Ekendra is a service for searching pan card related details or data for pan verification. Search PAN is a very easy and quick service for find or verify the pan card holder details. You can search / verify pan numbers in bulk (search multiple pan numbers in just one click).

A PAN card, or Permanent Account Number card, is a unique 10-digit alphanumeric identification number issued by the Indian Income Tax Department to individuals and entities for the purpose of tracking financial transactions. It is mandatory for individuals and entities to have a PAN card in order to file taxes, open a bank account, or conduct certain financial transactions in India.

Obtaining a PAN card is a simple process, which can be done online or offline. To apply for a PAN card, individuals must fill out an application form, known as Form 49A or Form 49AA, and submit it along with the necessary documents. These documents may include proof of identity, proof of address, and proof of date of birth.

The PAN card is a laminated card, and it displays the PAN number, the holder’s name, and a photograph. The PAN number is unique and permanent, it will not change throughout the life of the holder.

It’s important to note that PAN card is a requirement for carrying out many financial transactions like opening a bank account, investing in mutual funds, buying or selling property, etc. PAN card is also a proof of identity and address for the applicant, which is why it is an important document to have.

In conclusion, PAN card is a mandatory document for individuals and entities in India for the purpose of tracking financial transactions. It is easy to obtain and is a useful tool for conducting financial transactions and maintaining a good credit score. It serves as a valid proof of identity and address for all financial transactions.

PAN (Permanent Account Number) : PAN is a unique 10 character alphanumeric number for uniquely identify the pan cardholder or income tax payer. The PAN is mandatory for a majority of financial transactions like opening a bank account, receiving taxable salary or professional fees, sale or purchase of assets above specified limits etc especially high-value of transactions.

What is pan verification ?

pan verification is a process for knowing the pan details using pan number. pan verification is using for cross check pan details with applicant details.

How to verify pan number ?

Verifying pan number or permanent account number is a easy task. You can easily verify any pan number using income tax india efilling portal. income tax india efilling portal is a center government of india portal for tax payments and income tax related services.

Income tax india efilling have two service for pan verification 1. Know you pan . 2. AO details.

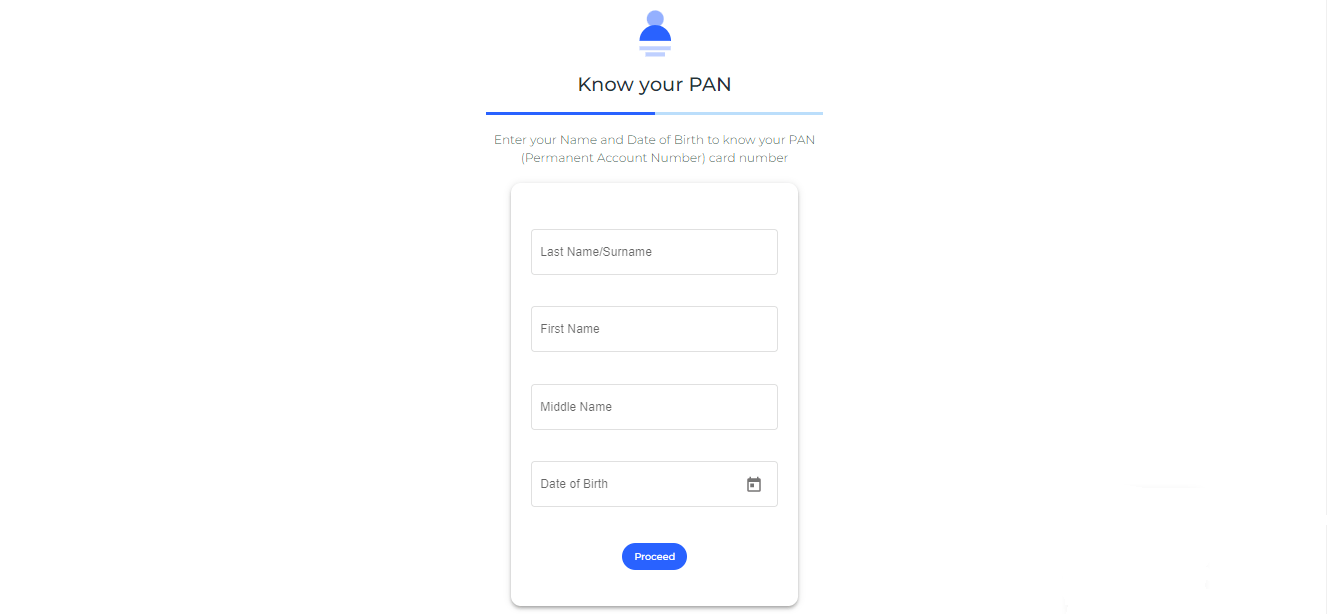

1. Know your pan service is a nothing but a service of pan verification by name. if you want to know AO – Area Code, AO Type, Range Code and AO Number. Applicants for PAN are required to provide the AO code in their pan application. so you can easily know any pan number, ao details, email and address of pan using pan card holder name and date of birth.

2. AO Details. : you can verify AO code details using pan number. In this service you must have the pan number. You can fetch the AO details and pan card holder name using pan number.