Unified Payments Interface (UPI)

Unified Payments Interface (UPI)

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood. It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

With the above context in mind, NPCI conducted a pilot launch with 21 member banks. The pilot launch was on 11th April 2016 by Dr. Raghuram G Rajan, Governor, RBI at Mumbai. Banks have started to upload their UPI enabled Apps on Google Play store from 25th August, 2016 onwards.

How is it unique?

- Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- Single mobile application for accessing different bank accounts.

- Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines, yet provides for a very strong feature of seamless single click payment.

- Virtual address of the customer for Pull & Push provides for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

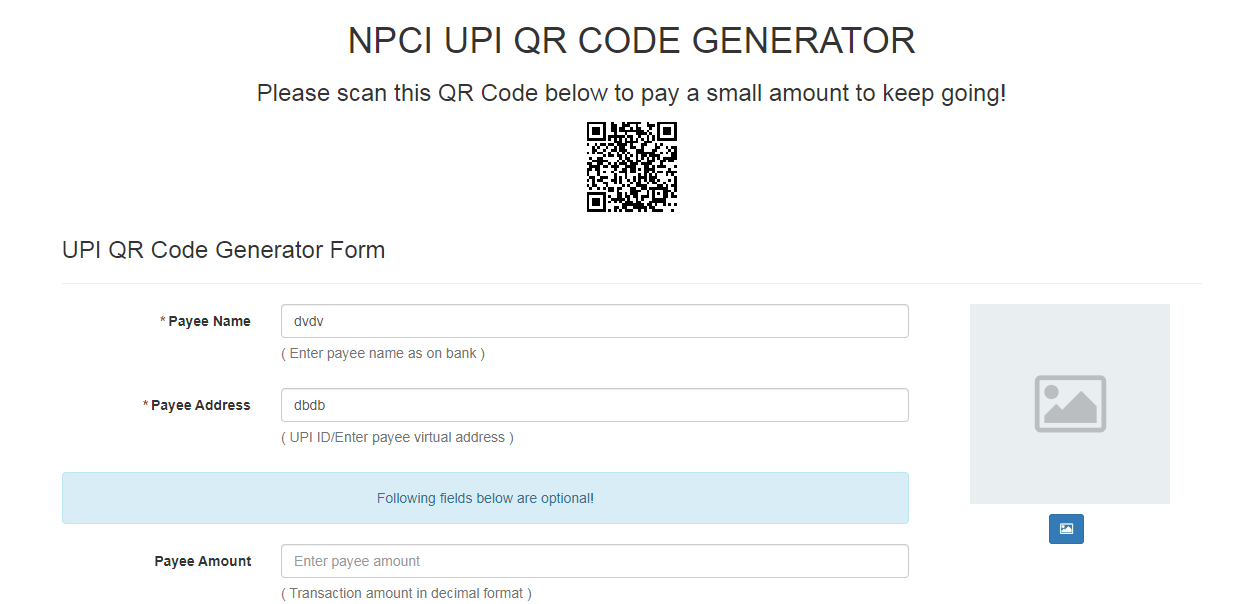

- QR Code

- Best answer to Cash on Delivery hassle, running to an ATM or rendering exact amount.

- Merchant Payment with Single Application or In-App Payments.

- Utility Bill Payments, Over the Counter Payments, QR Code (Scan and Pay) based payments.

- Donations, Collections, Disbursements Scalable.

- Raising Complaint from Mobile App directly.

Participants in UPI

- Payer PSP

- Payee PSP

- Remitter Bank

- Beneficiary Bank

- NPCI

- Bank Account holders

- Merchants

Steps for Registration:

- User downloads the UPI application from the App Store/Banks website

- User creates his/her profile by entering details like name, virtual id (payment address), password etc.

- User goes to “Add/Link/Manage Bank Account” option and links the bank and account number with the virtual id

Generating UPI – PIN:

- User selects the bank account from which he/she wants to initiate the transaction

- User clicks one of the option –

Change M-PIN

In the case of 3(a) –

- User receives OTP from the Issuer bank on his/her registered mobile number

- User now enters last 6 digits of Debit card number and expiry date

- User enters OTP and enters his preferred numeric UPI PIN( UPI PIN that he would like to set) and clicks on Submit

- After clicking submit, customer gets notification (successful or decline)

In the case of 2(b) –

- User enters his old UPI PINand preferred new UPI PIN (UPI PIN that he would like to set) and clicks on Submit

- After clicking submit, customer gets notification (successful or failure)

Product

A. Financial Transactions: UPI supports the following financial transactions viz.

Pay Request: A Pay Request is a transaction where the initiating customer is pushing funds to the intended beneficiary. Payment Addresses include Mobile Number & MMID, Account Number & IFSC and Virtual ID

Collect Request: A Collect Request is a transaction where the customer is pulling funds from the intended remitter by using Virtual ID.

B. Non-Financial Transactions: UPI will support following types of non-financial transactions on any PSP App viz.

- Mobile Banking Registration*

- Generate One Time Password (OTP)

- Set/Change PIN

- Check Transaction Status

- Raise Dispute/Raise query

* Mobile Banking Registration is possible only if the mobile number (which is to be registered) is registered with the Issuer Bank for SMS Alerts/mobile alerts.

UPI can be accessed on all platforms viz. Android / iOS – The Apps have been developed by members on Android 4.2.2 and above/iOS 8.1 and above platforms.