1 What is PAN?

Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card,

by an Assessing Officer of the Income Tax Department.

A typical PAN is AFRPP1595D

2 Who must have a PAN?

i. All existing assesses or taxpayers or persons who are required to furnish a return of income, even on

behalf of others, must obtain PAN.

ii. Any person, who intends to enter into economic or financial transactions where quoting PAN is

mandatory, must also obtain PAN.

3 Where to apply for PAN?

In order to improve PAN related services, the Income Tax department has authorized UTI Infrastructure

Technology And Services Ltd. (UTIITSL) to set up and manage IT PAN Service Centers in all cities or towns

where there is an Income Tax office. For convenience of PAN applicants in big cities, UTITSL has set up more than one IT PAN Service Center

4 How to find an IT PAN Service Center?

Location of IT PAN Service Centers in any city may be obtained from local Income Tax Office or any office of UTIITSL in that city or from website of the Income Tax department (www.incometaxindia.gov.in).

5 What services are provided by these IT PAN Service Centers?

IT PAN Service Centers will supply new PAN application forms (Form 49A) and Form 49AA, assist the

applicant in filling up the form, collect filled form and issue acknowledgement slip. After obtaining PAN from the Income Tax department, UTIITSL will print the PAN card and deliver it to the applicant.

6 How to apply for a PAN? Can an application for PAN be made on plain paper?

PAN application can be made only on new Form 49A and Form 49AA that may be obtained from IT PAN

Service Center at free of cost.

7 How to find ‘Assessing Officer code’?

The Assessing Officer code may be obtained from Income Tax Office where you submit your return of income. Applicants who have never filed return of income may find out Assessing Officer code with the help of IT PAN Service Center or jurisdictional Income Tax Office.

The PAN application will be incomplete without Assessing Officer code.

8 Is a photograph compulsory for making an application for PAN?

A photograph is compulsory only in case of ‘Individual’ applicants.

9 What is the procedure for applicants who cannot sign?

In such cases, Left Hand Thumb impression of the applicant should be affixed on Form 49A at the place meant for signatures and get attested by a Magistrate or a Notary Public or a Gazetted Officer, under official seal and stamp.

10 Is father’s name compulsory for female (including married/divorced/widow) applicants?

It is mandatory for Individual applicant’s to provide father’s name in the PAN application (Form 49A). Female applicants, irrespective of marital status, should also give father’s name in the PAN application.

11 Who can apply on behalf of non-resident, minor, lunatic, idiot, and court of wards?

Section 160 of IT Act, 1961 provides that a non-resident, a minor, lunatic, idiot, and court of wards and such other persons may be represented through a Representative Assessee. In such cases, application for PAN will be made by the Representative Assessee.

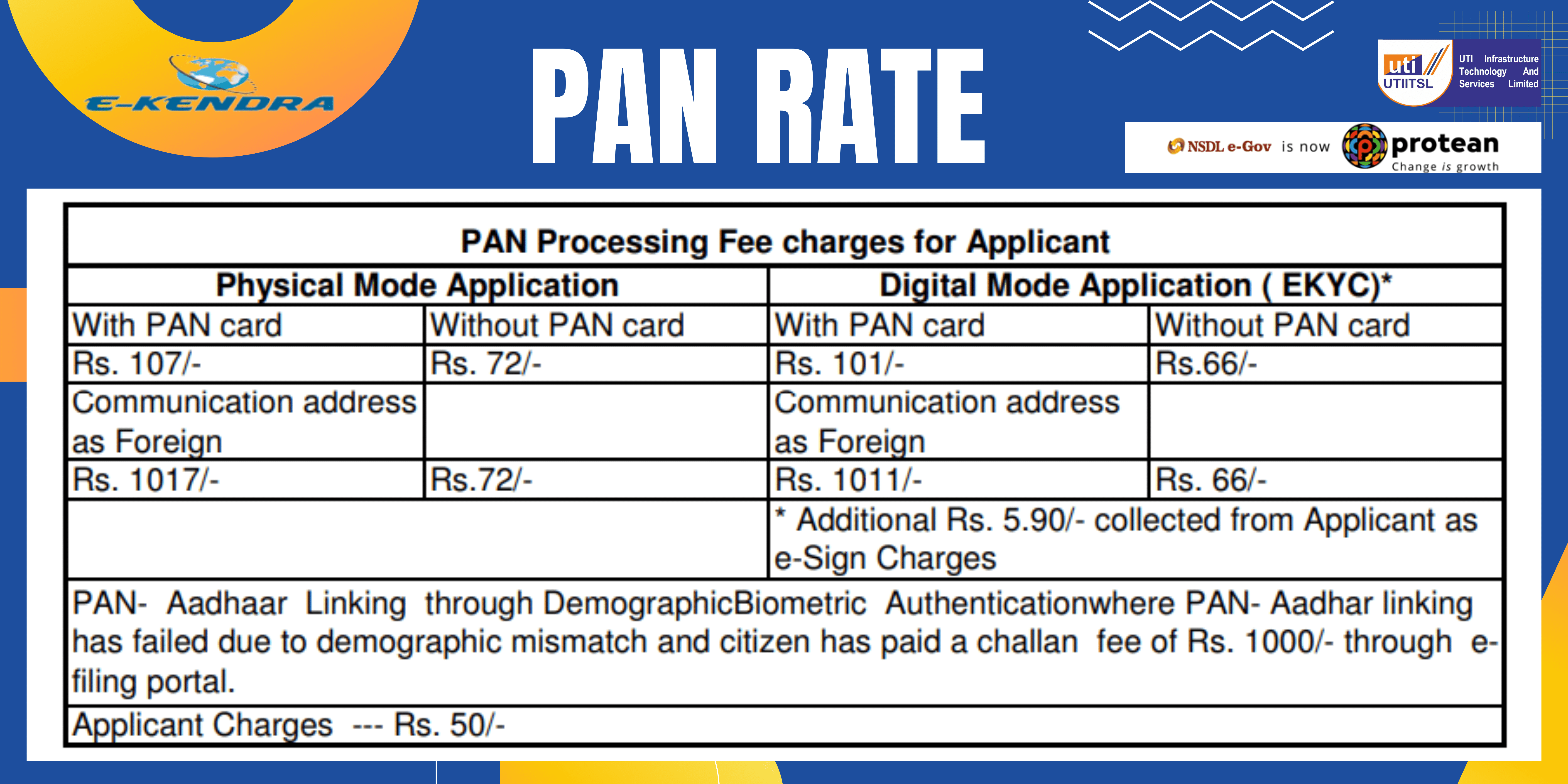

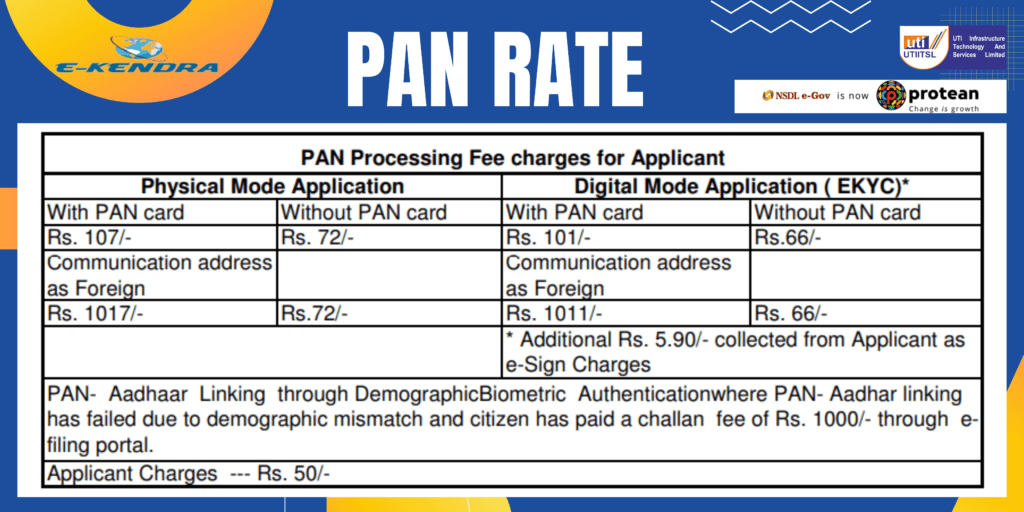

12 Are there any charges to be paid at IT PAN Service Centers?

UTIITSL has been authorized to collect a processing charge of 107/- (including GST) per PAN application and this includes cost of new tamper proof PAN card. This amount will have to be paid in cash at IT PAN Service Center that will have to be affixed on PAN Application Form. In case, the PAN card is to be dispatched outside India then additional dispatch charge of 910/- will have to be paid by applicant.

13 Do you need to apply for a PAN when you move or transferred from one city to another?

Permanent Account Number (PAN), as the name suggests, is a permanent number and does not change.

Changing the address or city, though, may change the Assessing Officer. Such changes must, therefore, be intimated to nearest IT PAN Service Center for required corrections in PAN databases of the Income Tax department.

14 Can a person obtain or use more than one PAN?

Obtaining or possessing more than one PAN is against the law.

15 Will the existing PAN cards issued by the Income- Tax Department remain valid?

All PAN allotted and PAN card issued by the Income Tax Department will remain valid. All persons who have been allotted a PAN need not apply again.

16 Income Tax Department has issued me a PAN card; can I obtain a new tamper proof PAN card?

For obtaining the new tamper proof PAN card a fresh application will have to be made in Composite Service Form (CSF) to IT PAN Service Center, in which existing PAN will have to be indicated along with copy of old PAN card. The payment of ` 107/- (including GST) will also have to be made.

17 When should I submit the application in the form “Request for New PAN Card or/and Changes or Correction in PAN data”?

You can submit the application in the form “Request for New PAN Card or/and Changes or Correction in PAN

data” in the following cases:

A] When you already have PAN but want a new PAN card,

B] When you want to make some changes or corrections in your existing PAN details.

18 I had applied for PAN but have not received any communication from Income Tax Department?

In case you had applied prior to notification of new form 49A on 29.5.2003 but have not received the PAN, you will have to apply afresh in new Form 49A at any IT PAN Service Center.

19 How will the new PAN card be delivered to me?

UTITSL will ensure delivery of new PAN card at the address indicated by you in form F49A, against

acknowledgement.

20 Is UTIITSL conducting Third Party Verification to verify identity and address of PAN applicants?

Yes. As per instruction from Income Tax Department, an authorized agencies agent may visit you for your

identity and address verification as per the documents submitted by you with the PAN application form. You are requested to ask authorization letter/ID card from the agent before verification. Your cooperation is solicited in this regard.

21 Who should be contacted for enquiries regarding PAN application?

PAN application number, coupon number and IT PAN Service Center where application was submitted should be mentioned in all references. PAN enquires should be addressed to: