How to apply for pan card through ekyc?

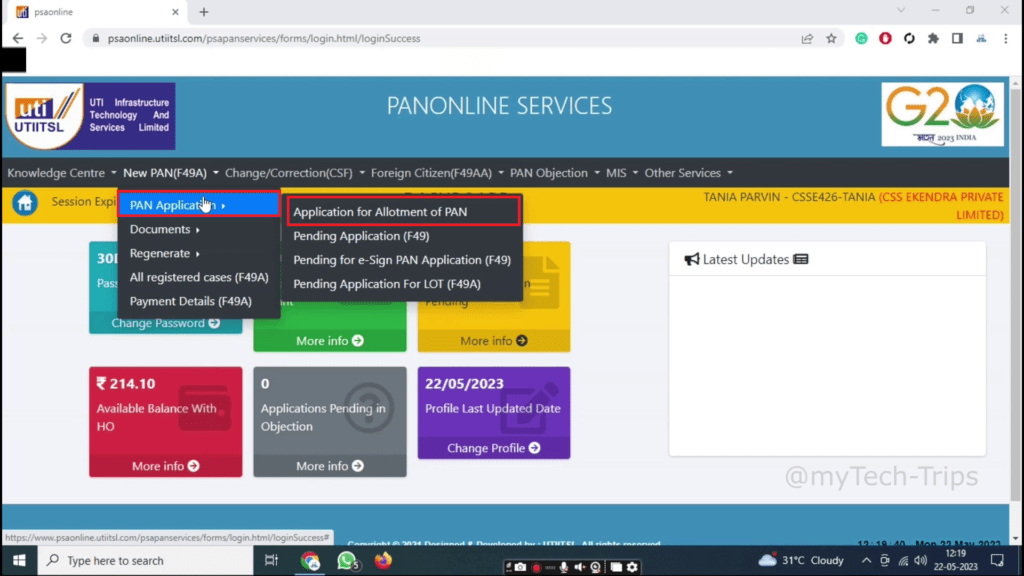

- Login PSA Panel: https://www.psaonline.utiitsl.com/psapanservices/forms/login.html/loginHome

- Click New PAN (F49A)

- Click PAN Application

- Click Application for Allotment of PAN

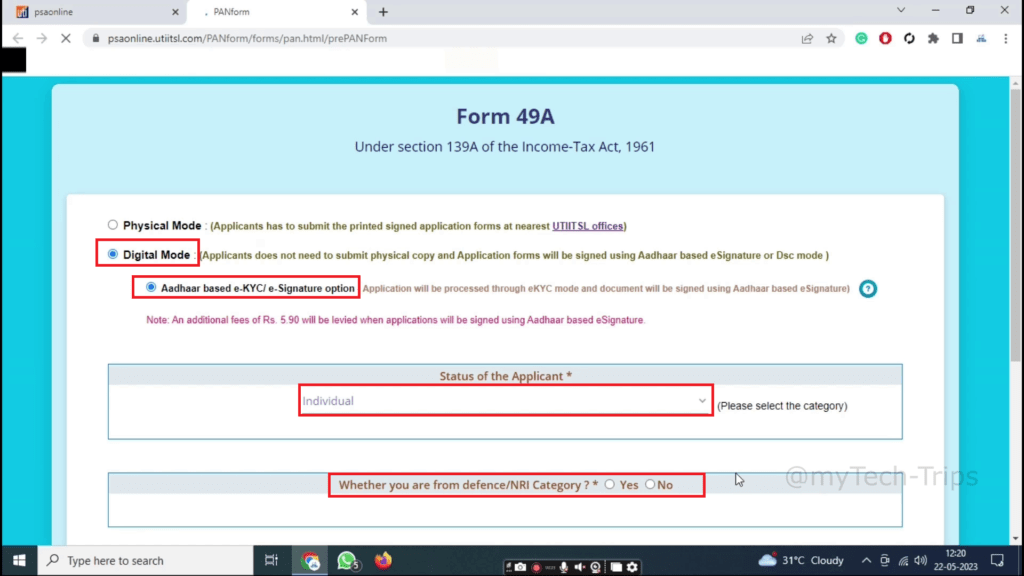

- Click Digital Mode – Aadhaar based e-KYC/e-Signature Option

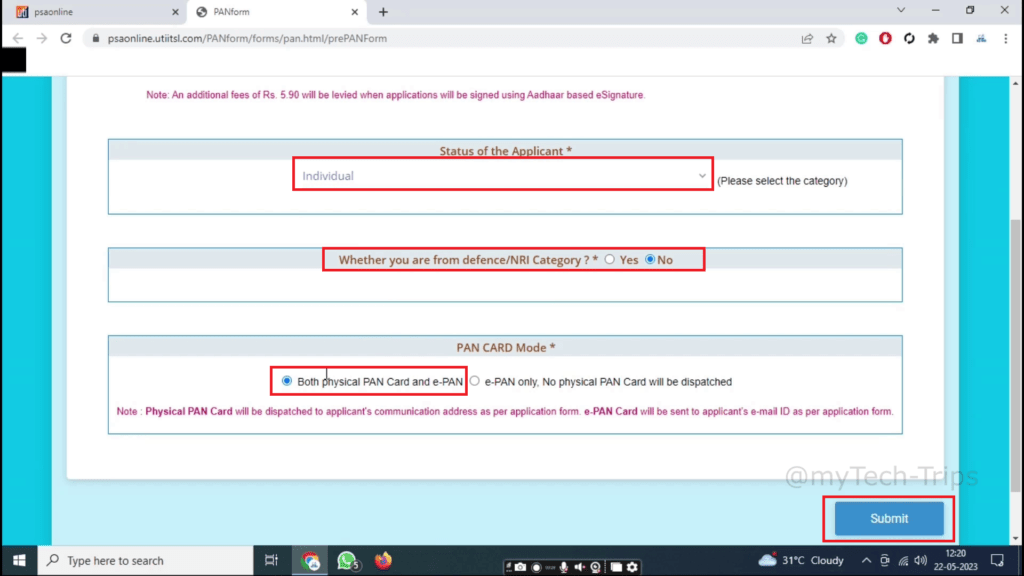

- Status of the Applicant

- Whether you are from defence/NRI category? YES or NO

- Click PAN CARD Mode

- Both physical PAN Card and e-PAN

- Click Submit button

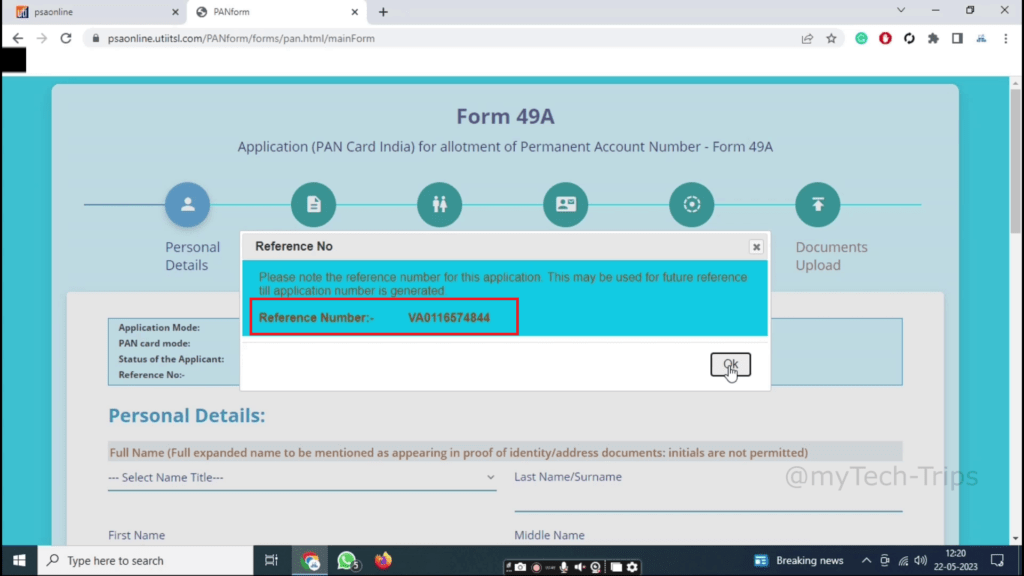

A reference number has been created.

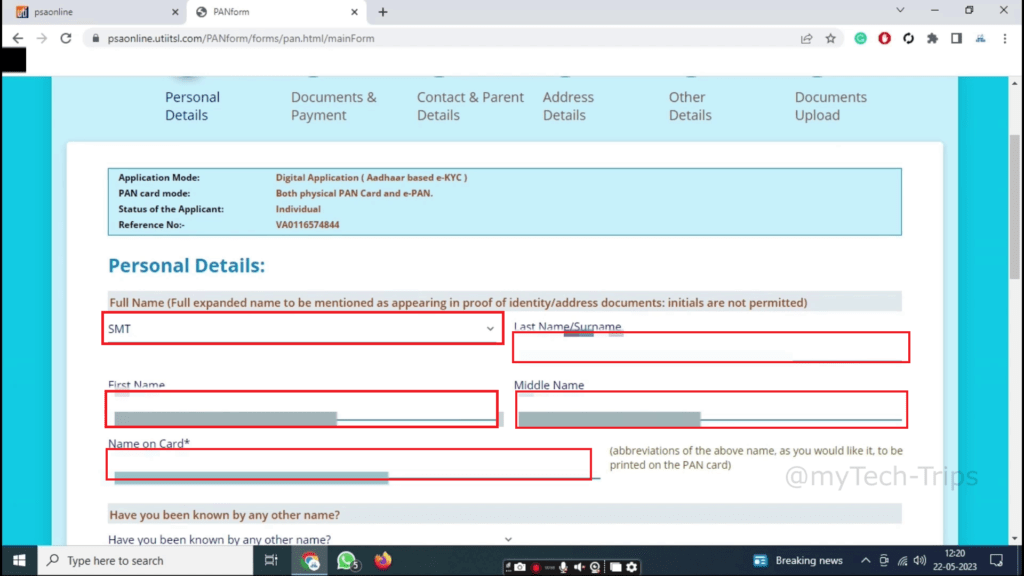

- Select Title and type first name/last name/ middle name

- Name on card is automatically captured

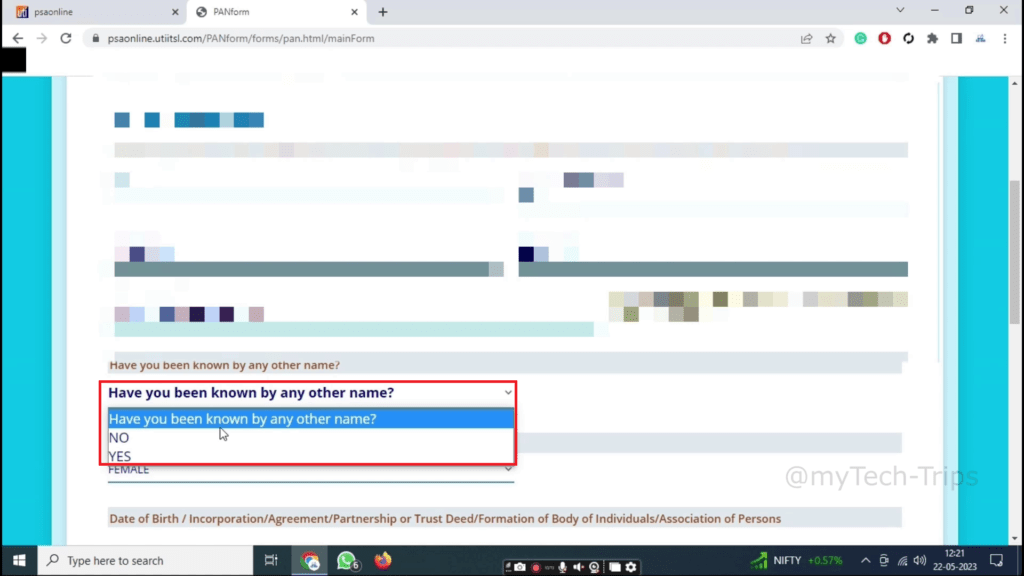

- Have you been known by any other name? NO

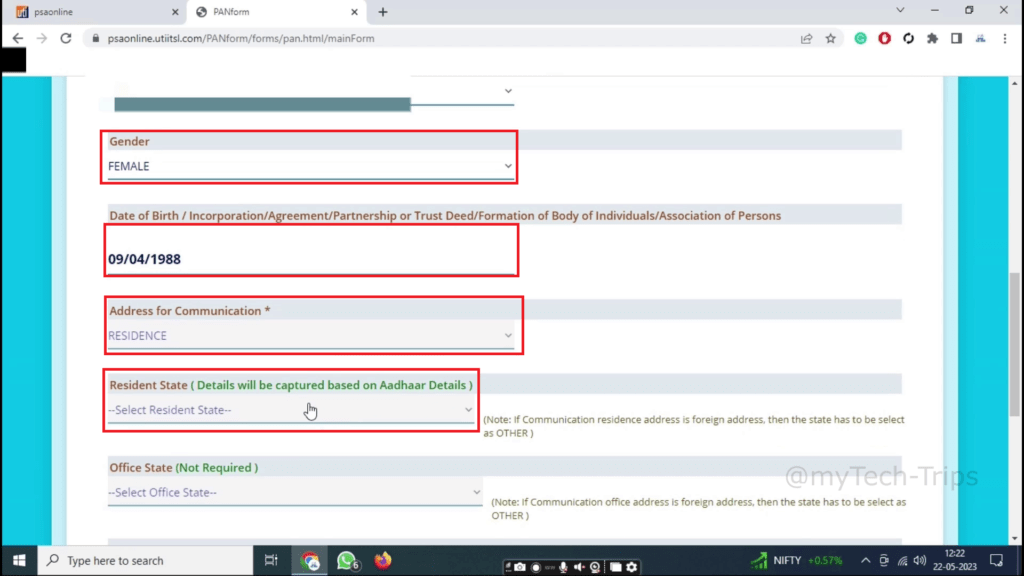

- Gender automatically select as per the title

- Type date of birth

- Address of communication – RESIDENCE

- Resident State – Select state

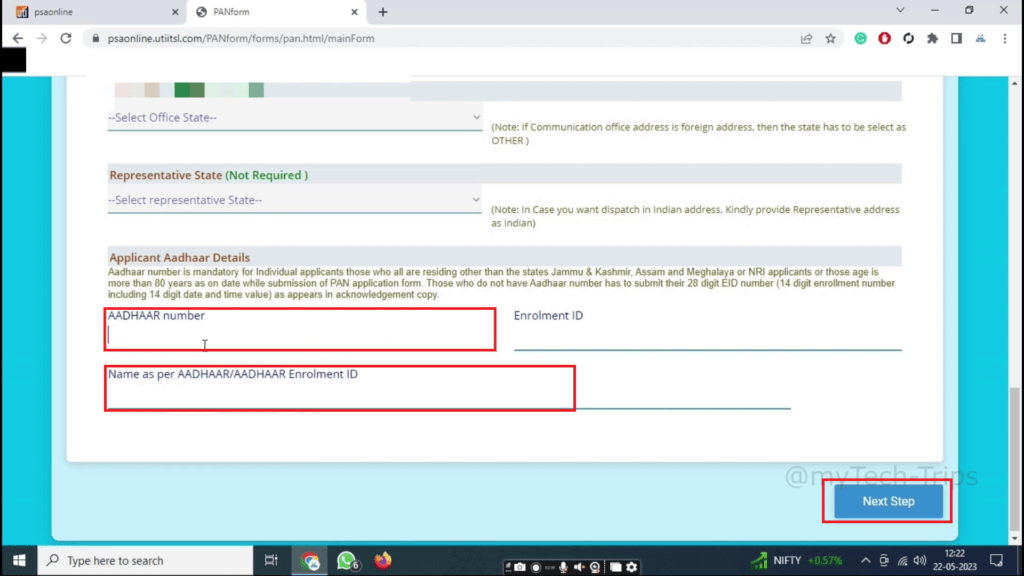

- Type AADHAAR number and re-enter AADHAAR number

- Type name as per AADHAAR Card

- Click Next Step button

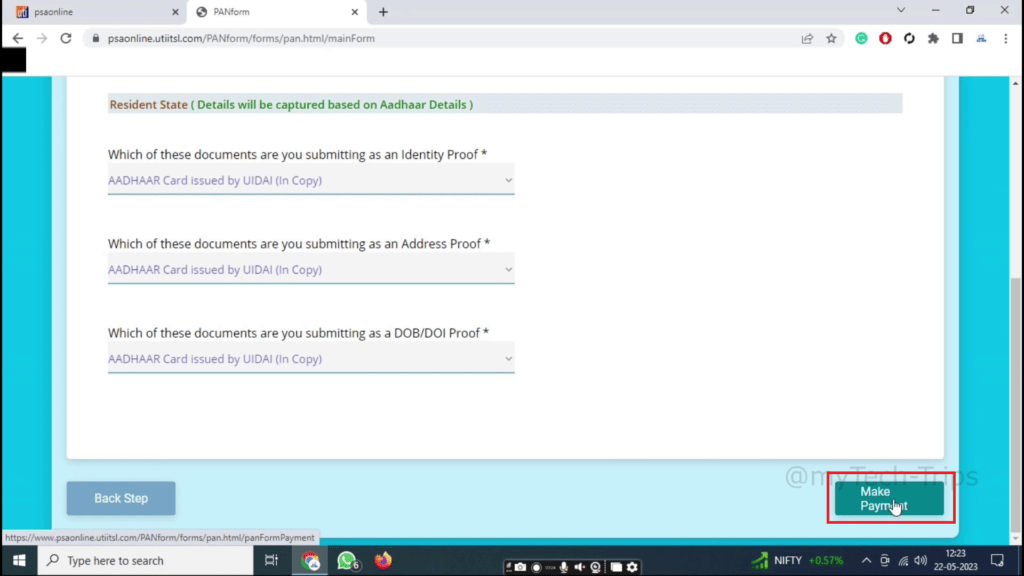

- Click Make Payment button

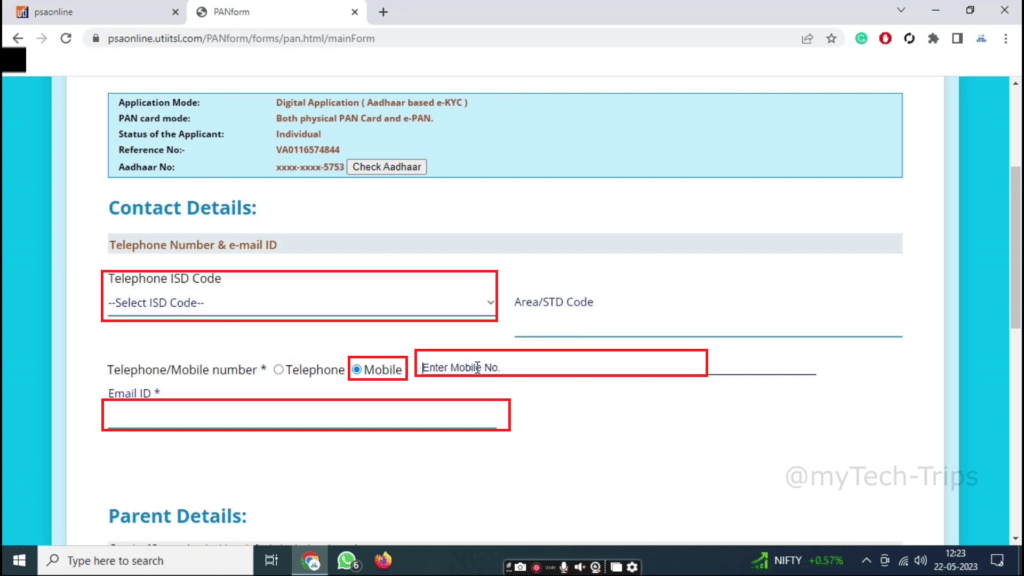

- Select ISD code country

- Type Mobile number

- Type email id

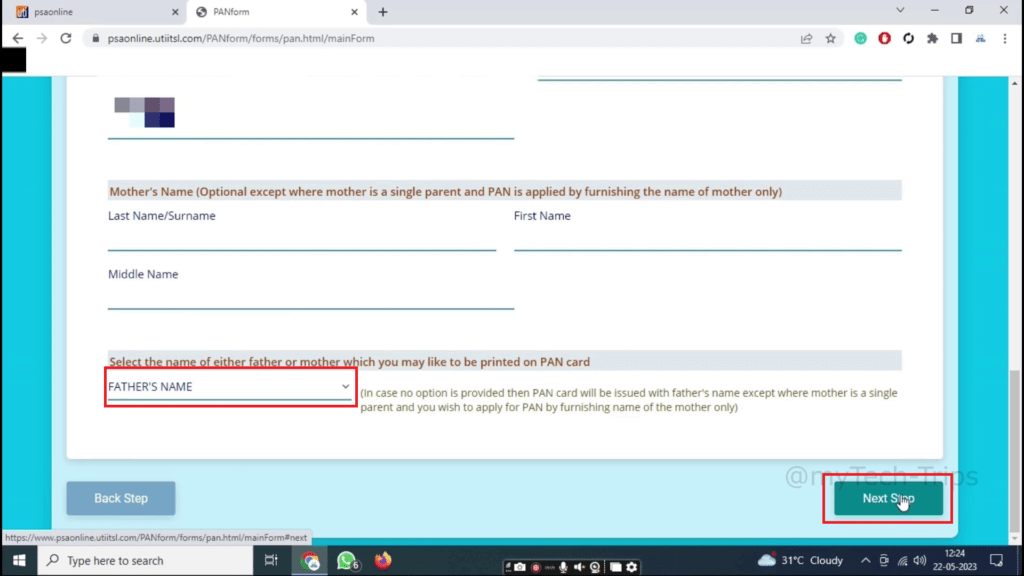

- Type the father’s name as Select Title and type first name/last name/ middle name

- Click Next Step button

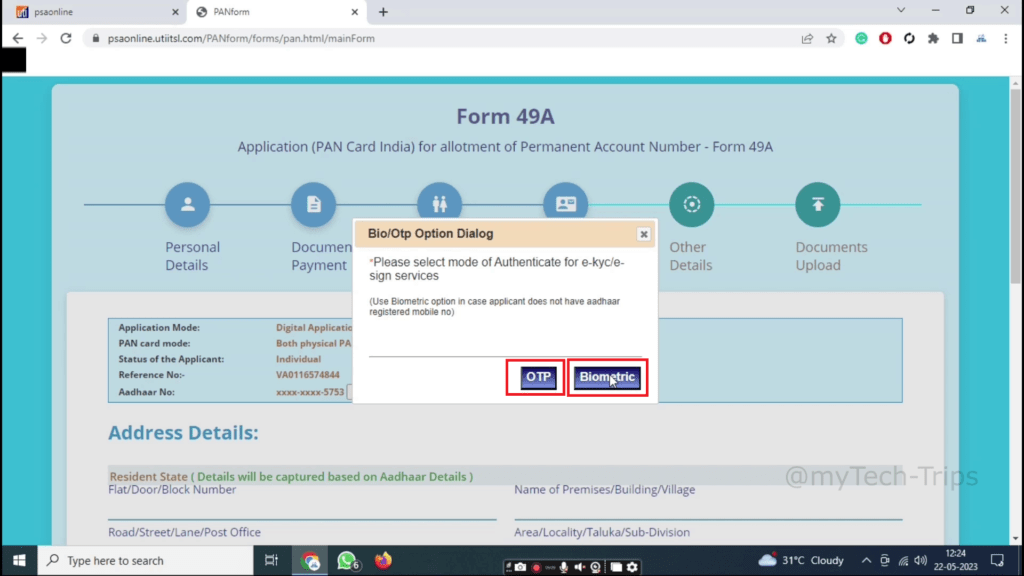

- Select Biometric

- If aadhaar and mobile number is linked then select OTP (Note – Best Select Biometric)

- Capture and Submit

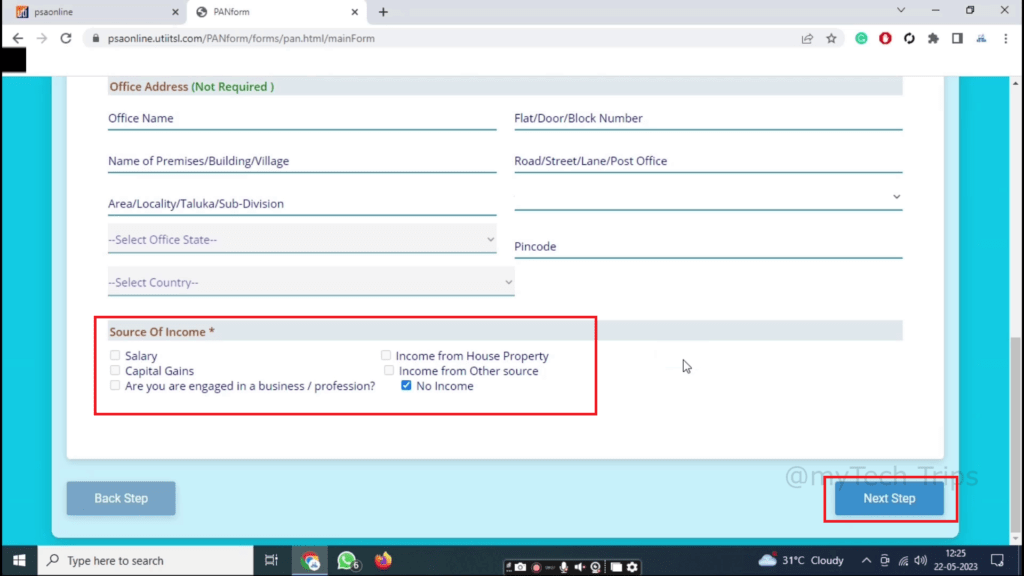

- Select Source Of Income

- Click Next Step button

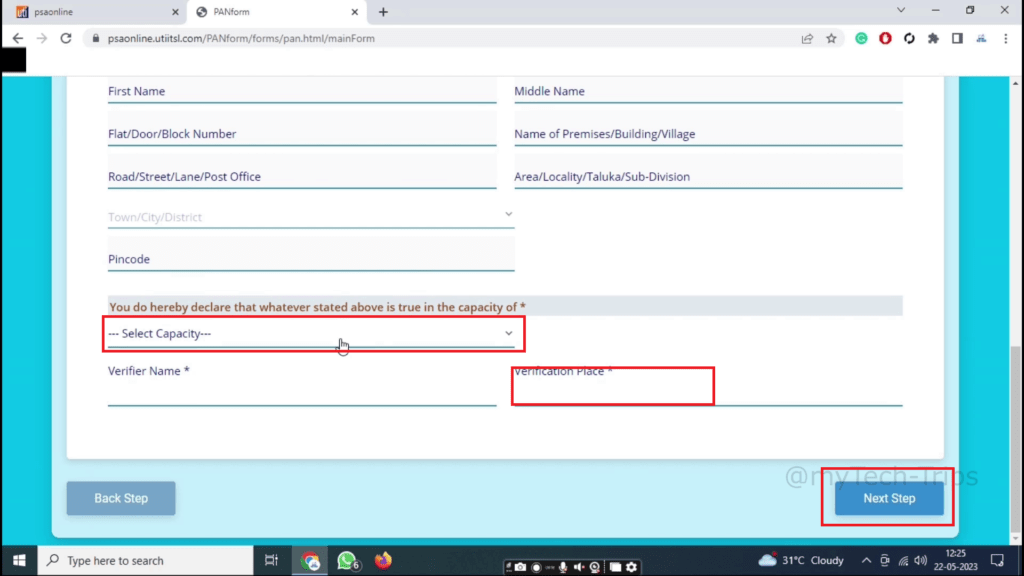

- Select HIMSELF/HERSELF

- Verification Place – Type

- Click Next Step button

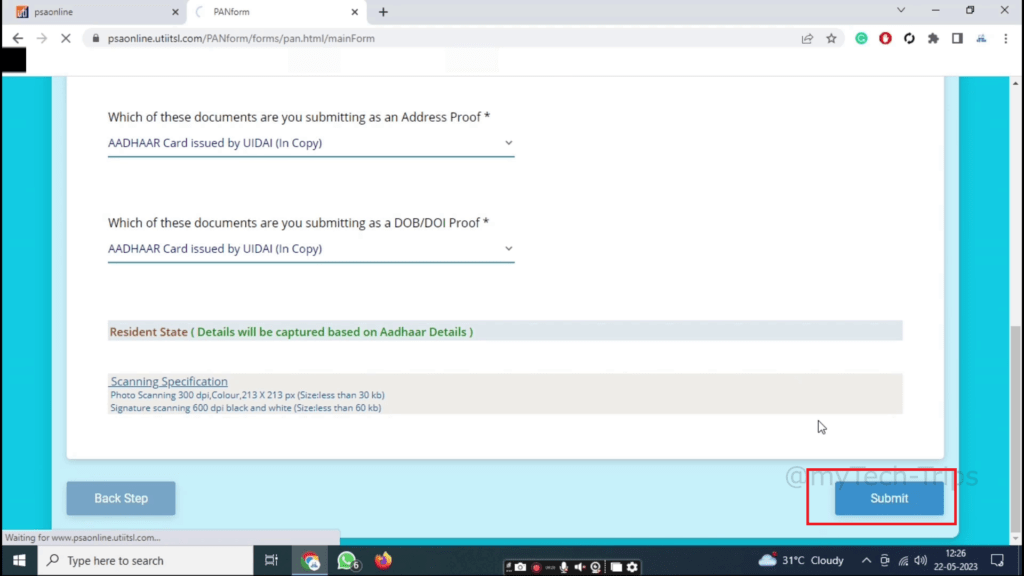

- Click Submit button

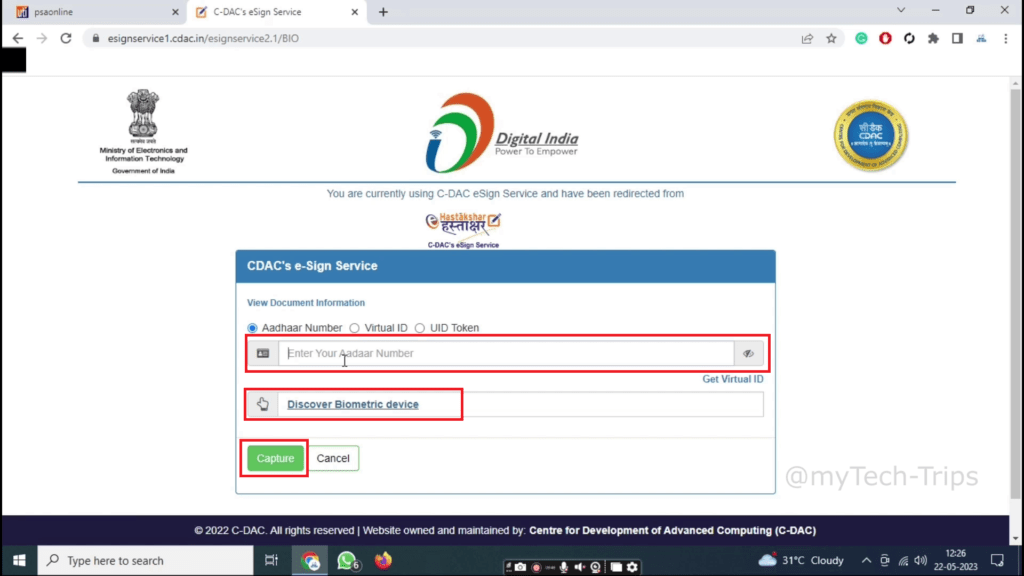

Esigh Page

- Type aadhaar number

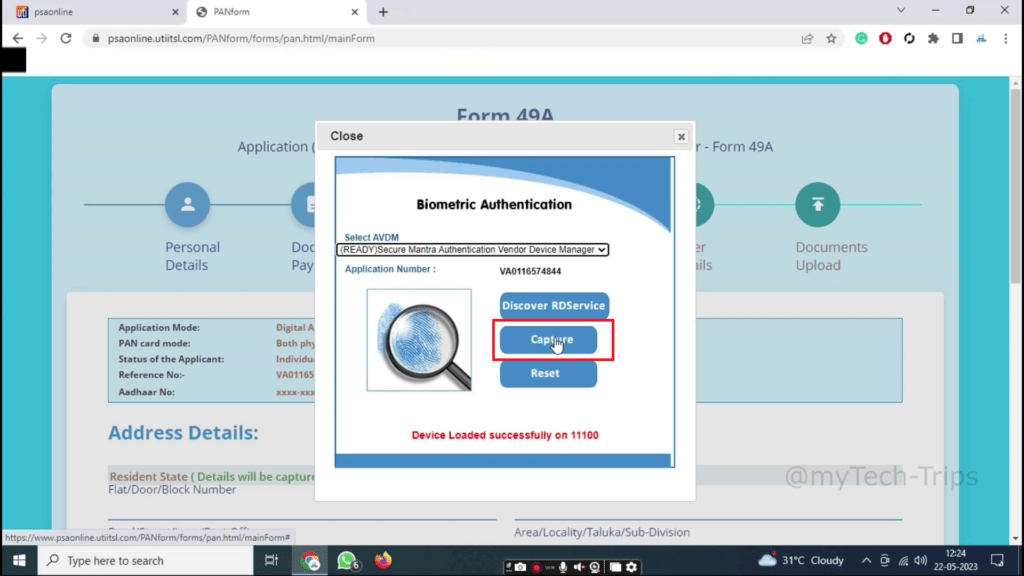

- Click Discover Biometric device

- Click Capture

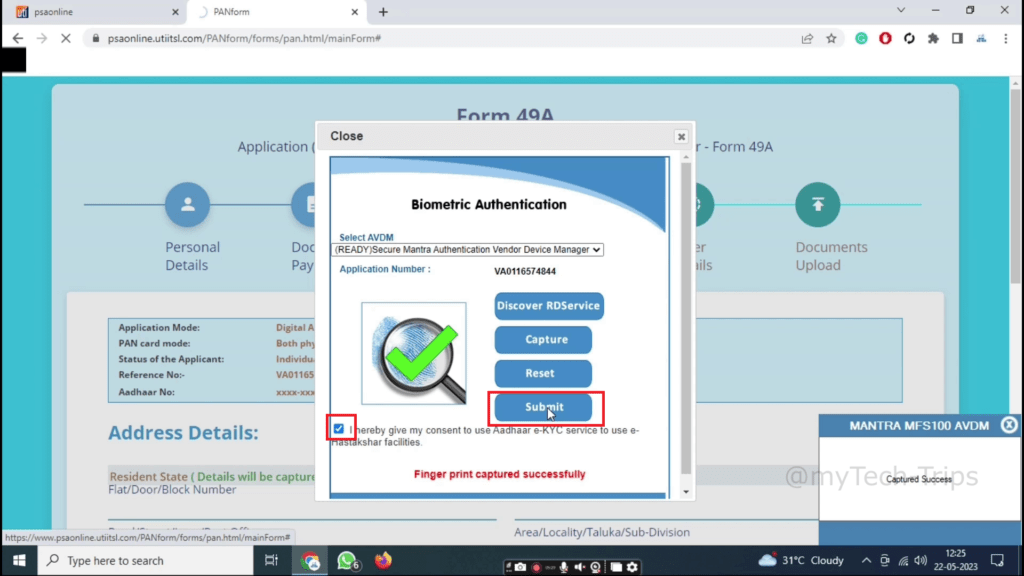

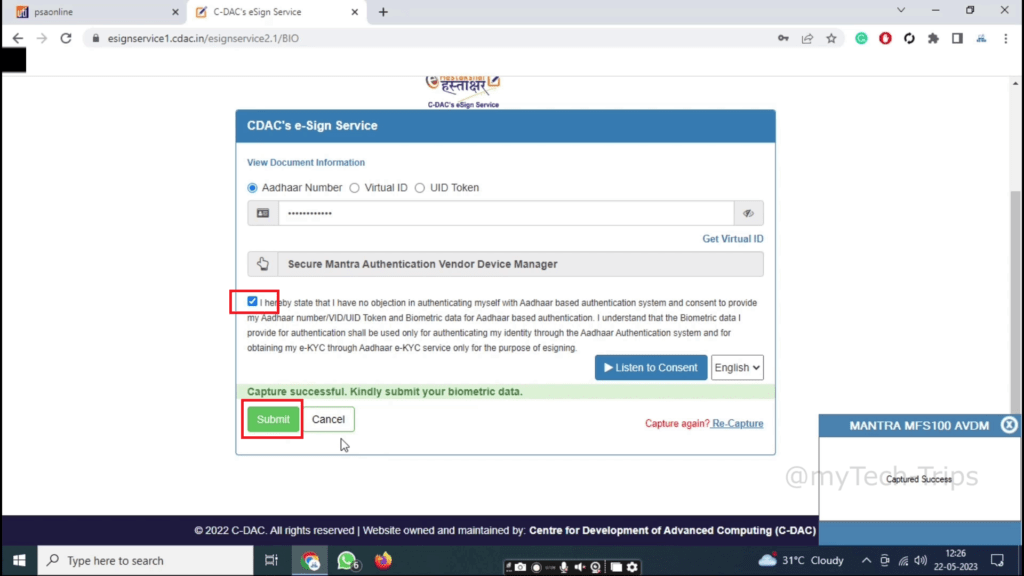

- Agree on terms and submit

Note: Please do not press the refresh or back button and wait for auto redirect

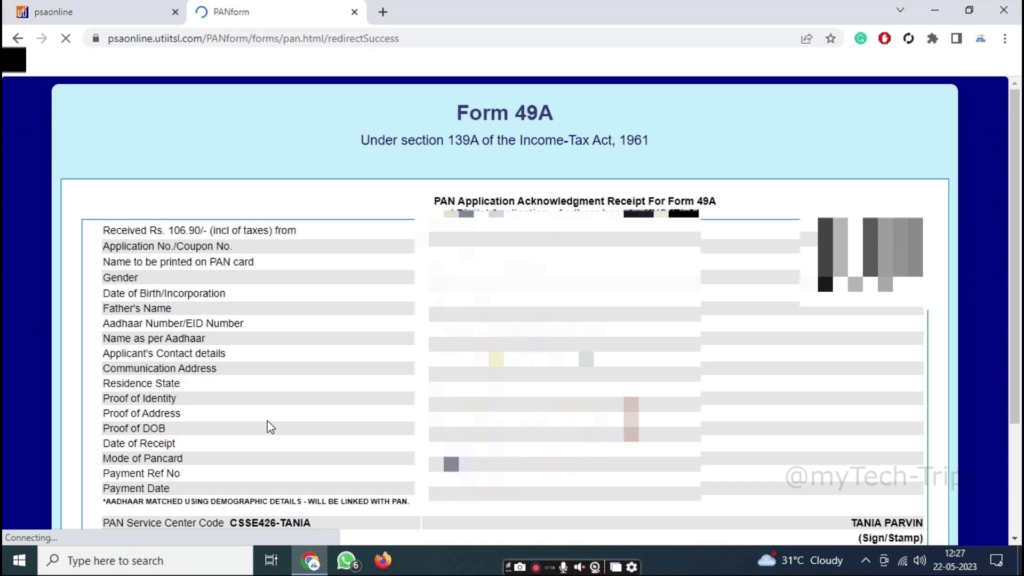

COMPLETE PAN CARD APPLICATION – EASY TO USE