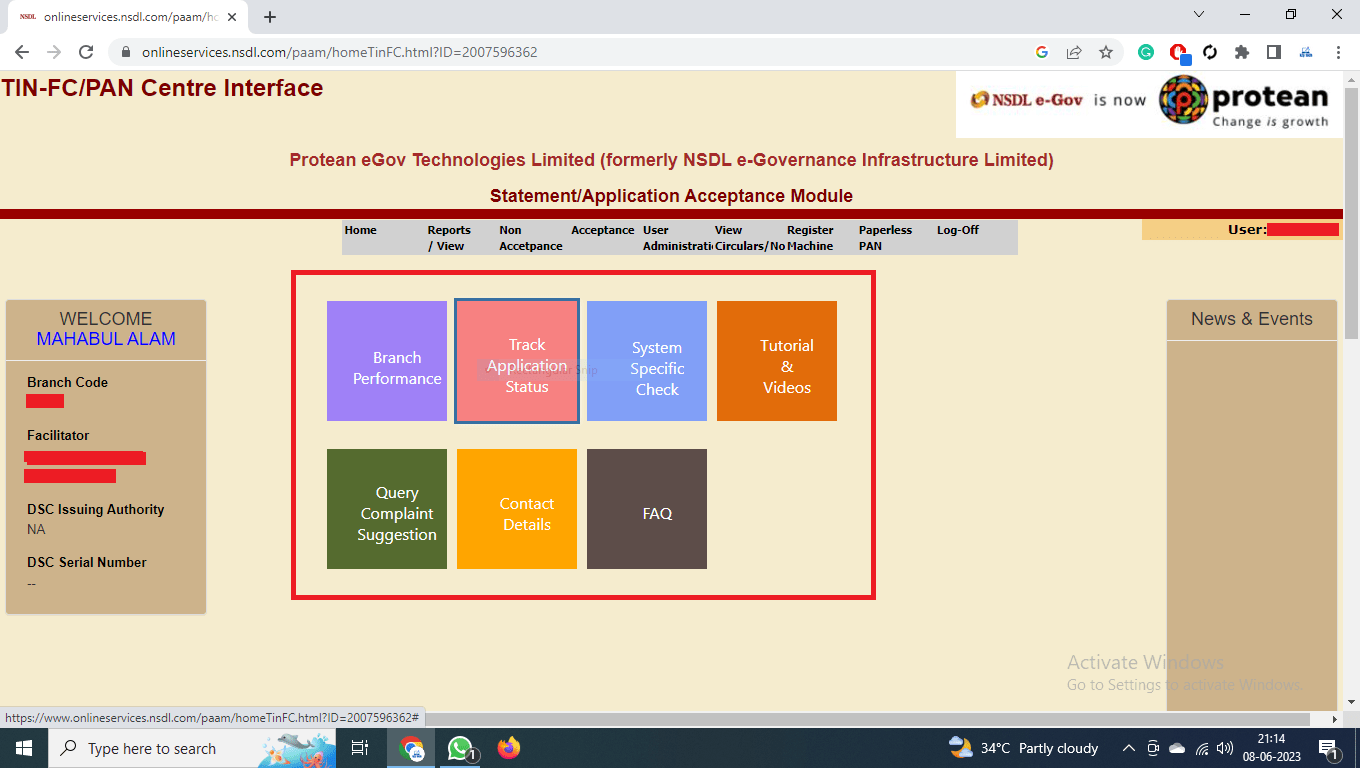

Register with NSDL or UTI Infrastructure Technology and Services Limited (UTIITSL): NSDL (National Securities Depository Limited) and UTIITSL are authorized entities responsible for processing PAN Card applications in India. Register your PAN Card center with either NSDL or UTIITSL to become an authorized service provider.

Complete Training and Certification: Undergo training and certification programs provided by NSDL or UTIITSL to gain the necessary knowledge and skills for processing PAN Card applications accurately and efficiently. This training is essential for ensuring compliance with regulatory requirements and maintaining the quality of service.

Setup Infrastructure and Systems: Set up the required infrastructure and systems for processing PAN Card applications. This includes computer systems, internet connectivity, biometric devices (if applicable), and other necessary equipment to facilitate application processing and verification.

Hire and Train Staff: Recruit and train staff members to assist with PAN Card application processing, customer service, and other administrative tasks. Ensure that your team is well-trained in handling sensitive information and adhering to data security protocols.

Promote Your Services: Promote your PAN Card center through various channels to attract customers. Utilize online and offline marketing strategies, such as creating a website, distributing flyers, and advertising in local newspapers, to increase awareness about your services.

Provide Excellent Customer Service: Offer exceptional customer service to build trust and credibility among your clients. Ensure prompt and courteous assistance to applicants, address their queries and concerns efficiently, and strive to provide a seamless experience throughout the application process.

Maintain Compliance and Quality Standards: Adhere to all regulatory guidelines and quality standards set by NSDL or UTIITSL. Regularly review and update your processes to ensure compliance with the latest regulations and maintain the quality of service offered by your PAN Card center.

By following these steps diligently, you can establish and operate a successful PAN Card center or agency, providing valuable services to individuals and businesses seeking PAN Card-related assistance.

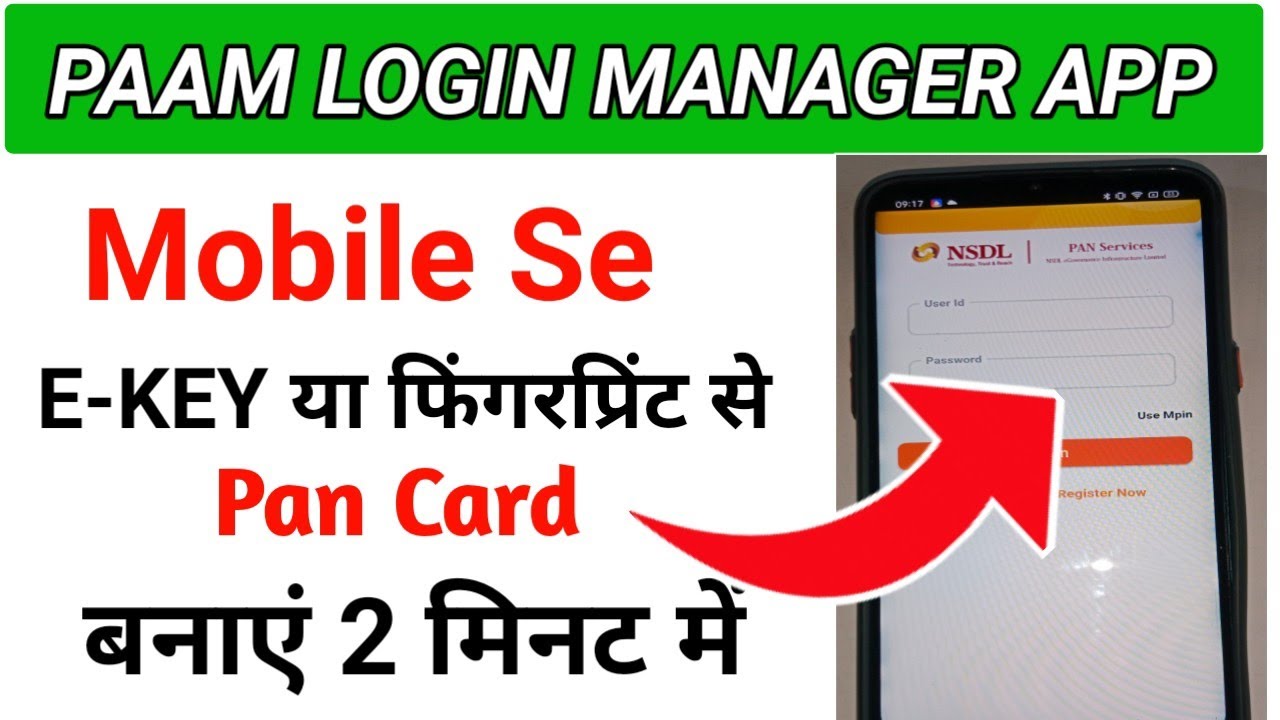

To start your own Pan card agency you can fill Online Pan Card application with Ekendra with the following steps:

- Signup using your phone number in the EkendraPAN web portal or EkendraPAN mobile application

- Complete your process of E-Kyc

- Activate your Pan card service from the service portal

By following the above steps, you will be able to activate the pan card service and offer the service of making new UTI & NSDL pan cards as well as the service of Pan card correction.

To know more about Pan card service, you can contact Ekendra at – 022-69621074

What is the required document list for the PAN Card Center or Agency?

When applying for a PAN card through a PAN Card Center or Agency, it’s essential to provide a set of documents to ensure a smooth application process. These documents serve as proof of identity, address, and date of birth, and are required by the Income Tax Department of India. Submitting clear and legible copies is crucial for accurate and timely processing, contributing to a hassle-free experience.

List of Required Documents:

Proof of Identity:

- Aadhaar card

- Passport

- Voter ID

- Driver’s License

Proof of Address:

- Bank statements

- Rent agreement

Proof of Date of Birth:

- Birth certificate

- School leaving certificate

Additional Requirement:

- Passport-sized photograph

Applicants are encouraged to carefully review and fulfill these document criteria to avoid any complications or delays in obtaining their PAN card.

Social media: Follow the CSS Ekendra Private Limited channel