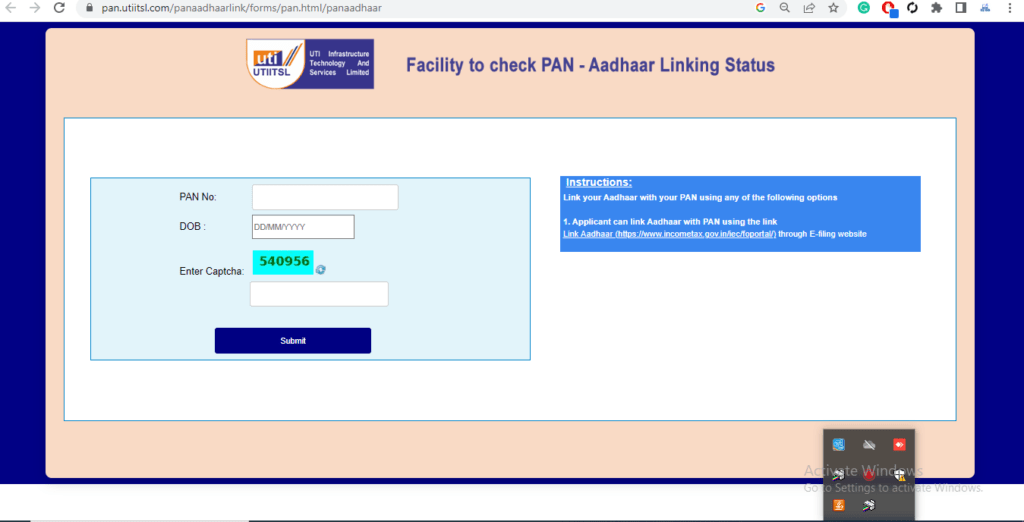

You can check the status of your PAN (Permanent Account Number) and Aadhaar linkage by following these steps:

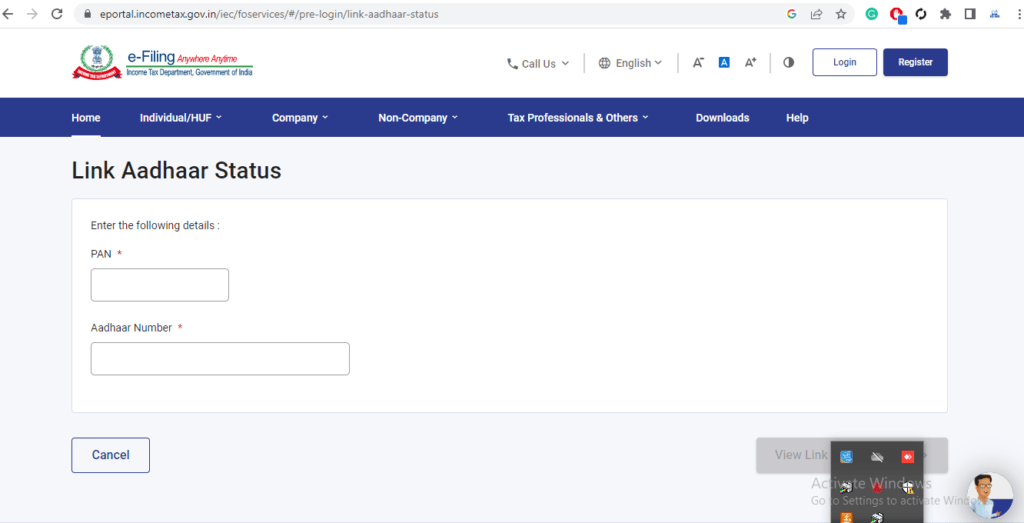

- Visit the Income Tax e-filing website at https://www.incometaxindiaefiling.gov.in.

- Click on the “Link Aadhaar” option under the “Quick Links” section on the left-hand side of the page.

- Enter your PAN and Aadhaar numbers, as well as your name as it appears on your Aadhaar card.

- Click on the “View Link Aadhaar Status” button.

- The website will display the status of your PAN and Aadhaar linkage. If your PAN and Aadhaar are linked, it will show a message indicating the same.

Alternatively, you can also check the status of your PAN and Aadhaar linkage by sending an SMS to 567678 or 56161 from your registered mobile number. The format of the SMS should be: UIDPAN <SPACE> <12 digit Aadhaar number> <SPACE> <10 digit PAN number>. The SMS service is free of charge.

It’s important to ensure that your PAN and Aadhaar are linked, as it is now mandatory to link the two for various financial transactions and to file income tax returns.

The deadline to link your PAN (Permanent Account Number) with Aadhaar has been extended several times in the past. The last deadline was March 31, 2022, which has already passed.

However, the Government of India may extend the deadline again in the future, so it’s best to stay updated with the latest information on this topic. You can check the official websites of the Income Tax Department or the Unique Identification Authority of India (UIDAI) for any updates on the deadline for linking PAN and Aadhaar. It’s important to ensure that your PAN and Aadhaar are linked, as it is now mandatory to link the two for various financial transactions and to file income tax returns.

Linking your PAN (Permanent Account Number) with Aadhaar is important for several reasons:

- To file income tax returns: As per the Income Tax Act, it is mandatory to link your PAN and Aadhaar to file income tax returns. If your PAN and Aadhaar are not linked, you will not be able to file your income tax returns and may be subject to penalties.

- To carry out financial transactions: Many financial institutions require PAN and Aadhaar linkage to carry out various financial transactions such as opening a bank account, buying or selling securities, applying for a loan or credit card, and so on.

- To prevent tax evasion: Linking PAN and Aadhaar helps the government to track tax evasion and prevent individuals from having multiple PANs, which can be used to evade taxes.

- To receive government benefits: Many government schemes and benefits are linked to Aadhaar, and linking your PAN with Aadhaar can help ensure that you receive these benefits.

- To simplify the tax process: Linking PAN and Aadhaar can simplify the tax process by allowing the government to pre-fill your tax returns with your personal and financial details, which can save you time and reduce errors in your tax returns.

In summary, linking your PAN and Aadhaar is important to comply with income tax regulations, carry out financial transactions, prevent tax evasion, receive government benefits, and simplify the tax process.