Top five low-cost invoicing software

Invoice software refers to a type of application or program designed to help businesses generate, send, and manage invoices for goods or services provided to clients or customers. This software typically includes features such as:

- Invoice Generation: Ability to create professional-looking invoices with customizable templates, including company logo, contact information, and itemized list of products or services provided.

- Client Management: Ability to store client/customer information, such as contact details, payment terms, and billing history.

- Automated Billing: Option to set up recurring invoices for regular clients or subscription-based services, with automated scheduling and reminders.

- Payment Processing: Integration with various payment gateways to facilitate online payments, including credit/debit cards, bank transfers, and digital wallets.

- Expense Tracking: Capability to track expenses related to invoiced projects or clients, enabling better financial management and reporting.

- Reporting and Analytics: Generation of reports on invoice status, payments received, outstanding balances, and other financial metrics to help businesses monitor their cash flow and performance.

- Tax Calculation: Calculation of taxes (such as sales tax or VAT) based on the applicable rates and regulations, with the option to apply taxes automatically to invoices.

- Integration with Accounting Software: Seamless integration with accounting software platforms like QuickBooks, Xero, or FreshBooks to streamline the invoicing-to-accounting process.

- Customization and Branding: Ability to customize invoices with branding elements, color schemes, and personalized messages to maintain brand consistency and professionalism.

- Security and Data Protection: Implementation of robust security measures to protect sensitive financial data, including encryption, secure data storage, and compliance with data protection regulations like GDPR.

Some popular examples of invoicing software include QuickBooks Online, FreshBooks, Zoho Invoice, Wave, and Xero. Businesses often choose invoicing software based on factors such as their specific invoicing needs, budget, scalability, and integration capabilities with other business tools.

Here are five low-cost invoicing software options:

- Wave:

- Wave offers free accounting and invoicing software with basic features.

- It allows you to create and customize professional invoices, track payments, and manage expenses.

- Wave is suitable for freelancers, small businesses, and entrepreneurs looking for a no-cost solution.

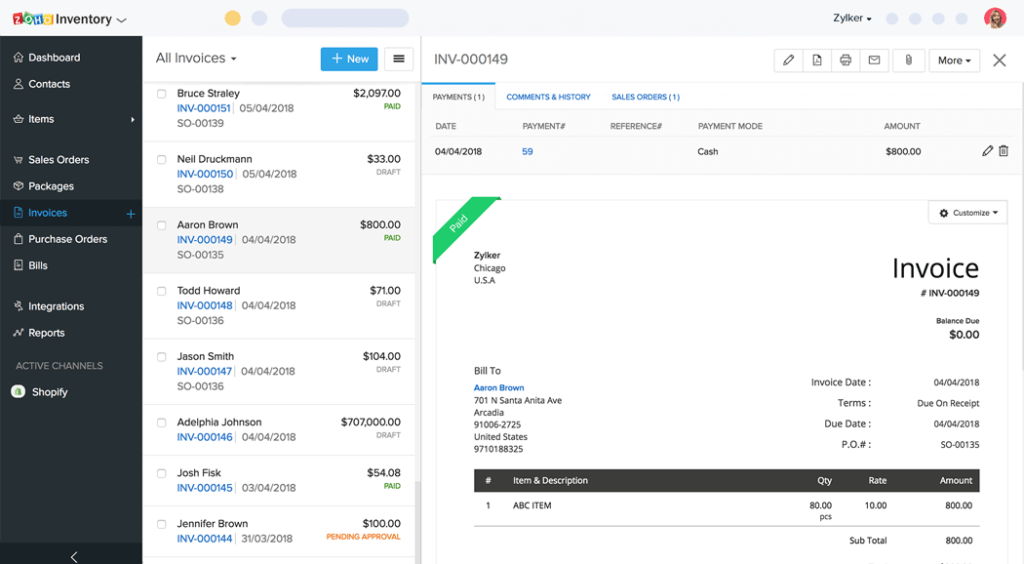

- Zoho Invoice:

- Zoho Invoice provides affordable invoicing software with plans starting from a low monthly fee.

- It offers features such as invoice customization, recurring billing, time tracking, and expense management.

- Zoho Invoice is suitable for small businesses and freelancers who need more advanced invoicing capabilities at an affordable price.

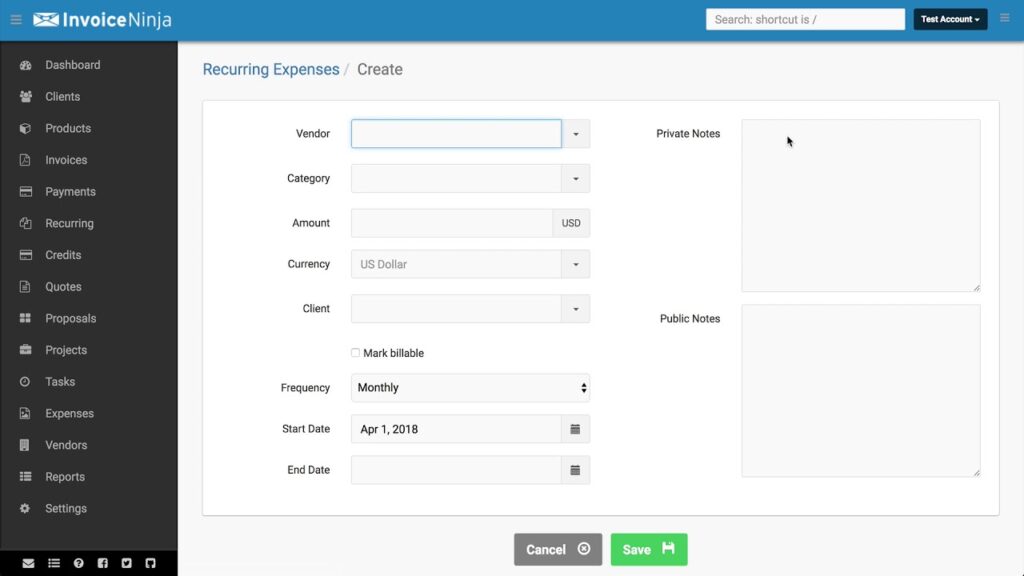

- Invoice Ninja:

- Invoice Ninja offers a free plan with limited features and affordable paid plans with additional functionalities.

- It provides features like customizable invoice templates, payment processing, time tracking, and expense management.

- Invoice Ninja is suitable for freelancers, small businesses, and independent contractors looking for budget-friendly invoicing solutions.

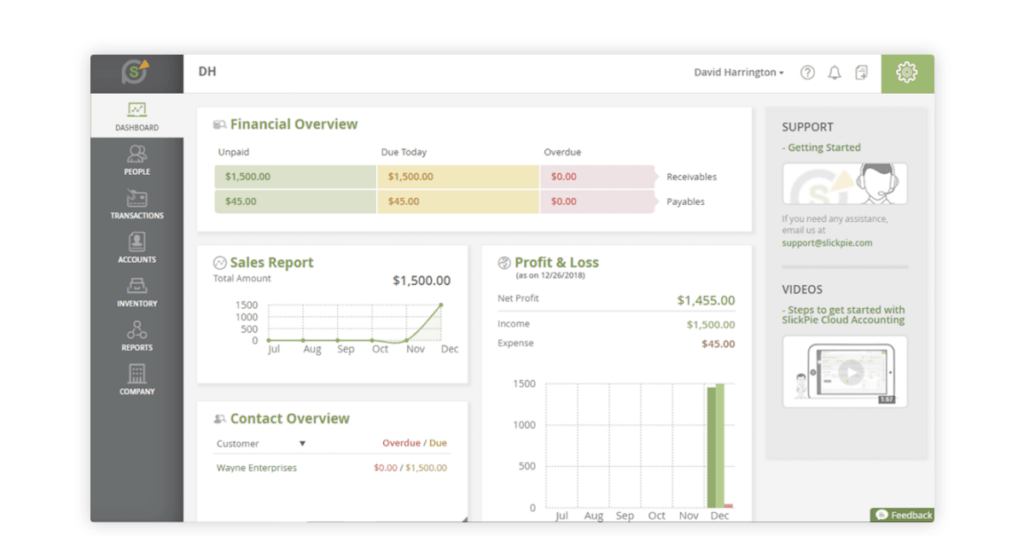

- SlickPie:

- SlickPie offers free accounting and invoicing software for small businesses.

- It provides features such as customizable invoices, automated payment reminders, financial reports, and expense tracking.

- SlickPie is suitable for small businesses and startups that need basic invoicing and accounting tools without the cost.

- Hiveage:

- Hiveage offers affordable invoicing software with flexible pricing plans.

- It includes features like customizable invoices, online payment processing, expense tracking, and time tracking.

- Hiveage is suitable for freelancers, small businesses, and consultants who need an inexpensive invoicing solution with essential features.

These options provide cost-effective invoicing solutions for businesses with budget constraints, offering essential features to manage invoicing and billing processes efficiently.

Wave:

Wave Invoicing is a free invoicing software offered by Wave Financial Inc. It’s designed to help small businesses, freelancers, and entrepreneurs streamline their invoicing and billing processes. Here are some key features and aspects of Wave Invoicing:

- Free to Use: One of the most appealing aspects of Wave Invoicing is that it’s completely free to use. There are no subscription fees, and users can access all the essential features without any cost.

- Professional Invoices: Wave allows users to create professional-looking invoices quickly and easily. Users can customize invoice templates with their logo, branding, and relevant details such as client information, itemized lists, and payment terms.

- Easy Invoicing Workflow: The invoicing workflow in Wave is user-friendly and intuitive. Users can create, send, and track invoices effortlessly, helping them stay organized and on top of their billing processes.

- Online Payments: Wave Invoicing integrates with payment gateways, allowing users to accept online payments directly from their invoices. This feature can help expedite payment collection and improve cash flow.

- Invoice Tracking: Users can track the status of their invoices in real-time, including when invoices are sent, viewed by clients, and paid. This visibility helps users stay informed and follow up on overdue invoices as needed.

- Recurring Invoices: Wave supports recurring billing, making it easy for users to set up and automate invoices for regular clients or subscription-based services. This feature saves time and ensures consistency in billing cycles.

- Expense Tracking: While primarily an invoicing software, Wave also offers basic expense tracking functionality. Users can categorize and track business expenses, helping them manage their finances more effectively.

- Financial Reporting: Wave provides basic financial reporting capabilities, allowing users to generate reports on income, expenses, and profit/loss. While not as robust as dedicated accounting software, these reports offer valuable insights into business performance.

- Customer Support: Wave offers customer support through various channels, including email, help articles, and community forums. While it may not provide 24/7 support, users can find assistance and resources to resolve issues or answer questions.

Overall, Wave Invoicing is a reliable and cost-effective solution for businesses seeking a simple yet effective tool to manage their invoicing and billing needs. Its ease of use, professional invoicing templates, and free pricing make it a popular choice among small business owners and freelancers.

Zoho Invoice:

Zoho Invoice is an online invoicing software provided by Zoho Corporation, a leading provider of cloud-based business applications. It is designed to help small businesses, freelancers, and entrepreneurs streamline their invoicing and billing processes. Here are some key features and aspects of Zoho Invoice:

- Invoicing Templates: Zoho Invoice offers a variety of professional invoice templates that users can customize to match their brand identity. Users can add their logo, choose colors, and include relevant details such as client information, itemized lists, and payment terms.

- Easy Invoicing Workflow: Zoho Invoice provides an intuitive interface for creating, sending, and managing invoices. Users can easily generate invoices, preview them before sending, and track their status to know when they have been viewed and paid.

- Online Payment Integration: Zoho Invoice integrates with various payment gateways, allowing users to accept online payments directly from their invoices. This feature facilitates faster payment processing and improves cash flow for businesses.

- Recurring Invoices: Users can set up recurring invoices for regular clients or subscription-based services. Zoho Invoice automates the invoicing process for these recurring charges, saving time and ensuring consistency in billing.

- Expense Tracking: In addition to invoicing, Zoho Invoice includes basic expense tracking features. Users can record and categorize expenses, attach receipts, and track reimbursable expenses related to client projects.

- Time Tracking: Zoho Invoice offers time tracking functionality, enabling users to track billable hours for client projects. Users can easily convert tracked time into invoices, making it simple to bill clients accurately for the time spent on their projects.

- Financial Reporting: Zoho Invoice provides basic financial reports that give users insights into their business finances. Users can generate reports on revenue, expenses, overdue invoices, and more to help them make informed business decisions.

- Integration with Zoho Apps: Zoho Invoice seamlessly integrates with other Zoho applications, such as Zoho CRM and Zoho Books, for a more comprehensive business management solution. Users can sync data across different platforms to streamline their workflows.

- Mobile Apps: Zoho Invoice offers mobile apps for iOS and Android devices, allowing users to manage their invoicing and billing on the go. The mobile apps provide access to essential features, such as creating invoices, tracking expenses, and accepting payments.

Overall, Zoho Invoice is a versatile invoicing software that offers a range of features to help businesses manage their invoicing and billing processes efficiently. With its customizable templates, online payment integration, and seamless integration with other Zoho apps, it’s a popular choice for businesses looking for a comprehensive invoicing solution.

Invoice Ninja:

Invoice Ninja is a popular online invoicing and billing software designed for freelancers, small businesses, and entrepreneurs. It offers a range of features to help users create, send, and manage invoices efficiently. Here are some key aspects and features of Invoice Ninja:

- Customizable Invoices: Invoice Ninja provides customizable invoice templates that users can tailor to match their brand identity. Users can add their logo, company information, and customize the layout and design of their invoices.

- Easy Invoicing Workflow: The platform offers a user-friendly interface for creating, editing, and sending invoices. Users can easily add line items, apply taxes, and set payment terms before sending invoices to clients.

- Online Payment Integration: Invoice Ninja integrates with various payment gateways, allowing users to accept online payments directly from their invoices. This feature streamlines the payment process for clients and helps businesses get paid faster.

- Recurring Invoices: Users can set up recurring invoices for regular clients or subscription-based services. Invoice Ninja automates the invoicing process for these recurring charges, saving time and ensuring consistent billing.

- Expense Tracking: In addition to invoicing, Invoice Ninja includes expense tracking features. Users can record business expenses, categorize them, and attach receipts for easy expense management.

- Time Tracking: Invoice Ninja offers built-in time tracking functionality, enabling users to track billable hours for client projects. Users can easily convert tracked time into invoices, making it simple to bill clients accurately for the time spent on their projects.

- Client Portal: Invoice Ninja provides a client portal where clients can view and pay invoices online, track their payment history, and communicate with the business. This feature enhances transparency and improves the overall client experience.

- Reporting and Analytics: Invoice Ninja offers reporting tools that provide insights into business performance. Users can generate reports on revenue, expenses, invoice aging, and more to help them make informed decisions.

- Multi-Currency Support: Invoice Ninja supports multiple currencies, making it suitable for businesses that operate internationally. Users can invoice clients in their preferred currency and track payments in multiple currencies.

- White-Labeling: Invoice Ninja offers white-labeling options for users who want to brand the platform with their own logo and colors. This feature allows businesses to maintain a professional appearance and reinforce their brand identity.

Overall, Invoice Ninja is a comprehensive invoicing and billing solution that offers a range of features to help businesses manage their invoicing processes effectively. With its customizable invoices, online payment integration, and robust reporting tools, it’s a popular choice for businesses of all sizes.

SlickPie:

SlickPie is an online invoicing and accounting software tailored for small businesses and freelancers. It offers a range of features to simplify the invoicing process and manage finances efficiently. Here’s an overview of SlickPie’s invoicing software:

- Free Accounting Software: SlickPie offers free accounting software, including invoicing features, making it an attractive option for small businesses and freelancers on a budget.

- Professional Invoices: Users can create professional-looking invoices using customizable templates provided by SlickPie. The platform allows users to add their logo, company details, and customize invoice fields to suit their branding needs.

- Easy Invoicing Workflow: SlickPie provides a user-friendly interface for creating, editing, and sending invoices. Users can quickly add line items, apply taxes, and set payment terms before sending invoices to clients.

- Online Payment Integration: SlickPie integrates with payment gateways, enabling users to accept online payments directly from their invoices. This feature facilitates faster payment processing and improves cash flow for businesses.

- Recurring Invoices: Users can set up recurring invoices for regular clients or subscription-based services. SlickPie automates the invoicing process for these recurring charges, saving time and ensuring consistent billing.

- Expense Tracking: In addition to invoicing, SlickPie includes expense tracking features. Users can record business expenses, categorize them, and attach receipts for easy expense management.

- Financial Reporting: SlickPie offers basic financial reporting tools to provide insights into business performance. Users can generate reports on income, expenses, profit/loss, and more to make informed financial decisions.

- Bank Reconciliation: SlickPie allows users to reconcile bank transactions with their accounting records, ensuring accuracy and integrity in financial reporting.

- Multi-Currency Support: SlickPie supports multiple currencies, making it suitable for businesses that operate internationally. Users can invoice clients in different currencies and track payments accordingly.

- Security: SlickPie prioritizes data security and employs encryption and secure data storage practices to protect sensitive financial information.

Overall, SlickPie offers a comprehensive invoicing and accounting solution with essential features tailored for small businesses and freelancers. With its user-friendly interface, customizable invoices, and integration with payment gateways, it’s a popular choice for businesses looking for a cost-effective invoicing software solution.

Hiveage:

Hiveage is an online invoicing and billing software designed to meet the needs of freelancers, small businesses, and consultants. Here’s an overview of Hiveage’s invoicing software:

- Invoicing Templates: Hiveage provides customizable invoice templates that users can personalize with their branding elements, such as logos, colors, and fonts. This allows businesses to create professional-looking invoices that reflect their brand identity.

- Easy Invoicing Workflow: The platform offers a user-friendly interface for creating, editing, and sending invoices. Users can easily add line items, adjust quantities and prices, and apply taxes or discounts as needed.

- Online Payment Integration: Hiveage integrates with various payment gateways, allowing users to accept online payments directly from their invoices. This feature enables businesses to streamline the payment process and improve cash flow.

- Recurring Invoices: Users can set up recurring invoices for regular clients or subscription-based services. Hiveage automates the invoicing process for these recurring charges, saving time and ensuring consistent billing.

- Expense Tracking: In addition to invoicing, Hiveage includes expense tracking features. Users can record business expenses, categorize them, and attach receipts for accurate expense management.

- Time Tracking: Hiveage offers built-in time tracking functionality, enabling users to track billable hours for client projects. Users can easily convert tracked time into invoices, making it simple to bill clients accurately for the time spent on their projects.

- Financial Reporting: Hiveage provides reporting tools that give users insights into their business finances. Users can generate reports on revenue, expenses, profit/loss, and more to help them make informed decisions.

- Client Portal: Hiveage offers a client portal where clients can view and pay invoices online, track their payment history, and communicate with the business. This feature enhances transparency and improves the overall client experience.

- Multi-Currency Support: Hiveage supports multiple currencies, making it suitable for businesses that operate internationally. Users can invoice clients in different currencies and track payments accordingly.

- Mobile Apps: Hiveage offers mobile apps for iOS and Android devices, allowing users to manage their invoicing and billing on the go. The mobile apps provide access to essential features, such as creating invoices, tracking expenses, and accepting payments.

Overall, Hiveage offers a comprehensive invoicing and billing solution with a range of features to help businesses manage their invoicing processes efficiently. With its customizable templates, online payment integration, and expense tracking capabilities, it’s a popular choice for businesses looking for a flexible and user-friendly invoicing software solution.

Contain table:

1, Banking:

2, Payment gateway:

3, Recharge Services:

- Mobile Recharge

- DTH Recharge

- Googleplay redeem

4, API Solutions:

5, PAN Card Services:

- UTIITSL Agent Registration

- How to apply new pan card with UTI PSA Portal

- Paperless eKyc PAN Agent – UTI

- utipan psa

- PAN Rate Banner

- Important Court Directives

6, Products:

- B2B Mobile Recharge Software

- B2C Mobile Recharge Software

- B2B Reseller Recharge Software

- API Reselling Software

- Whit label Recharge Software

- Pan Card White Label / Pan Card API

- Pan Card White Label / Pan Card API

Social media: Follow the CSS Ekendra Private Limited channel